High yield junk bonds are an area of significant interest for investors.

When the market is liquid and investors are confident about tomorrow, they are willing to take risks. And this leads to investments in higher risk companies and their outstanding debt.

With this in mind, high yield bonds can be watched as a proxy for market health. That said, it should not be used as an indicator in isolation (it’s an ETF). And you will get a far better read on the credit markets by simply following issuances / defaults, etc… (check out Fil Zucchi for more).

That said, the ETF is also tradable. So whether it’s an indicator or a trade, today we look at the Junk Bonds ETF (JNK) and highlight why it’s trading near an area of interest.

Note that the following MarketSmith charts are built with Investors Business Daily’s product suite.

I am an Investors Business Daily (IBD) partner and promote the use of their products. The entire platform offers a good mix of analysts, education, and technical and fundamental data.

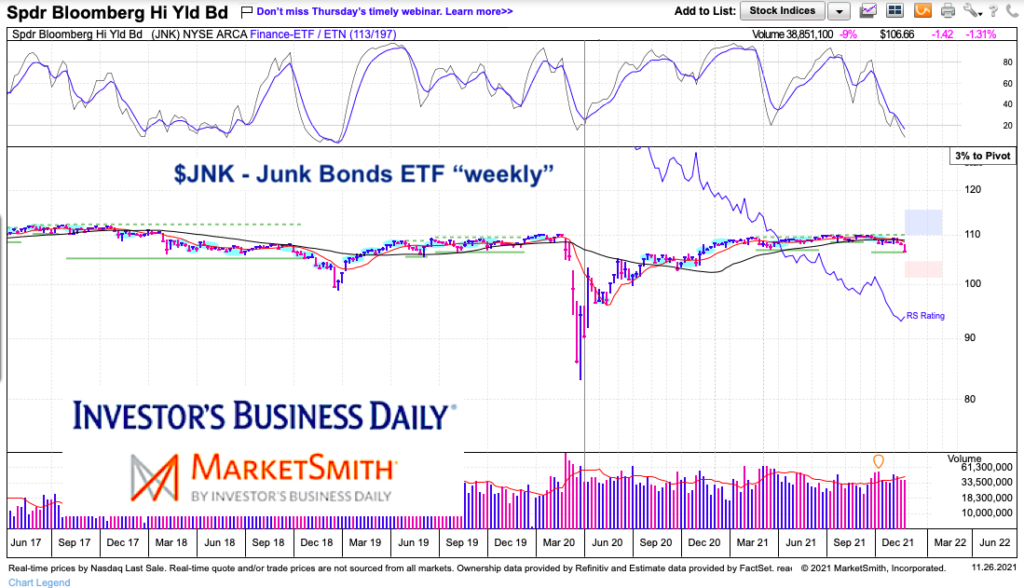

$JNK Junk Bonds ETF “weekly” Chart

Zooming WAY out and looking at a long-term weekly chart of JNK, we can see that it rallied out of the coronavirus crash but has struggled getting above its prior highs (with failing momentum).

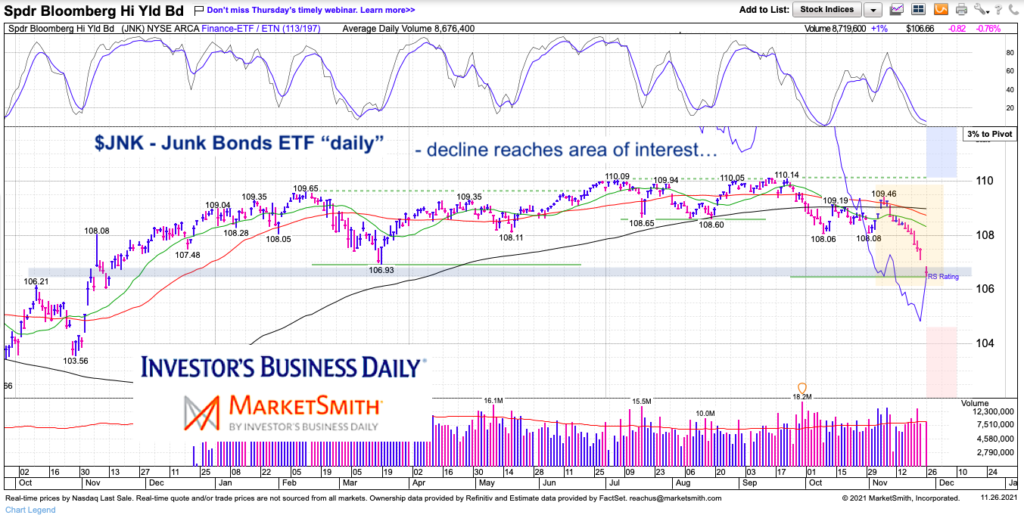

$JNK Junk Bonds ETF “daily” Chart

Turning to the daily chart, we can really see how the air has been let out of the balloon recently and taken JNK down to the $106 level. That level marks last November’s breakout as well as the March lows.

The selling began in September and recently intensified. This aligns with the pullback in equities. However, if stock market bulls are to regain control of the market, they’d like to see junk bonds firm up. And holding near the $106 area would be a great start.

If this area gives way, the correction in equities may continue for a bit longer and JNK might be headed toward $100.

Twitter: @andrewnyquist

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.