The equity markets enter the second half of the first quarter sitting at new record highs.

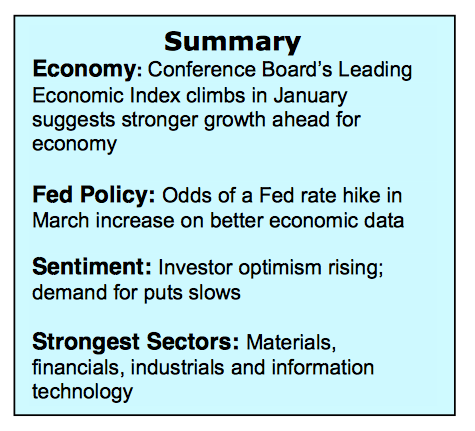

Stocks were supported last week by stronger-than-expected economic reports. Improving business conditions and the outlook for tax and regulatory reform are fueling confidence among investors, consumers and manufacturers. The popular averages have made a string of all-time record highs but market volatility (INDEXCBOE:VIX) has been conspicuous by its absence.

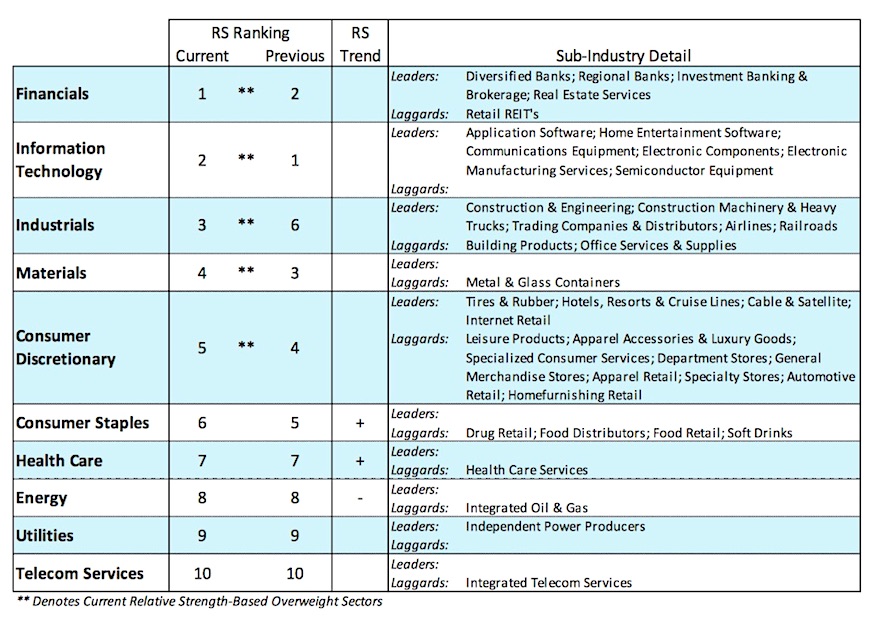

The S&P 500 (INDEXSP:.INX) has not seen a 1% move in either direction since early December which has prevented the market from becoming overbought and vulnerable to a correction. The best performing sectors continue to be financials, information technology, industrials and materials. Perhaps the most important performance last week occurred outside the equity markets. Despite a multitude of data that could have upset the bond market, yields remained remarkably stable. T-bond yields surprisingly eased last week as the debt markets overlooked a stronger-than-anticipated CPI report, a jump in industrial production, rising retail sales, a blowout report from the Philly Fed and new highs in the stock market. This suggests stocks are trading in a sweet-spot where revenue growth is finally emerging while bond yields remain unthreatening.

The technical condition of the stock market improved last week. Although the popular averages have risen for seven consecutive sessions, there is little evidence that the move has reached the exhaustion stage. Virtually all the negative divergences have cleared with the Dow Transports, Russell 2000 and S&P mid-cap indices joining the Dow Industrials and S&P 500 Index to record highs. The new high list includes the NY Stock Exchange Composite, an index with more than 2000 issues and appears to be gaining momentum.

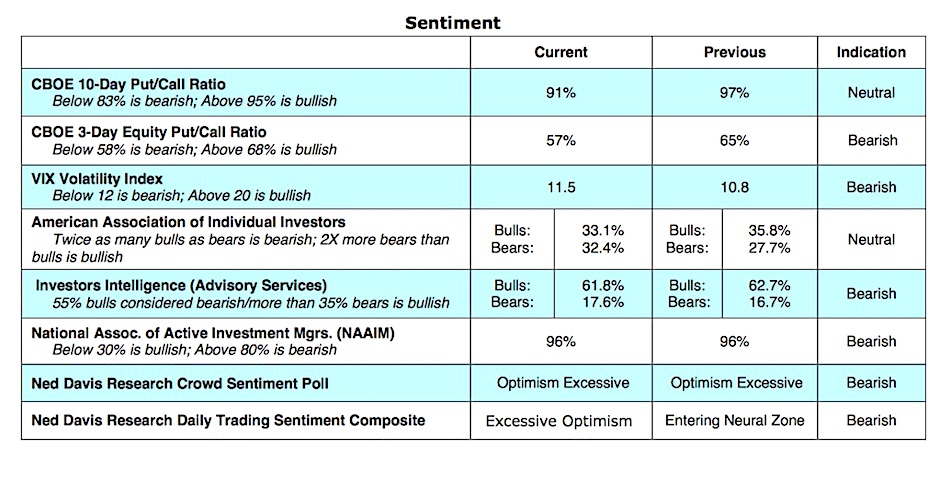

Stock market breadth is in a bullish mode. After stalling early in February, the number of issues hitting new 52-week highs is expanding. The performance by the stock market last week caused bullish sentiment to expand, which continues to be an area of concern. Most notable was the plunge in the demand for put options. The 10-day CBOE put/call ratio fell in the neutral zone late last week and further deterioration would argue a pullback is near given that often wrong option traders have aggressively bought puts since the November election.

Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.