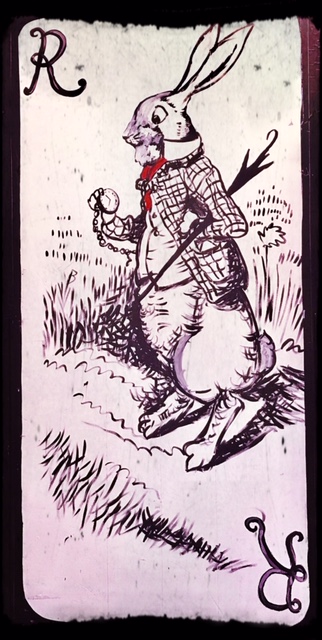

With the midterm elections out of the way, the stock market behaved similarly to the White Rabbit from Alice in Wonderland.

Fear of Missing Out (FOMO), sparked a rally that seemingly forgot about its very important date with rising rates, rising debt and a drop in the U.S. Dollar.

The Dow Industrials ETF (NYSEARCA: DIA), cleared back over the 50 daily moving average and into an unconfirmed bullish phase.

The S&P 500 (NYSEARCA: SPY) and NASDAQ 100 (NASDAQ: QQQ) both cleared back over their 200 DMAs to return to a Warning Phase.

The Russell 2000 (NYSEARCA: IWM), perhaps more like our frenzied and nervous Rabbit, lagged.

Yes, small caps did indeed rally.

However, they still have a quite a distance to go before they reach the 200 DMA at 160.73.

In Alice, the Rabbit illustrates that worrying by itself never solves anything.

In Alice, the Rabbit illustrates that worrying by itself never solves anything.

Could it be that the Russell’s are telling us that the market has gone cheerfully mad?

On the weekly chart, the Russell 2000 remains in a caution phase.

Yet, we should not look at the Russell’s alone.

We find that the relationship between that and the Transportation sector through IYT is often the most revealing.

Even with today’s rally, Transportation is also in a caution phase.

Nevertheles, IYT had the best percentage performance closing up 2.29%.

Retail, still in the best shape, trades above its 50 WMA.

Biotechnology, on the other hand, rallied right to its 50 DMA and stalled.

Then there’s Regional Banks, the first to break all support, which barely closed in the green.

Finally, Semiconductors, well under its 50-WMA, failed to break last week’s range of 86.95-98.13.

I remember October 4thwell.

That was the day the Dow made a new all-time high while the Russell’s were breaking down under the 50 DMA.

If there is anything to be learned from our White Rabbit, it is this:

Do not chase him, as it just might mean that you are chasing a fantasy that could send you down a rabbit hole.

S&P 500 (SPY) – In an unconfirmed warning phase, the 200 DMA support line is at 276.07. The 50-WMA this now recaptured is lower at 275.16. Next resistance is the 50 DMA above at 283.

Russell 2000 (IWM) – 160.73 is the overhead 200 DMA, which corresponds with the 50-WMA at 159.60. Under 155, I’d get more cautious.

Dow (DIA) – 258.70 is the 50-DMA support this must hold

Nasdaq (QQQ) – 172.27 the underlying 200 DMA support with resistance at the overhead 50 DMA at 178.40

KRE (Regional Banks) – I imagine the FOMC minutes will be key for this. 55 pivotal

SMH (Semiconductors) – 98.13 last week’s high. If that clears, we can see 101.50. If not, and this fails 94, worry.

IYT (Transportation) – 190 pivotal with 193.70 the wall of resistance this must clear.

IBB (Biotechnology) – 111.25 is today’s high and exactly where the 50-WMA sits. The must hold spot is 106

XRT (Retail) – 49 is pivotal. 49.40 is the overhead 50 DMA.

Note that you can get daily trading ideas and market insights over on Market Gauge. Thanks for reading.

Twitter: @marketminute

The authors may have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.