Do you follow me on X?

You should. I keep track of The Retail Sector ETF (NYSEARCA: XRT) like it’s my job!

Well, it is my job as I created the retail sector character from my imagination.

Why?

Because without the Retail Sector (XRT), the economy and eventually the stock market would sputter.

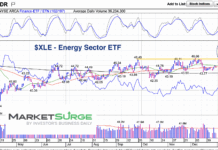

XRT has danced around the 200-DMA (Daily Moving Average) for the last 2 weeks, and this is after failing the 50-DMA in mid-October.

Looking at the chart, you can see the failure of the 50-DMA (Blue) and the gradual slope change on it to down.

What’s crazy, is that this was at the same time the S&P 500 was running to new all-time highs.

But that doesn’t fool us.

While we were saying that we don’t want to see a weak link become an anchor, Granny hung in there.

But we were also cautious about buying equities with the Retail Sector on the descent.

Then look at what happened.

XRT broke the July 6-month calendar range high (horizontal green line).

Then, XRT failed the 200-DMA on the Real Motion indicator (bearish diversion).

Meanwhile, SPY fell about 5% from the highs while NASDAQ fell 9%.

That trapped a lot of longs.

Nonetheless, while we raised stops and took profits, XRT continued to hold the 200-DMA (Sloping green line), hence, we never got too bearish.

However, Thursday’s action was indeed spooky.

So perhaps you lost a few of your long positions if you are using good risk parameters.

If you just stick it out on dips and don’t mind sitting with losses or watching your profits dwindle, Friday was key!!

Not only did XRT retake the 200-DMA, but it continued its run up.

On the Leadership indicator, XRT is outperforming the SPY for the first time since early September.

Real Motion (red dots) had a mean reversion and Friday moved back up above its 200-DMA.

We call Thursday’s action an unconfirmed phase change from caution to distribution.

However, we need 2 days to confirm a phase change.

Now, with the move on Friday, we are back in an unconfirmed caution phase.

That makes Monday critical, especially ahead of Black Friday.

Should XRT fail the 200-DMA again, we can notch Friday up to habitual dip buyers.

If XRT holds though, and can march back up to the 50-DMA, then we can notch that up to Santa!

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.