The drop in demand for electricity and the increased supply of natural gas caused prices to plummet for all electricity producers – including coal and solar, over the last 5 years.

In short, it’s been ugly.

An ETF that invests in solar companies, the Guggenheim Solar ETF (TAN) trades at about $25 per share today, down from a high in May 2008 of $278. An ETF that invests in natural gas, the First Trust Natural Gas ETF (FCG) trades at about $20 per share today, down from its 2008 high of $157.50.

The two largest publicly traded coal companies in the U.S., Peabody Energy and Arch Coal, have both been through bankruptcy in the last 5 years. For producers of electricity, the last few years have been historically rough.

Despite recent volatility, over the longer term I continue to see tremendous opportunity in select equities; specifically, electricity generation stocks look appealing.

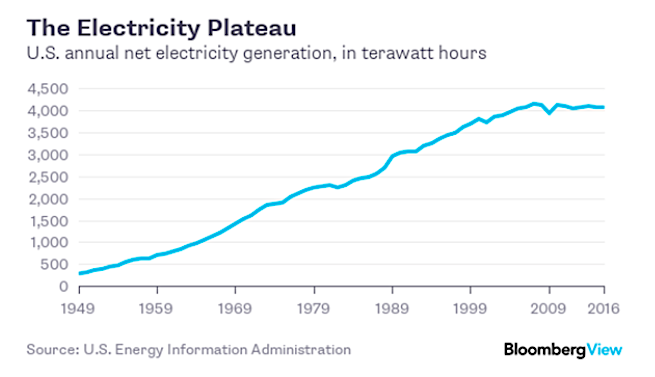

In 2008, electricity consumption in the U.S. suddenly stopped growing, and even contracted slightly:

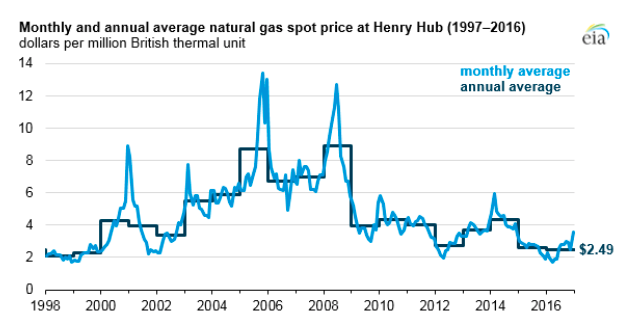

At the same time, technological advances allowed oil and gas companies to extract previously unobtainable oil and gas by fracturing or ‘fracking’ shale rock. This caused a surge in natural gas production, which caused natural gas prices to plummet:

In the midst of change, I believe there is opportunity. I believe demand for electricity in the U.S. will eventually return to growth. More processing power in our computers, tablets and phones generally requires more electricity. Drones require electricity. Electric cars will require, you know, electricity. Demand for natural gas is growing even faster than demand for electricity: rather than updating coal-fired generation plans to meet environmental criteria, many utilities are opting to simply shutter them and instead buy more natural gas. Coal-fired plants that do not meet environmental criteria cannot simply be turned back on – it takes years to update them. So our electrical grid is becoming more reliant on natural gas, and consuming more of it.

In addition, exports of natural gas from the U.S. have begun to skyrocket, via pipeline to Mexico and also via huge new Liquefied Natural Gas (LNG) terminals. Natural gas can only be shipped in liquid form, which requires cooling to minus 260 degrees. It’s a tricky process. In the next few years, massive new LNG terminals will come online in the U.S., allowing us to ship LNG to energy-hungry Asia, as well as a Europe that is currently dependent on a sometimes unfriendly Russia for most of its supplies.

At some point, depressed prices for electricity generation will move higher, as domestic demand and foreign exports continue to grow. Energy prices are famously volatile, so please do not construe any of the above commentary as a recommendation to buy.

This material was prepared by Greg Naylor, and all views within are expressly his. This information should not be construed as investment, tax or legal advice and may not be relied upon for the purpose of avoiding any Federal tax liability. This is not a solicitation or recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. The information is based on sources believed to be reliable, but its accuracy is not guaranteed. Investing involves risks and investors may incur a profit or a loss. Past performance is not an indication of future results. There is no guarantee that a diversified portfolio will outperform a non-diversified portfolio in any given market environment. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Listed entities are not affiliated.

Data Sources:

Bloomberg View – electricity generation chart

EIA.GOV – natural gas prices chart

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.