Sometimes we can get a little overboard with our use of market personification. Though abstract and ethereal, the stock market can be thought of as a projection of human emotion, though it is obviously incapable of human behavior.

Keeping a pulse on the stock market’s mood is a rather elusive, but important part of understanding market risk or opportunity especially when it is at extreme levels.

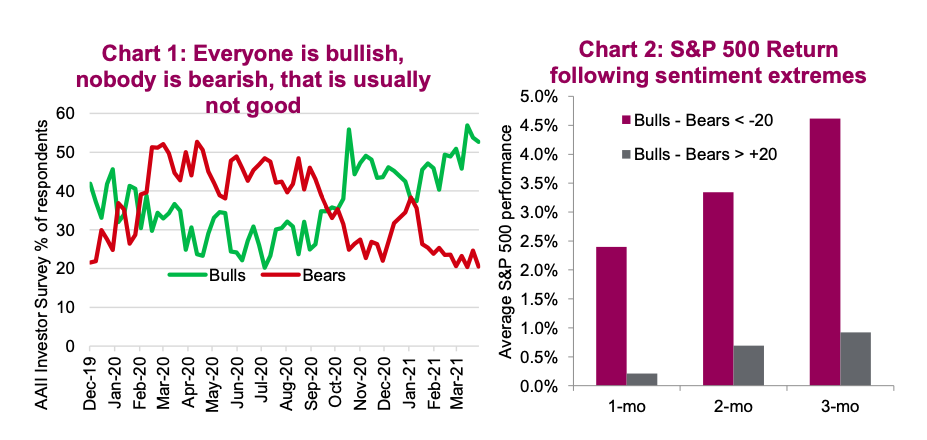

Earnings, cash flow, macro-trends are all important in the long run, but the markets mood can change in an instant. One of our go-to indicators for market sentiment is the AAII Bull/Bear survey that is released every Thursday. It simply asks members where the market go over the next six months.

Currently the number of bullish investors outnumber the bearish investors by 32 points as the spread in the charts below indicate. When this spread goes +/- 20 we take notice, as it’s historically been a predictive contrarian indicator. Elevated sentiment has historically resulted in lower future returns as an overly optimistic mood typically follows a strong run for equities.

This isn’t the only sentiment indicator, just one of many in the toolbox. The VIX Index one as well. Often called the ‘fear gauge’, it’s now trading in the 17s and at the lowest level since before anyone of us took notice of Covid-19. Cash levels of institutional money managers have also steadily been declining and are currently well below where they were at the prior 2007 market peak.

Insider trading activity can also provide clues to what those who have their ears closest to the ground are doing. The CFO of Coinbase selling 100% of her vested shares on the first day of trading got some attention, but even in aggregate the ratio of insider sales to buys recently hit 143, or 143 sales for every purchase according to data from Sentient Trader.

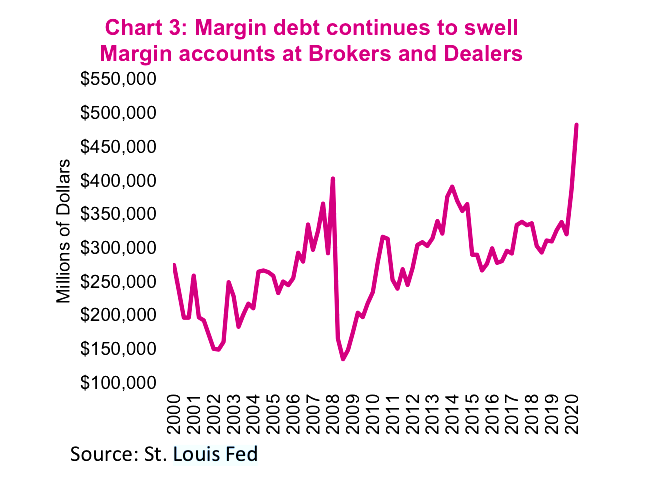

An additional sign of heightened investor confidence is the willingness to go into debt. Investors are increasingly borrowing against their existing holdings causing margin debt to skyrocket. While the available data from the St. Louis Fed in chart 3 is delayed, in late 2020 total margin debt rose by over 50% from Q1 to Q3. This is one of the highest increases over the past 20 years. With memories of the sudden collapse of Archego Capital still fresh, we shouldn’t have to remind investors of the embedded market risk high leverage.

With various tools all giving similar readings, it’s difficult not to be a little nervous. Should a correction occur in the near term, we’ll look back and sayhow obvious the signs were. Then again, there are tangible reasons to be optimistc. Should we be so bold to utter those dredded words; maybe this time is different? Not likely. The risk of a correction is always present, maybe moreso now than in the past few months.

Flows setting records

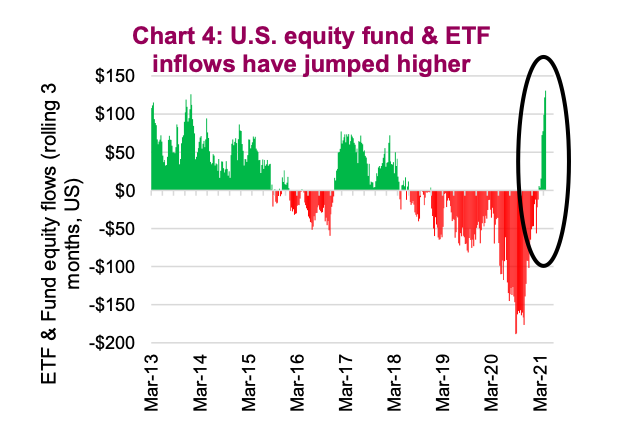

Sentiment is one thing, often based on surveys or other softer data points, but nothing speaks to what investors are thinking or how they are feeling like the movement of their dollars. And the dollars are flowing fast. The rolling 3-month total of inflows to both equity funds and ETFs combined in the U.S. is about $100 billion. That may not sound like that much but this is the first meaningful positive inflow since early 2018, three long years ago.

The steady outflows from mutual funds has slowed while the inflows into ETFs has exploded to the upside. Looking at a combined number of both funds and ETFs helps negative this migration from one structure to another and helps capture the net flow of individual investors.

While clearly positive for fund/ETF product manufacturers (yay!!!), more importantly it is additional evidence that individual investors are becoming more active. Whether this behaviour is borne out of boredom during the pandemic, fear of missing out on another big up year, playing the market with stimulus cheques, an increasingly engaged individual investor cohort can have a dramatic impact on market. When they are ‘piling in’, this impact is to the upside and could go on for sometime.

On the cautionary side, individual or retail investor flows are notorious for performance chasing and ‘piling in’ very late in market gains. So enjoy this as the flows may continue to lift markets for sometime. But be prepared to add defense quickly, because when the momentum breaks the market will fall.

Source: Charts are sourced to Bloomberg L.P. and Richardson Wealth unless otherwise noted.

Twitter: @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.