Louisiana-Pacific Corporation (NYSE: LPX) tanked on Wednesday morning, trading 6 percent lower.

The decline comes in large part due to a Merrill Lynch downgrade of LPX stock. Merril downgraded the building materials manufacturer from buy to neutral.

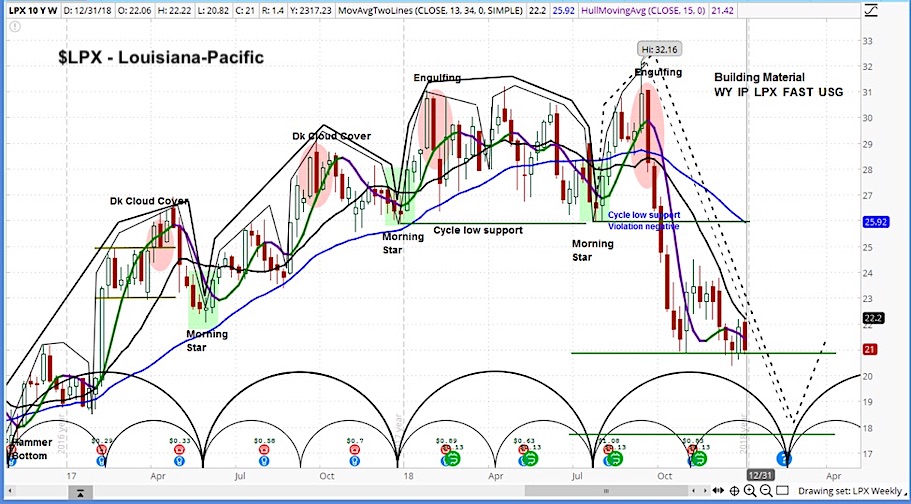

Louisiana-Pacific’s stock price (LPX) has followed a reliable market cycle of late and this suggests additional downside risk into the new year. See chart below.

Stock analyst George Staphos of Bank of America Merrill Lynch reduced his target for LPX to $24, having reduced its rating from buy to neutral. Staphos noted his expectation for consensus to begin to account for the decline in prices for the panels in the latter half of 2018.

Our analysis of the market cycles for LPX shows that it remains in the declining phase of its current cycle. This is occurring in a stock that has whose cycles have proven to be reliable in the recent past, along with timely candlestick signals.

Our view is decidedly negative, as LPX has broken below the point at which it started its current intermediate cycle. The timing is suggestive of a decline into mid-February. Our target is near $18.

Louisiana-Pacific Corporation (LPX) Stock Weekly Chart

For more from Slim, or to learn about cycle analysis, check out the askSlim Market Week show every Friday on our YouTube channel.

Twitter: @askslim

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.