Over the past several weeks, I have been providing a great deal of coverage on the divergences between the “haves” and “have nots”. A smaller amount of stocks have been holding up the stock market, leading investor pessimism higher as many assets and stocks have been difficult to “ride” in any direction.

The performance chasing in high flying stocks like Amazon (AMZN), Netflix (NFLX), Google (GOOGL), and Facebook (FB) has created a wide gap between the “average” stock in the S&P 500 Index.

Here is an interesting statistic from Bespoke Investment Group to back up this claim:

In the S&P 500 as a whole, the average stock is currently 19.4% below its 52-week high. Four sectors have readings below this level — Telecom (-22%), Consumer Discretionary (-22.2%), Materials (-24.5%) and Energy (-42.5%). – Bespoke Investment Group

Essentially this is telling us that the average stock is very near bear market territory. Pretty crazy when you think about the fact that the S&P 500 Index is only about 4% off its all-time high.

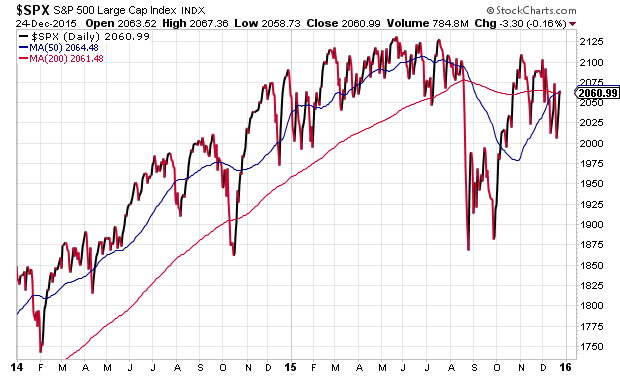

S&P 500 Chart (2014-2015)

The reason for this very differentiated performance is the market capitalization weighting of the index. A narrow group of large stocks in this basket are propping up the smaller underperformers to create the illusion of strength in the stock market as a whole.

This is also why there is such a great deal of investor pessimism on Wall Street. Those that own individual stocks are feeling the pain of those double digit losses unless they were lucky enough to pick one or two winners. However, in a group of 25 or 50 holdings, the odds seem to favor a greater number of losers. And this only increases the amount of investor pessimism.

There is two ways to look at this data:

- We are screwed. This is probably the start of another cyclical collapse in the stock market that will be fully realized once the leaders lose their momentum. Better load up on canned goods, gold, and ammunition.

- There is a whole lot of room for this market to rebound on the upside. If the average stock is nearly 20% off its recent high, that means there is significant margin for prices to surge without treading into “bubble” territory.

My prediction in 2016 is that there will be a great deal of reshuffling in the sector deck. I don’t know when or where it will occur. I’m not going to predict that energy or basic materials will be the big leader next year or that the consumer stocks will falter. I’m simply pointing out that there will likely be some reversion to the mean along the way. This will create new risks and opportunities depending on how your portfolio is currently positioned.

Sure there will be some traders who will hoard lots of cash and be able to pick a few consistent trends. However, that style of portfolio management is far different from the average investor who is looking to compound their wealth over the long-term.

In my opinion, the best way to avoid getting run over by picking the wrong area of the market is to stay diversified and boring with your core equity exposure. The hit or miss proposition of individual stocks makes for a very difficult environment to maintain correlation with the broader market. And with investor pessimism levels elevated, it can lead to risk management mistakes.

Two ETFs that I like for this type of exposure are the iShares MSCI USA Minimum Volatility ETF (USMV) and the iShares MSCI USA Quality Factor ETF (QUAL). Both funds offer a smart-beta approach to security selection by singling out 120+ large and mid-cap stocks with historically low volatility or solid underlying fundamentals (respectively). In addition, these ETFs offer an ultra-low expense ratio of 0.15%, which makes them attractive for those that want to minimize costs.

I am entering 2016 with these ETFs in my own accounts as well as my wealth management clients. My game plan is to use these types of diversified vehicles in the equity sleeve of our multi-asset portfolios unless we see a more prominent shift market trends. That will prompt a re-evaluation of the overall asset allocation and may lead to additional changes as necessary to pair back risk or pounce on new opportunities.

Thanks for reading.

Twitter: @fabiancapital

Gather more insights from David’s investment blog.

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.