Last week I posted a Case Study looking at a couple of Short Strangle options plays with IWM. The idea behind the case study was to see how the trades would perform and follow their progress. Again, this was with the iShares Russell 2000 ETF (NYSEARCA:IWM).

After such a strong rally following the election, we were likely to see some sideways action or some mean reversion.

At the time IWM was trading at $130.45. It since rallied to $134.10 and today came back to $130. 97 which is only slightly higher than when we set up the case study.

This is perfect for the Russell 2000 Short Strangle options play via IWM. We’ve had 5 trading days pass and the ETF is basically back where it started.

Let’s see how the trades are working out.

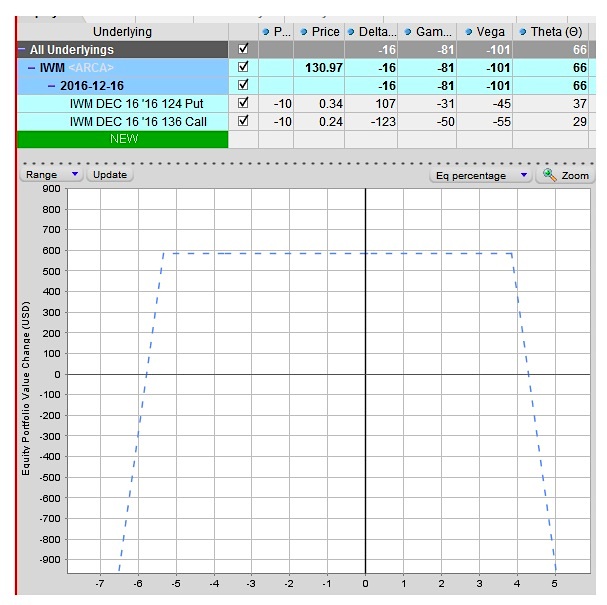

EXAMPLE 1 – 124 Put and 136 Call

Initially, the 124 put was trading at $0.84 and the 136 call was trading at $0.49. The profit potential in the trade was $1,330 for 10 contracts.

As of the close on Dec 1st, the 124 puts are trading at $0.34 and the 136 calls are trading at $0.26.

P&L on the trade so far is $730 out of a possible $1330 or around 55% of the total potential profit. Total return on capital (margin was $47,000) is 1.55%.

This would be a good time to think about taking profits.

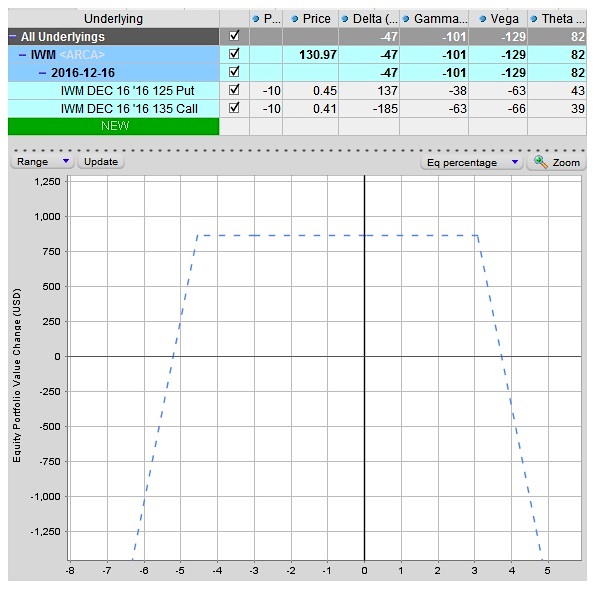

EXAMPLE 2 – 125 Put and 135 Call

The second example was slightly more aggressive by bringing the strikes in a little closer to the money.

The 125 put was trading at $1.01 and the 135 call was trading at $0.71. The profit potential in the trade was $1,720 for 10 contracts.

As of the close on Dec 1st, the 125 puts are trading at $0.44 and the 135 calls are trading at $0.42.

P&L on the trade so far is $860 out of a possible $1720 or around 50%. Total return on capital (margin was $49,000) is 1.43%.

Again, with profits currently at 50% of the potential, this would be a good time to think about taking profits.

Thanks for reading.

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Twitter: @OptiontradinIQ

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.