This post was written with Derek Benedet of Richardson GMP.

A common saying for investors is that volume tends to lead price. By volume, we mean the number of shares traded from one owner to another in a single day.

High volume days are evidence that an increased number of investors believe a share price is too high and others believe it is too low. This is price discovery in action. It’s these high volume days which we wanted to explore further to see if trading volume spikes carried any forward looking implications for the share price. And if so, should this be incorporated into an investment strategy.

One evolution of the market which has complicated volume analysis especially over recent years are the rise of high frequency trading (HFT). The specific definition of volume has one flaw, though every share traded is from one owner to another, the party on the other side, or both sides, is now more often a machine. The good news is that despite algorithms or HFT being a significant part of most of the volume, these trades tend to be ultra-short term, often washing themselves out over the day.

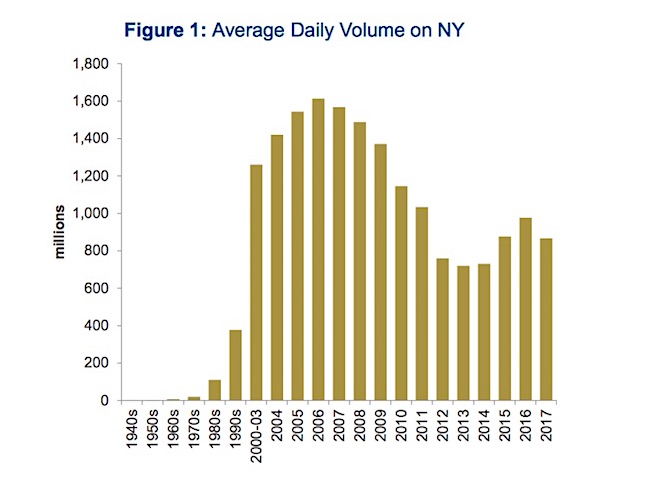

Figure 1 below shows, that overall volume has actually declined somewhat from the highs in 2008, it remains very elevated by historical standards. While volume is comprised of HFT, ETF basket execution and active investors, we find it still carries a level of information for the market and for changing levels of price discovery.

Why Trading Volume Spikes

At the company level, volume spikes do not occur out of nowhere. They usually come in isolated episodes typically surrounding events such as earnings or important news, triggering significant buying and selling. It’s these events of heightened market activity that often bring out the worst in investor behavior. When a stock is more active, investors may be more susceptible to making an emotional or behavioral mistake. It is this potential opportunity to capitalize on the mistakes of others that drew our interest. Identifying volume spikes is the first step in locating where and when the ‘herd’ is most active. What’s important is that the behavior on these days is often extreme, not just from one participant but many participants. When volume is higher, does it mean the price is overvalued or oversold, evidence of changing attitudes towards price discovery? These periods of high turnover represent frenzied moments that let investor biases shine.

The Analysis

The question we were intrigued with, was whether these frenzied days present enough opportunities on a consistent basis to warrant attention from an investment process perspective. We examined these high volume days or anomalous spikes in shareholder turnover for all companies in the TSX 60 and S&P 100 Index over the past ten years.

In terms of defining a volume spike, we took the day’s volume divided by the shareholder float to come up with a share turnover ratio. We defined a volume spike as any time the share turnover ratio was greater than two standard deviations away from its historical average.

For each company we measured the relative (to its index) percentage move over the subsequent 5, 30, 90-day periods after every volume spike. Our sample size in our analysis was comprised of 4920 high volume days for TSX listed companies and 4610 high volume days for S&P 100 members. Initially we were direction agnostic, but added a second filter to determine whether the initial price move was higher or lower.

