If you are wondering what is meant by the word ‘Fade’, you are not alone. This appears to be a term used by the millennials in the office to denote a trend that is over or starting to end. Such as ‘the manbun hair style has faded’.

In this case, we are not talking men’s hair fashion, but instead a investing theme or strategy we have been endorsing and implementing in the portfolios we manage since late 2014.

Cyclical yield, when it comes to dividend focused equity investing, targets more dividend- paying companies that are more sensitive to the economy than to changes in interest rates or yields. As an example, UPS which delivers packages around the world would be a dividend payer that is economically sensitive. If the economy is doing better, we tend to ship more packages. Conversely, PPL CP which is a large U.S. utility that generates and delivers electricity to customers is more interest rate sensitive. Sure, maybe we use a bit more power when the economy is doing well but given the stable cashflow, the company tends to trade with greater sensitivity to changing bond yields than economic data.

The premise behind the cyclical yield theme is if the economy is going well, it puts upward pressure on bond yields, a negative for those dividend-paying companies that are closer to bond proxies or are more interest rate sensitive. And thanks to rising economic activity, will be good for those dividend-paying companies that are more economically sensitive.

Our methodology for differentiating dividend-paying companies between interest rate sensitive and cyclical yield is based on the company’s or industry’s sensitively to bond yields. Measuring against economic activity is rather difficult given economic data is infrequent, compared to daily yields and stock prices. As it happens, the least interest rate sensitive industries are dominated by those considered economically cyclical.

The spectrum on the right sorts Canadian industries that pay dividends, based on their sensitivity to changes in bond yields, the bottom ones are the most sensitive and the least at the top. As you can see, the least sensitive tend to be much more economically cyclical, hence our ‘Cyclical Yield’ nomenclature.

Yes, we were early

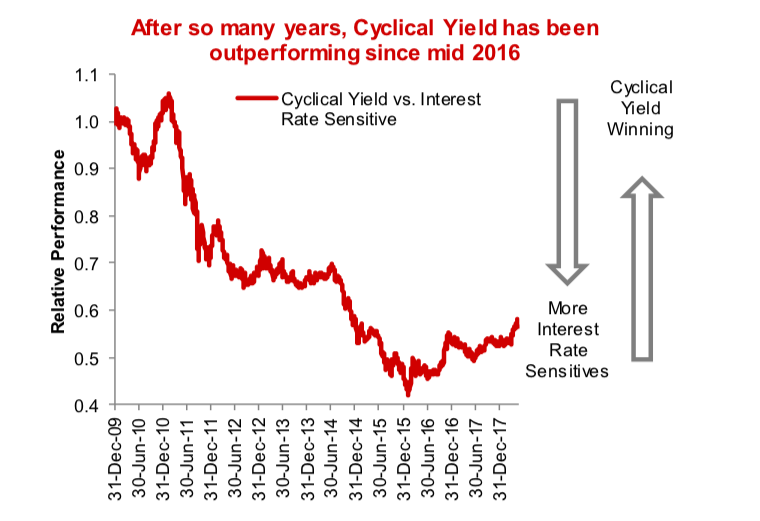

As firm believers in transparency when it comes to managing money, we started publishing our thoughts on interest rate sensitivity and the Cyclical Yield theme as we were tilting our portfolios. Given we started publishing in late 2014, we must concede that we were a tad early. There was still another leg down in bond yields, and the Interest rate sensitives continued to outperform Cyclical Yield for a little more than a year. But in 2016, the situation changed, and Cyclical Yield has been outperforming ever since.

This theme has really helped. Our flagship Dividend Fund which has a good tilt towards Cyclical Yield names is currently ranked in the 7th percentile over the past year in the Morningstar Canadian Dividend & Income Equity category. We have noticed a strong divergence among this peer group as a function of their respective interest rate sensitivities.

We would typically prefer to be early than late when it comes to investing.

Which does raise the question, when should investors begin to fade the Cyclical Yield names. At this point in the cycle with bond yields on an uptrend and global economic growth appearing broad-based and robust, the time to fade is not now. However, we must be cognizant that Cyclical Yield industries and names will not hold up well in the next bear market. If the bear market coincides with a recession, as is usually the case, being more sensitive to economic data will not be good.

Steady as she goes, for now…..

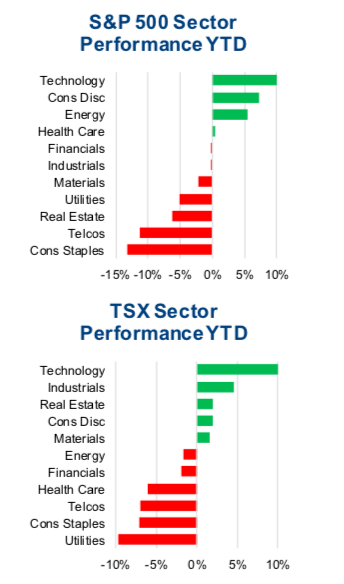

More evidence of the recent outperformance of the more economically sensitive companies vs interest rate sensitives can be seen in the relative sector performance of the S&P 500 and TSX Composite year-to-date. Note for each of these major indices the better performing sectors are those considered more levered to the economy. These include Technology, Industrials, Materials and Energy. Those performing the worse include Utilities, Consumer Staples, Real Estate and Telcos. This divergence in performance across North American equities is material. And while all good ideas inevitable come to an end, we don’t believe this thematic has been played out.

The duration and magnitude of the outperformance of interest rate sensitives over cyclical yield last more than half a decade (back to the 1st chart). No guarantee the reversal will last as long, but we would be surprised if it ended soon. Plus, with inflationary data such as PPI, wages and other metrics rising, this could surprise the market in coming months to push yields higher. Again, favoring the Cyclical Yield theme.

Portfolio Management Implications – We conducted a survey in our Daily Launch Pad asking when readers thought the next bear market would take hold. Over 80% expected this to happen within the next two years, including almost 30% saying in the next year. Now surveys are surveys, but we do not want to be tilted towards Cyclical Yield in the next bear.

Currently, we have modeled two scenarios that would cause us to start rebalancing away from Cyclical Yield and more to Interest Rate Sensitives. The first is higher yields. Should we see yields move higher, such as the ten-year Treasury over 3.3%, and Interest Rate Sensitives becoming more compelling, we would begin to transition. While valuations have become more compelling in Utilities, Telcos and Consumer Staples relative to six months ago, it is not enough to start to lure us in. The other scenario would be a deterioration in our Market Cycle indicators, notably on the economic side. We use over 30 Market Cycle Indicators that each have historically been decent forward-looking indicators. Weakness in these would cause us to become more conservative in our allocations to companies sensitive to the economy. Currently these indicators remain rather bullish for the market cycle.

Acknowledging we can’t call tops or bottoms, managing this turn even if a bit early will be a crucial determinant of future success. But today still appears way too early.

Charts are sourced to Bloomberg unless otherwise noted.

Twitter: @sobata416 @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.