A rising tide lifts all boats. We’ve all heard the saying before—and it’s hard to argue against, especially when applied to a dramatic shift in sentiment like the one small cap equities enjoyed during the first quarter. During that time, a whopping 84% of constituents of the S&P 600 Index saw their shares increase in value.

Now, however, it appears that the easy money has been made. There’s still a strong case for smaller companies, but investors have become more selective about which ones to favor.

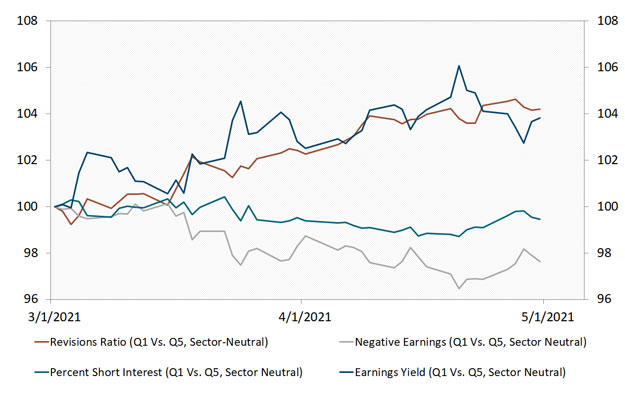

During the past six weeks, as shown above, stocks generating attractive earnings yields and positive earnings revisions have outpaced money-losing businesses and heavily shorted names (think Gamestop Inc.). This change is healthy, in our opinion, and could bolster the case for an enduring run for the long-overlooked asset class.

The switch also highlights how active management is poised to take on greater importance in the months and quarters ahead as equities rise and fall based on underlying business strength as opposed to the latest macro prediction or day-trader chatter on message boards.

If the trend holds, it could be an excellent time to be fundamental small-cap investor.

Chart Source: Cornerstone Macro, LP; Daily 3/1/2021 to 4/30/2021. The data in this chart represents the performance of the top quintile of S&P 600 Value Sector-Neutral Factors vs. their bottom quintile basket. Sector Neutral is an approach that assigns quintiles to stocks based on their ranking of factors within their respective sectors. The stocks are then compiled into portfolios with sectors equal to those in the initial index. Negative earnings are represented by earnings with a net income less than zero over the last twelve months. All indices are unmanaged. It is not possible to invest in an index.

This article was written by Will Nasgovitz, CEO and Portfolio Manager.

Disclosure:

Past performance does not guarantee future results.

Investing involves risk, including the potential loss of principal.

There is no guarantee that a particular investment strategy will be successful.

Value investments are subject to the risk that their intrinsic value may not be recognized by the broad market.

As of 4/30/21, Heartland Advisors on behalf of its clients did not own shares in GameStop.

Portfolio holdings are subject to change without notice. Current and future portfolio holdings are subject to risk.

The statements and opinions expressed in the articles or appearances are those of the presenter. Any discussion of investments and investment strategies represents the presenters’ views as of the date created and are subject to change without notice. The opinions expressed are for general information only and are not intended to provide specific advice or recommendations for any individual. Any forecasts may not prove to be true.

Economic predictions are based on estimates and are subject to change.

ALPS Distributors, Inc., is not affiliated with Heartland Advisors.

Definitions: Earnings Yield is the reciprocal of the price to earnings ratio. Price/Earnings Ratio of a stock is calculated by dividing the current price of the stock by its trailing or its forward 12 months’ earnings per share. Revisions Ratio is upward revisions subtracted by downward revisions, divided by total earnings per share revisions. S&P 600 Index is a group of 600 U.S. stocks chosen for their market size, liquidity and industry group representation. All indices are unmanaged. It is not possible to invest directly in an index. Short Interest is the quantity of stock shares that investors have sold short but not yet covered or closed out. Short interest is a market-sentiment indicator that tells whether investors think a stock’s price is likely to fall.

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.