The Results

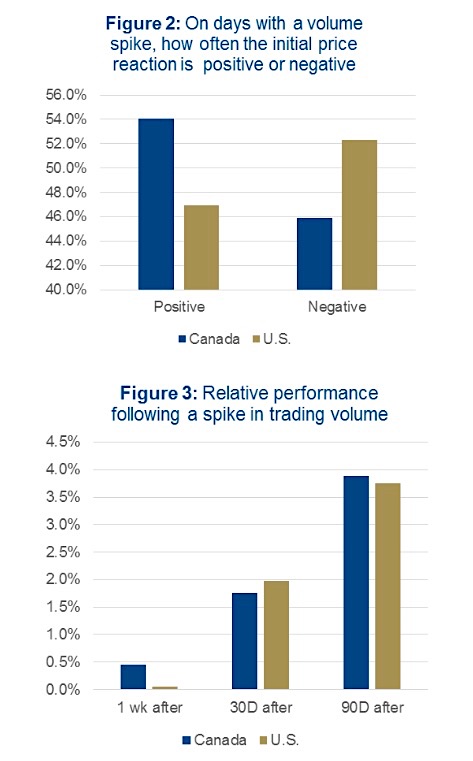

We found that more often than not, volume spikes actually occurred on days when stocks are moving higher for TSX listed companies. The same cannot be said for members of the S&P 100. The difference was small, but interesting none the less. Figure 2 below shows the differences are more often positive for Canadian companies compared to members of the S&P 500.

In our analysis we noted that regardless of the direction of the initial price reaction, the subsequent relative performance for the given time periods was, on average, positive across all time periods. After 90 days the relative performance following volume spikes saw a median outperformance of 4.3% in Canada and 3.8% in the U.S. Results are illustrated in Figure 3 above. This apparently strong upward bias could be partially attributable to the fact that we have been in a bull market for most of the past ten-year analysis period.

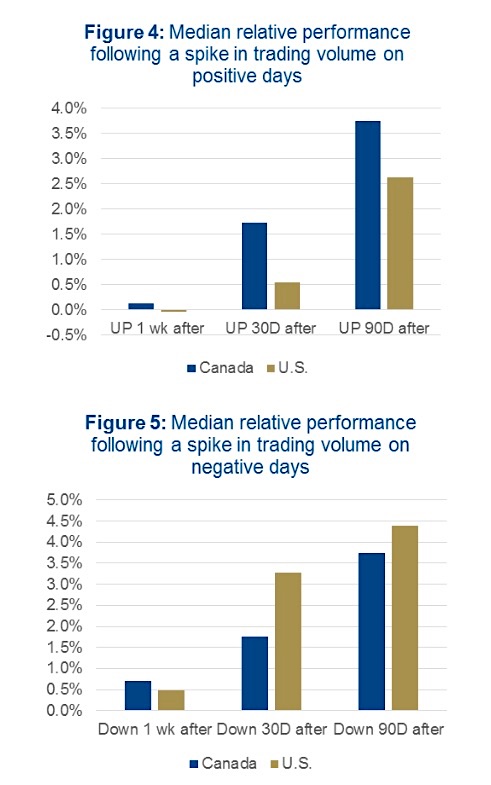

We also noted that there are indeed differences in subsequent stock performance depending on whether the price action that day was positive or negative. While the results for Canadian companies were relatively consistent, the outperformance was higher in the U.S. following the days when prices initially fell on volume spikes as can be seen in Figures 4 & 5 below.

Investment Implications

So does screening for spikes in volume add value to trading decisions? From the results, we can conclude that observing volume spikes, and trading accordingly does add value. Of course translating a sound concept into a valid trading strategy or signal is easier said than done. The wide dispersion of results from a company level, lead us to believe that looking at fundamental factors surrounding the move is still necessary.

Volume spikes are evidence that the price equilibrium is no longer stable as participants on both the buy and sell side search for a new equilibrium. This price discovery has tended to result in positive subsequent performance relative to the benchmark. It does appear, on average, when there is a spike in volume it is better to be a buyer than a seller. Will this hold in a bear market? We will leave that question for another day.

Thanks for reading.

Charts are sourced to Bloomberg unless otherwise noted.

Twitter: @sobata416 @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.