By Joshua Schroeder

By Joshua Schroeder

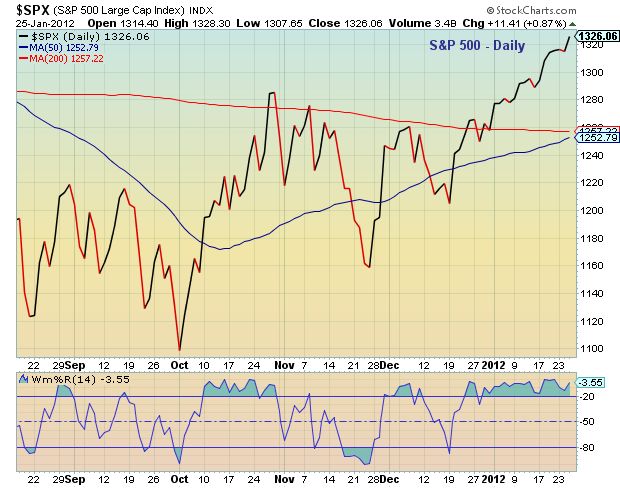

Recent US economic data have been surprising to the upside. The combination of better than expected home sales, regional manufacturing activity and jobless claims have helped to take the S&P 500 up nearly 20% since the Fall of 2011.

And with the recent stock market gains and the wind of earnings season currently at our back, the importance of Europe’s debt problems has been forgotten, or at least so it seems. Many have even begun to claim that the US is “de-coupling” from the rest of the world and that US companies have clear skies and higher earnings ahead.

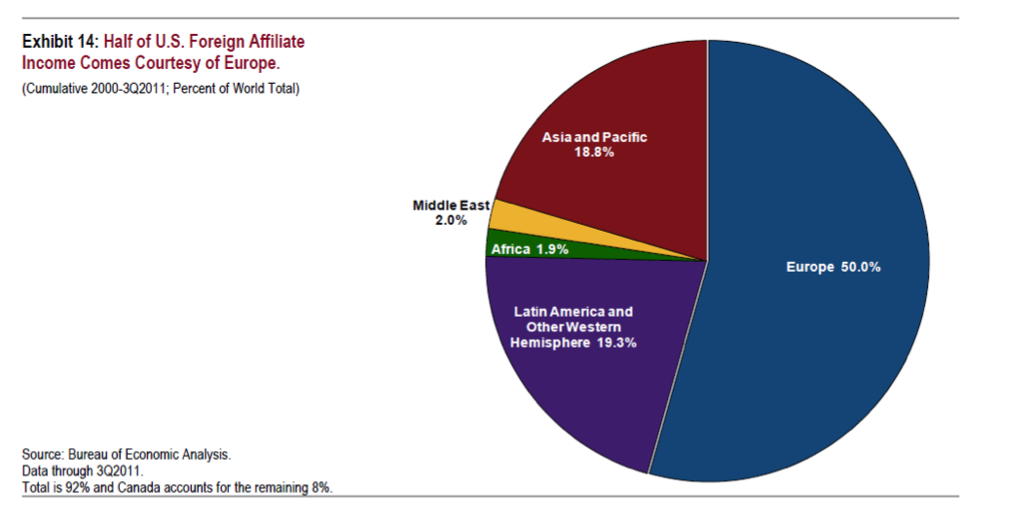

While I continue to be cautiously optimistic about the growth prospects in the US and a long run bull on US equities, I am also fully aware that the US economy is more integrated and dependent on the world economy than ever before. In fact, over half of US foreign affiliate income comes from Europe, a fact that those who talk of decoupling willingly overlook. As long as the European debt crisis remains unresolved it will continue to be a cause of uncertainty and volatility in the capital markets as well as the biggest potential earnings pitfall for US multinationals in 2012.

While I continue to be cautiously optimistic about the growth prospects in the US and a long run bull on US equities, I am also fully aware that the US economy is more integrated and dependent on the world economy than ever before. In fact, over half of US foreign affiliate income comes from Europe, a fact that those who talk of decoupling willingly overlook. As long as the European debt crisis remains unresolved it will continue to be a cause of uncertainty and volatility in the capital markets as well as the biggest potential earnings pitfall for US multinationals in 2012.

Against this backdrop I begin to wonder how much higher we can go in the short term. While the recent run in stocks has been great, I find it hard to trust. The VIX, a measure of volatility in the markets, is now down to levels not seen since July of 2011 and I see little change in the macroeconomic fundamentals in the rest of the world, particularly in Europe to justify it. I personally am bracing for more volatility and raising cash to put to work when Europe once again takes center stage with its debt crisis.

———————————————————-

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of his employer or any other person or entity.

No positions in any of the securities mentioned at time of publication.

Follow us on Twitter @seeitmarket and be sure to “Like” See It Market on Facebook to keep up with current news and updates on the site.