By Andrew Nyquist

By Andrew Nyquist

So here we are again, trying to weigh the significance of the US economic slowdown as it pertains to the upcoming Federal Reserve Rate meeting on June 19-20 and ongoing Fed Policy action. With global equities taking a hit over the past two months, many are anticipating, and pushing for, further Fed easing… or at a minimum, hints at QE3 (another round of Quantitative Easing). Sound familiar?

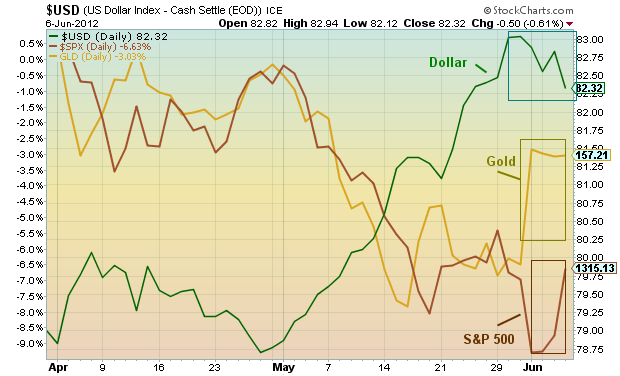

And when the markets “want” something, they speak loud and clear. Case in point, Fed Chief Ben Bernanke is speaking to the Joint Economic Committee in Congress today, and knowledge of this scheduled event, combined with the recent equity swoon, has the market up to its usual tricks: holding the Fed hostage for a few hints at further easing… check out the recent Dollar dip and Gold/Equities rise in the chart below; clearly, the markets are looking (and hoping) for the Fed to remain easy.

US Dollar vs S&P 500 vs GLD Chart

But, it’s more complicated than that. Over the past month, the dollar has moved steadily higher, likely due to a confluence of fundamental global economic issues (read on) and technical factors. This has alarmed equity and commodity markets and pushed the Dollar closer to a technical breakout (Read: “What If the Dollar’s Rise Doesn’t Stop Here?“). Furthermore, the Dollar is lingering in and around the key support/resistance toggle zone of 81.50-82.50 and the direction the Dollar takes from this important juncture will likely play an important role in the performance of global equities and commodities throughout the remainder of the year. See chart below.

US Dollar Chart

Well, it’s still 2 weeks away and a lot can happen between now and then… but many have been asking, “What if the Fed disappoints?”

Although this may matter on a short-term reactionary basis, the dollar’s movements are more likely to be a function of technical forces, fundamental global economic issues, and currency market volatility. Furthermore, even if the Fed serves the porridge “just right,” there are still many complex global economic factors weighing on overseas markets, that should buoy the dollar over the intermediate term, including:

1) Many emerging and developed countries are struggling economically and trying to catch up to the U.S. in terms of easing and currency devaluation. And, believe it or not, the US is in better shape than many over the near term.

2) There is whiff of global deflation in the air — this is evident by ongoing low(er) rate environment, continued debt destruction, and a heavy precious metals environment.

3) Continued European distress and the potential for EU action (i.e. Euro Bonds).

4) Ongoing economic concerns in China could lead to further easing and pro-growth economic policy initiatives (i.e. the surprise overnight rate cut).

Note that #3 and #4 (as well as potential for additional easing all around the world) may occur as economists become less concerned about inflation and begin to weigh deflationary pressures. Currency wars anyone?

So, although the Fed’s actions may cause some near-term “noise” in the markets, the dollar should remain elevated in spite of slowing domestic growth. And only a “sustained” break lower through 80 would derail the intermediate term dollar train.

Trade safe.

———————————————————

Twitter: @andrewnyquist and @seeitmarket Facebook: See It Market

No position in any of the securities mentioned at the time of publication.

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of his employer or any other person or entity.