Beyond the calm that persisted in the financial markets for the bulk of the year, 2017 was a season of real life hurricanes. Whether the financial markets can avoid stormy weather in 2018 remains to be seen… with the S&P 500 (INDEXSP:.INX) at all-time highs, it safe to say that investors have alluded stormy weather thus far in 2017.

While the skies overhead remain relatively clear for now, there are clouds that have formed on the horizon. Here’s an early take on the 2018 investing outlook.

Market Clouds May Test Investor Resolve

The goal here is to identify what we see as the most significant of those clouds and provide some context for how they might become more than just what-ifs on the horizon. To be clear, it is not time now to hang the storm shutters, but knowing where in the basement they are stored may not be such a bad idea.

As great as the financial impact of the storms that pummeled Houston, Florida and Puerto Rico this past year was, it is dwarfed by the scale of human suffering that did not abate as the winds died down. On top of this, we can scan the country to see continuing devastation caused by the ongoing opioid epidemic. This is exacerbated by a caustic political/social environment where we increasingly live near, talk with and listen to only those with whom we agree. It is said that the first service we can provide each other (just ahead of active helpfulness) is listening. Perhaps in 2018 we can each take a step toward expanding our comfort zones, striking up conversations with those we know see the world through a prism that is not our own, and spending time listening.

We mention this here, because we do not want to lose track of the world outside of investments and the financial markets at a time when economic growth has accelerated and stocks have rallied to new highs. The uptick in economic growth is consistent with an economy that has turned a significant corner on its way to improved long-term growth.

Real median household and personal income moved to new all-time highs in 2016, the latest period for which this data is available. In fact incomes had already bottomed in 2013 when “secular stagnation” became the phrase du jour to describe the current economic environment. As it turns out, this may have been as ill-timed as the White House Conference on the New Economy in 2000 (which included sessions titled “Is the New Economy Rewriting Rules on Productivity and the Business Cycle” and “Is a Debt-Free U.S. Government Good For America’s Economic Future”). These both appear to have been more of a glance at the rearview mirror than a reliable assessment of the road ahead. Moving into 2018, recession risk appears low at home and abroad, with economic and stock market strength being seen on a global basis. Most areas of the world are seeing bull markets for stocks and increasingly robust economic expansions.

Before considering 2018, we should pause and reflect on 2017, a year of investing that was unique in many ways. We don’t need an exhaustive list to get a sense of the year that was. These two might suffice: between November 2016 and November 2017 the S&P 500 posted 13 consecutive monthly gains (on a total return basis) and during that time period the maximum peak-to-trough drawdown (based on daily closing prices) was only 2.8%. This represents one of the smallest such pullbacks on record. Despite this calm and persistent up-trend, we would not conclude that the experience of 2017 was a hallmark of a new investing environment. Investors would be well-advised instead to see this passing year as a gift to be appreciated and not likely to be repeated any time soon. Proactively considering risk tolerances in anticipation of a return to more normal volatility in 2018 would be a great a way to celebrate the gains of 2017.

Our base case for 2018 (60% likelihood) is that it will be a year that is pretty much the polar opposite of 2017. The persistent upward trend with no meaningful pullbacks of 2017 could yield to a year where stocks finish relatively near where they begin while seeing broad swings along the way. If the clouds on the horizon coalesce into a more substantial storm, stocks could finish the year down close to double digits (20% likelihood). On the other hand, if a new front blows in and the current clouds dissipate, the expected swings in 2018 could be more muted than currently expected and stocks could continue their upward trend, albeit likely at a somewhat slower pace than was seen in 2017 (20% likelihood).

Our expectations for 2018 are not grounded in concerns over new stock market highs in 2017. When it comes to stocks, what goes up does not necessarily need to come down. Further, historical experience shows that making new highs is more bullish for stocks than not making new highs. The broad strength in 2017 has been an important factor keeping the rain clouds at bay. Rather, it is three specific potential themes for 2018 that could weigh on stocks and leave investors happily reminiscing about the placidity of 2017. The lack of drawdowns in 2017 is more likely an historical anomaly than a new paradigm. A return to even just historically average pullbacks could leave investors feeling uneasy. The experience has been that low drawdown years have tended to be followed with more than just average pullbacks (seeing average peak-to-trough declines in excess of 10%).

