Wednesday morning brought some love to the US econonmy.

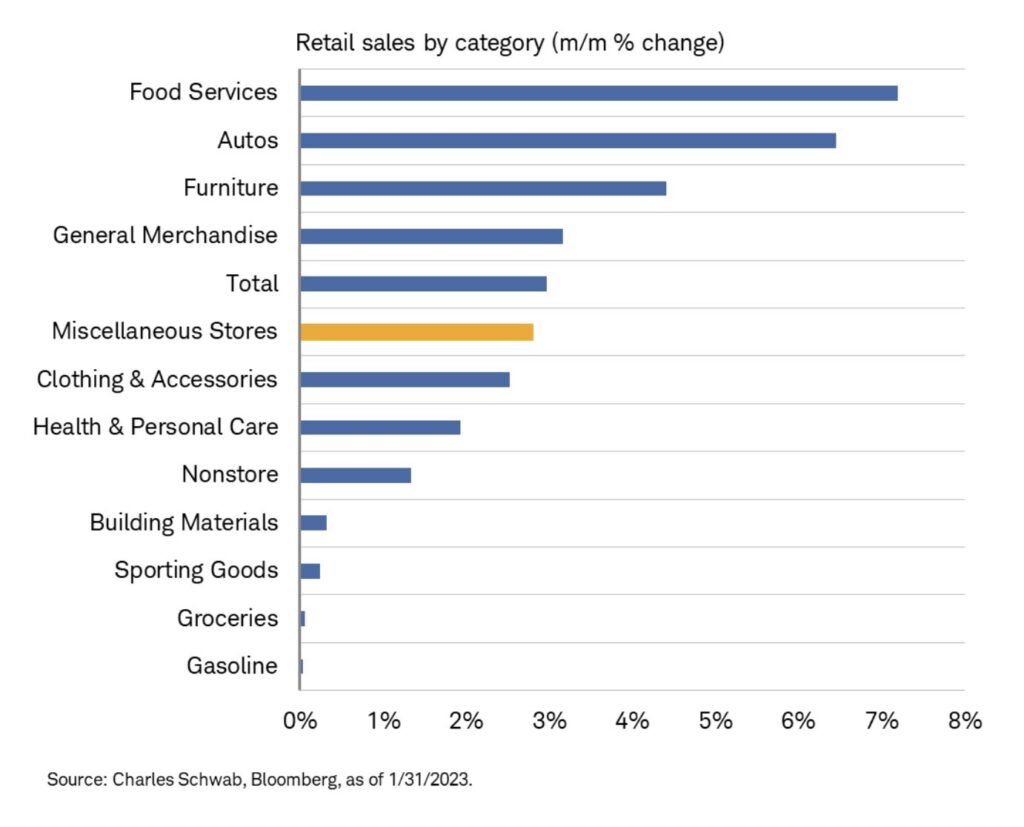

The January retail sales, rose 3% month/month vs. +2% estimated.

The breakdown fascinates.

With food inflation where it is, and egg prices the big headline, the leader for today’s number is FOOD, particularly eating out.

At the bottom of the chart or with the least rise in sales by retail consumers is groceries and gasoline.

Makes for some head scratching really.

Considering folks bought cars and ate out, but did not gas those cars much or buy a lot of food to cook at home with.

Is the whole country buying Teslas and eating at Wingstop?

Both of those stocks did extremely well with WING making new 52-week highs and Tesla up more than double from its January low.

There’s Retail Sales, Then There’s Granny Retail

Retail through the eyes of our Granny of the Economic Modern Family is a great go to as the basket of XRT has a good blend of e-commerce, brick and mortar, consumer staples and discretionary goods.

Notice on this weekly chart that the 23-month moving average is much higher than current levels.

Another point is that with Wednesday’s ebbulience, the price remains below last week’s high.

Furthermore, last week’s high remains below the week prior.

So, XRT is making lower highs each of the last 3 weeks, but also has found a basis of support at 68.00.

Moving down to our Leadership indicator, Retail is outperforming the benchmark which makes sense given today’s retail sales number.

And that is a good thing given Granny resides next to the Russell 2000 as the king and queen of the U.S. economy.

However, neither are proving to us yet that they are entering a growth stage beyond the 2 year business cycle high and can sustain this rally.

Finally, Real Motion on the bottom, shows a negative divergence. While on the price charts the 50-DMA (blue) is above the 200-DMA (green), the momentum chart looks a bit different.

The 200-DMA is above the 50-DMA so not as strong a phase. Secondly, the momentum red dots are below the 200-DMA while the price is above it on the top chart. And, the momentum skips along the 50-DMA.

Although the momentum is weaker, it does not necessarily mean the price cannot go higher.

However, it does suggest that the overhead monthly moving average resistance is palbable and bulls can have some fun, but should also remain vigilant.

Stock Market ETFs Trading Analysis & Summary:

S&P 500 (SPY) 420 resistance with 390-400 support

Russell 2000 (IWM) 190 pivotal support and 202 major resistance

Dow (DIA) 343.50 resistance 338 support

Nasdaq (QQQ) Nice comeback-still 2 inside weeks working so watch 311 as a good point to clear or fail from

Regional banks (KRE) 65.00 resistance 61 support

Semiconductors (SMH) 248 cleared now support-254.60 last week’s high

Transportation (IYT) The 23-month MA is 244-now resistance 228 support

Biotechnology (IBB) Sideways action 130-139 range

Retail (XRT) 78.00 the 23-month MA resistance and nearest support 68.00

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.