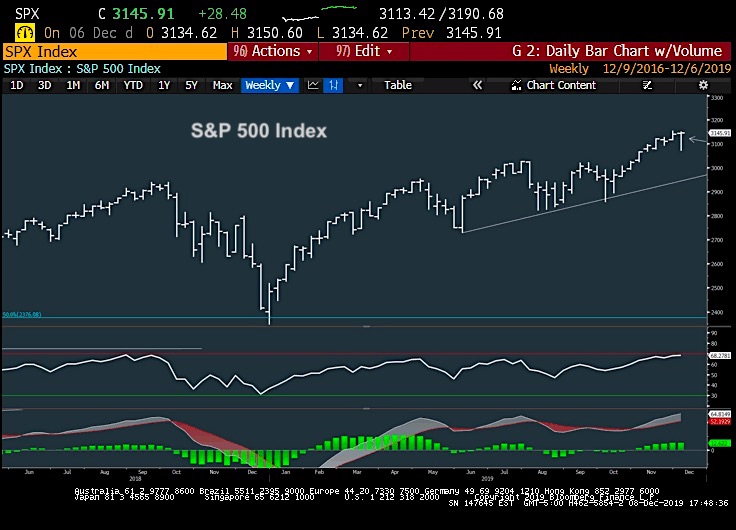

The major US stock market indices remain trending higher after last week’s early weakness failed to gain traction. For the week, the S&P 500 Index INDEXSP: .INX was down 5 points.

A quick 3-day decline erased 25% of the two-month rally from early October, but those losses were recouped just as quickly.

By the end of the week, no damage had been done to the weekly charts, and the momentum loss was only seen on daily charts.

While the patterns and trend have suffered to some extent in recent weeks and flattened out, it’s a necessity to see some type of pullback to new weekly lows to really care, technically speaking.

For now, increasingly, this looks like it might be delayed until January.

Below are 13 important developments to follow this week and into year-end.

1) SPX, NASDAQ and DJIA turned down sharply last Monday, erasing 25% of prior rally; Yet 90% of this weakness was recouped Wednesday-Friday

2) Momentum is overbought on hourly charts, yet pulled back to neutral on daily charts, while common trend following gauges like MACD turned negative

3) Despite daily technical damage to trends and momentum, the weekly chart shows no such thing, as prices recovered sufficiently to hold up well above prior weeks’ lows

4) Treasury yields failed to keep pace with Equities; Yields turned down sharply early last week, and still haven’t recouped this damage

5) Precious metals turned down sharply last week given some rosy economic data and consolidation is ongoing for the Metals. Gold still lags the movement in Gold stocks which have shown some above-average strength of late

6) US Dollar broke its one-month trend from early November and fell four out of the last five sessions, as Pound Sterling broke out ahead of this week’s election, signaling promise for the Tories against the Labour party.

7) Energy, Consumer Staples, and Healthcare took top spots in performance last week, while Industrials, Technology and Discretionary were all negative.

8) Leading sectors like Transportation dropped more than 1.8% last week, performing the worst out of any of the 24 S&P GICS Level 2 groups

9) Many Emerging market currencies snapped back sharply last week on US Dollar weakness. For many, however, like the Chilean Peso, Colombian Peso and Brazilian Real, have moved to decade-long new low territory, and bounces cannot be trusted as being anything more than temporary

10) EEM looks to have engineered a breakout of its one-month downtrend from late October and should be favored for gains in the days ahead and outperformance out of EM near-term

11) Small caps and Mid-cap outperformance continued for a third straight week after bottoming relatively speaking back in mid-November

12) Growth looked to have turned back lower last week vs Value in relative terms after having bounced from early November

13) Crude oil looks to be on the verge of breaking out above a very important area of trendline resistance near $60 in a trend which has held since April.

If you have an interest in seeing timely intra-day market updates on my private twitter feed, please follow @NewtonAdvisors. Also, feel free to send me an email at info@newtonadvisor.com regarding how my Technical work can add alpha to your portfolio management process.

Twitter: @MarkNewtonCMT

Author has positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.