3 Key Themes to Watch in 2018:

1. Potential slowdown in earnings growth within the context of elevated valuations.

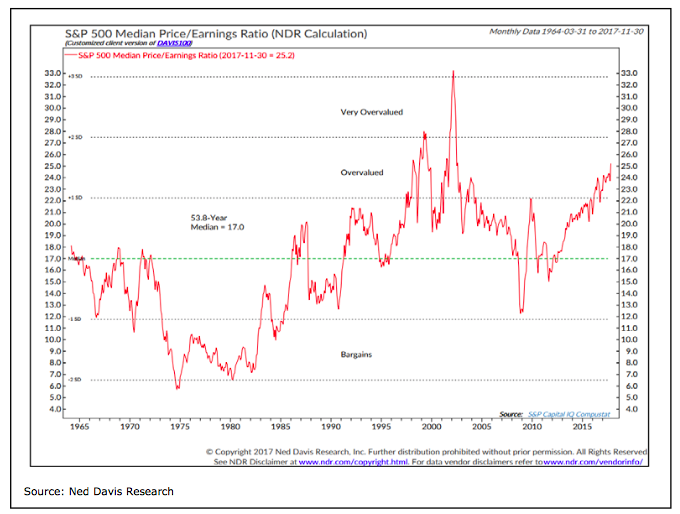

Earnings experienced a mid-cycle recession that ended in the third quarter of 2016. The recovery in earnings since then has provided a boost to stocks. Previous instances of such mid-cycle earnings recoveries suggest the growth in earnings could soon peak, moderating somewhat over course of 2018. This history also shows that stocks have struggled after earnings growth has peaked during these mid-cycle recoveries. This could be further exacerbated by stock valuation indictors suggesting stocks are expensive by almost any metric. Our preferred valuation measure shows the median price/earnings ratio for the S&P 500 (NYSEARCA:SPY) at 25x, the highest level in 15 years and well-above the long-term average near 17x. While market valuations are a notoriously poor short-term timing indicator, they do help identify risk over the longer term.

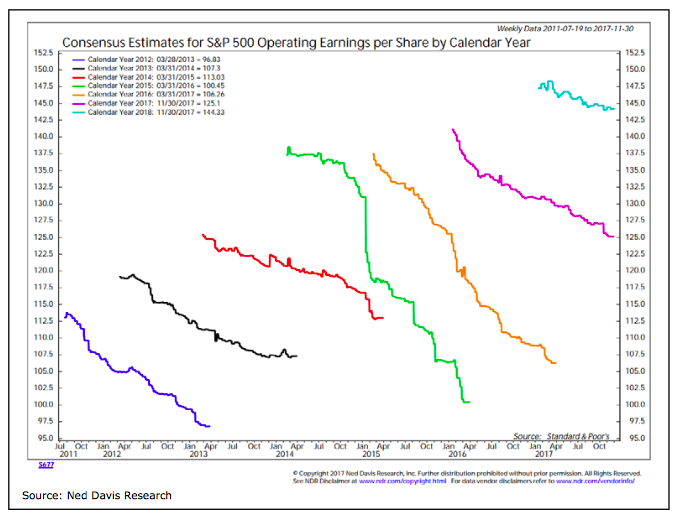

A meaningful slowdown in earnings is not currently built into earnings estimates. Current expectations have the pace of earnings growth moderating only slightly next year, with earnings expected to rise 15% in 2018 after gaining 18% in 2017. Importantly, while history suggests earnings growth could slow in 2018 current conditions are still consistent with robust earnings growth. Tax reform could provide a near-term tailwind from an earnings perspective, but the key to this may be the performance of the economy. Continued strength (or even a modest acceleration) in the economy could help sustain strong earnings growth. We will be keeping an eye on the economic surprise indexes for evidence that the economy is delivering upside surprises which could help validate the high earnings expectations.

It would be encouraging to see enough strength in the economy that earnings estimates actually drift higher over the course of the year. We are seeing that in terms of global earnings estimates, but have not, yet, seen it with respect to domestic earnings (although the pace of downward revisions to estimates has slowed).

2. Experimental central bank policy and untested central bank policymakers.

Central banks have already begun to get less friendly to financial markets, although at this point it would be premature to label them a headwind. The central bank balance sheet expansion since 2009 (known as quantitative easing) has provided ample liquidity to the financial markets. Globally, that peaked in 2016 and began to edge lower in 2017. 2018 could see a pronounced acceleration in this balance sheet unwind (quantitative tightening). The U.S. Federal Reserve continues to raise interest rates and has begun to reduce its balance sheet, the Bank of England raised rates for the first time in a decade in late 2017, and the ECB will be paring its pace of bond buying in 2018.

Even if this experimental combination of reduced liquidity and higher rates is negotiated successfully, it seems more likely than not that a few market-related hiccups could emerge along the way. The key could well be the inflation outlook – both at home and abroad. If inflationary pressures heat up, it could require central banks to take more aggressive measures or risk losing the confidence of the bond market (pushing yields higher). If the central banks move too aggressively relative to bond market expectations, the result could be a continued flattening and ultimate inversion of the yield curve, which has negative implications for economic growth. Several indicators bear watching on this front – commodity prices, bond yields, and the inflation indexes themselves. Already the Federal Reserve could be facing a delicate balancing act. Yields at the long end of the Treasury curve remain relatively low while the New York Fed’s Underlying Inflation Gauge is accelerating and moving toward 3% for the first time in a decade.

Messaging remains an important component of Federal Reserve policy and striking the right balance between conflicting signals is always a challenge. This could be even more so in 2018 given the turnover that is taking place across the Federal Reserve Board of Governors, including the transition at the top, from Janet Yellen to Jerome Powell as Chair. Market expectations for tightening seem to lag the Fed’s own forecasts, stressing the importance of getting communication right. History shows new Fed Chair’s tend to struggle in this regard, with stocks seeing a median maximum drawdown of just over 10% in the six months after a new leader is installed at the Fed.

continue reading this article on the Next Page…