Range of Profit:

The real difference between the two trades is the range of profit. When we buy stock, we know the position will lose money if the market trades below our entry price. When we sell a vertical spread, we end up with a break even point that can be well below the current market price at expiration.

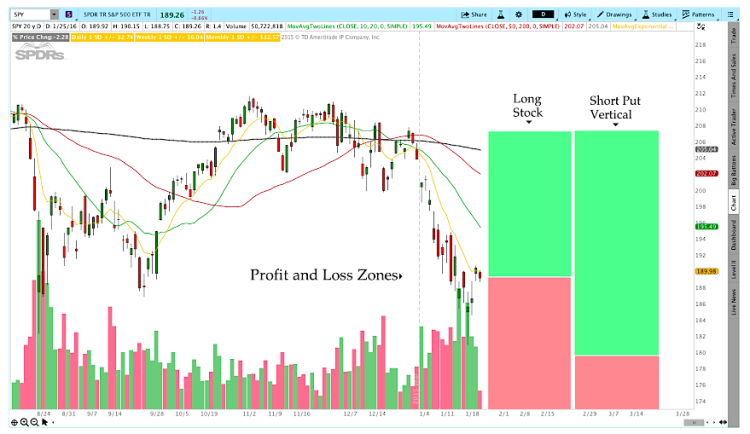

The chart below displays the profit zones for the two positions:

The break even point of 179.56 on the Put Credit Spread illustrates why people sell options instead of attempting to time the market. For the long stock trade, the break even point is the entry price or 189.35. An options trader might evaluate the market and choose to sell a put spread because they believe the market won’t go significantly lower. They might also reason that the market could go a little bit lower, but probably won’t make a new low. In other words, many options traders prefer to think about where the market won’t go rather than where it might go.

Isn’t selling options risky?

Trading options and especially selling options is not without risk. Even though the strategies have high win rates, poor risk management will lead to significant losses. In the put vertical we looked at above, the potential payoff is much less than the maximum loss. Due to that risk:reward, most options traders do not take the full maximum loss on their positions and choose to hedge, adjust, or simply exit the trades.

Good risk management is important for all traders and it’s especially important for options sellers because the maximum profit is limited. That being said, if you control your risk, selling options can provide a much wider range of profit with a high probability of success trading options.

To see a sample trading system that sells Credit Spreads using an objective trend filter, click here .The system includes entry and exit rules, markets to trade, and a comprehensive discussion on managing risk and expectancy.

Thanks for reading.

This post appeared on NewTraderU.

Twitter: @ThetaTrend

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.