Wednesday showed weakness in key sectors including the Biotech ETF (IBB), Semiconductors ETF (SMH), and the Transportation ETF (IYT).

We have closely been watching the transportation sector for improving strength as it has attempted to clear its 50-Day moving average (DMA). Instead IYT has broken underneath the 200-DMA, and though it sits in a support area, the failed rally through the 50-DMA shows a large amount of overhead resistance.

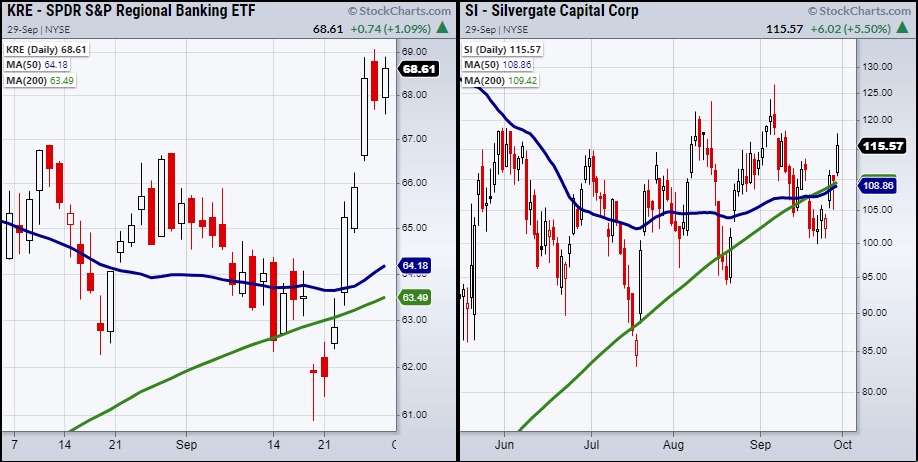

That said, one sector that is standing its ground is the Regional Banking ETF (KRE).

However, even the financial sector should be traded carefully with a looming debt ceiling ahead and only a small amount of time before a decision must be made in mid-October.

On the other hand, if the market decides to push higher, this could make financial equites enticing as their strength has shown through this week’s trading action.

One particularly interesting bank stock is Silvergate Capital (SI).

Although it has been rangebound since May, if SI can clear the high of its range near $122 and hold, it could be ready for a major move into the $160 area.

Another factor that could make SI a stronger banking pick is its ability to offer crypto banking services along with traditional services.

Therefore, with many weak sectors not including KRE, traders should stay cautious as the debt ceiling becomes the focus for the coming weeks.

Watch Mish’s most recent appearance on Fox Business: Making Money with Charles Payne!

Stock Market ETFs Trading Summary & Analysis:

S&P 500 (SPY) Inside day. With Tuesday low to hold at 432.94.

Russell 2000 (IWM) Needs to hold 220.

Dow (DIA) Inside day. 342.41 minor support to hold.

Nasdaq (QQQ) Needs to get back over 360.

KRE (Regional Banks) 66.35 support and 70 resistance.

SMH (Semiconductors) 250 next support area.

IYT (Transportation) Could not stay over the 200-DMA at 249.83.

IBB (Biotechnology) 157-160 major support

XRT (Retail) 92-98 rangebound area

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.