“Nobody ever lost money taking a profit” ~ Bernard Baruch

When is a 10 percent stock market correction not a 10 percent correction? How about a 20 percent plunge being a bit more than just crossing the line into bear market territory? Huh? What? Bear with me for a minute.

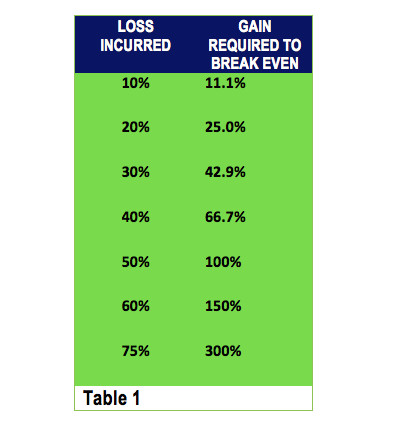

First, some quick backstory. From time to time, we’ve all likely heard about the math involved with incurring substantial losses. Frequently, these reminders come from traders stressing why you need to keep losses to a minimum and how difficult it is regain out-sized losses. I’ve owned Newmont Mining over the past four years (full disclosure – I still do), so I’m well aware how a 50% loss requires a sequential 100% gain to get back to square one.

If you need more on how this works, please see table #1 below.

Thank you for bearing with me – I believe what I am about to detail is as important (or even more so), than the above mathematics. It’s also something I’ve never seen discussed in 24 years of investing. Not one time.

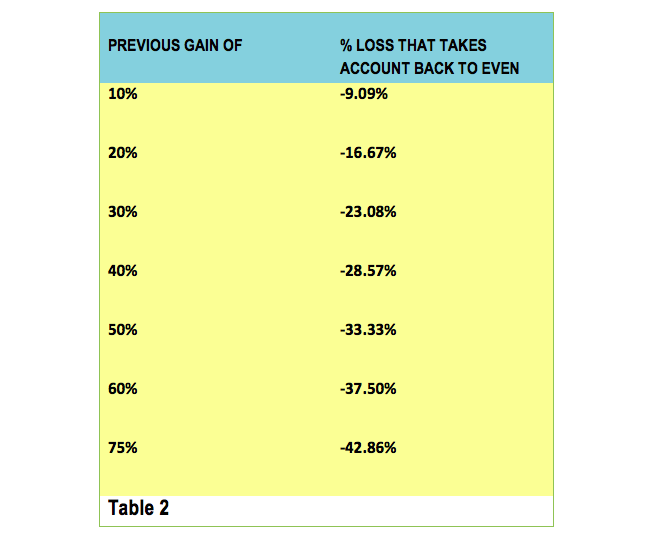

If you’ve been the recent recipient of outsized gains, you’re susceptible to essentially the inverse of table #1. This is what turns a bear market into something much more. For starters, let’s evaluate the most recent bear market of October 2007 to March 2009. The S&P 500 loss from peak to trough was -56.4% (Oct 9, 2007 high of 1565.15 to the March 5, 2009 low of 682.55). If an investor held the S&P 500 long-term, there is a distinct possibility that they held the S&P 500 the first time it crossed 682.55. To ride it round trip from 682.55 to 1565.15, and then back to 682.55, means a 129% gain was extinguished. By a 56.4% loss. Yes, I understand what happened next, but sometimes timeframes are not conducive to the narrative of long-term investing, nor is psychology easy when account statements arrive reminding an investor their gains are no longer.

Enter Table #2. This gives you some ideas in real money terms what major selloffs can mean – I kept the parameters identical to the earlier table for comparison purposes. If you have a 10% gain, a mere 9.09% loss takes you right back to where you started. This is why you need to understand that a 10 percent correction can be more than 10 percent. Have a 50 percent or 75 percent gain? A bear market of -33.33 percent or -41.18 percent, respectively, will wipe it all out.

When the returns get more skewed, the math gets even funkier. Assume you bought an asset for $2000 per unit. For simplicity, let’s call it Bitcoin. Now, let’s say this Bitcoin asset becomes an investing sensation and speculators can’t get enough of it. Perhaps your $2000 unit screams up all the way to $18,000. Some call it a bubble but your co-workers are getting free drinks at happy hour, so no complaints there. You are up 800% on your initial investment! Fast forward a couple months, and your asset is exchanging hands at $7,000. “It’s ok, I’m still up big”, you tell yourself. That 60% correction from $18k to $7k? Took your 800% gain to a 250% gain – that appear as a 550% correction to some. Math matters.

Nutshell? I know technical types really stress the math of limiting outsized losses due to the incredible difficulty in getting principal back. I get that. What I think you also need to also concern yourself with is how challenging outsized gains can be to achieve in the first place. When you do have them, you may want to revisit Baruch’s quote and examine the math in how quickly they can reverse.

Twitter: @HeartCapital

Any opinions expressed herein are solely those of the author and do not in any way represent the view or opinions of any other person or entity.