Tuesday, we talked about the 6-month calendar range as a support level to hold in both the S&P 500 (SPY) and the Nasdaq 100 (QQQ).

Wednesday, both indices were able to hold support from their calendar range lows around $427 for the SPY and $352 for the QQQ. This test of the calendar range and recent lows shows that we have a solid support level the market needs to stay over if it’s going to rally higher.

However, while these are great levels to watch in the ever-changing market puzzle, we need more context when it comes to market demand and consumer sentiment.

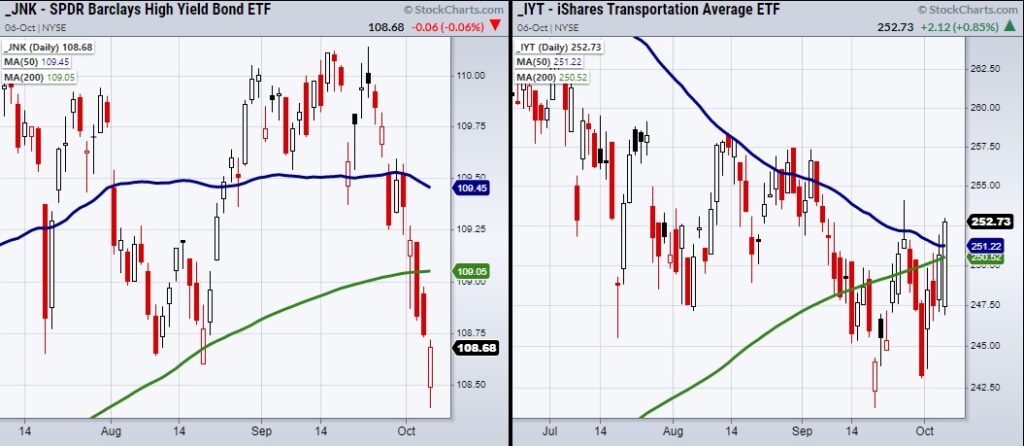

Luckily, we have two special ETFs we like to watch in addition to the major indices. The first is the Transportation Sector ETF (IYT) and the second is High Yield Corporate Bonds ETF (JNK).

With the holiday shopping season coming up, we should watch the transportation sector along with high yield corporate bonds as IYT shows the movement of goods while JNK shows investors’ willingness to take on risky corporate debt.

But simply knowing what to watch is not going to cut it. We need to keep in mind basic technical analysis and think about how each symbol is adding to the overall market picture.

For instance, as seen in the chart above IYT was having trouble clearing its 50-Day moving average (DMA) at $251.23. Now that it has closed over the 50-DMA, we should watch for it to hold over this price level.

On the other hand, though JNK looked terrible on the market open, it was very close to filling the gap from Tuesday’s low of $108.73.

For Thursday, watch for JNK to create a reversal pattern with a close over $108.73.

Overall, we have indices holding recent support along with an improved close over a key moving average in IYT and a potential reversal pattern in JNK.

This gives us clear levels to watch for a move higher or a clean break to the downside with lows nearby.

Watch Mish’s most recent appearance on Fox Business: Making Money with Charles Payne!

Stock Market ETFs Trading Analysis & Summary:

S&P 500 (SPY) Watch to clear the 10-DMA at 435.79.

Russell 2000 (IWM) Needs to get back over 222.

Dow (DIA) Flirting with the 10-DMA at 343.95.

Nasdaq (QQQ) 352 support area.

KRE (Regional Banks) Bounced off its 10-DMA at 68.25. 70 resistance.

SMH (Semiconductors) 248.78 support area.

IYT (Transportation) Watching for a second close over the 50-DMA at 251.22.

IBB (Biotechnology) Needs to find support.

XRT (Retail) 88.87 support the 200-DMA.

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.