Earlier this month, as Bitcoin mania was in full swing, we checked in on the other pure store of value: GOLD.

We discussed seasonal tendencies and potential timeframes for the next gold swing higher. Considering that January is a strong month for Gold, it’s not surprising that a rally is already unfolding…

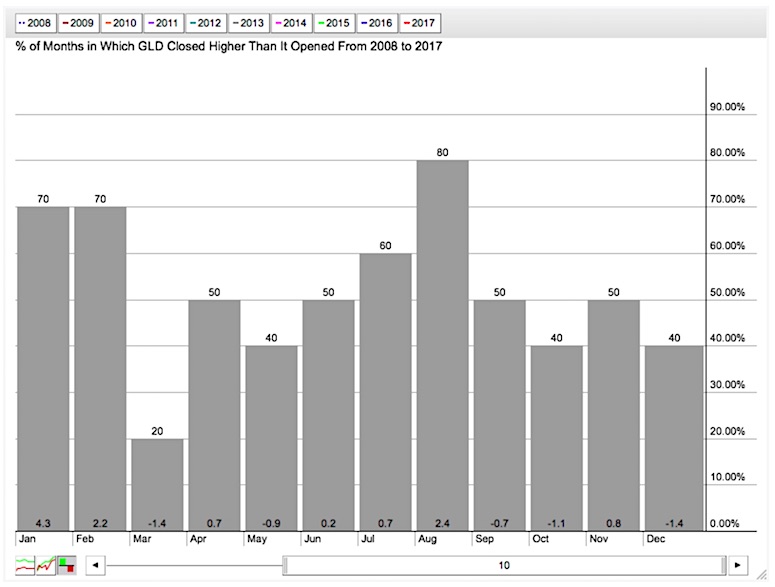

Gold Seasonality

Gold, as tracked by the GLD ETF, shows a remarkable seasonal tendency to outperform in January. Over the past 5 and 10 years, GLD has averaged a January return of over 4% and has been positive for the month 70-80% of the time.

Gold Seasonal Chart by Month (10 Year)

Since our article on December 13, GLD has rallied from the 118 swing low and has now moved above the simple 50 day moving average. Volume has been picking up as well, with December 26th marking the highest daily volume in over two weeks. This is notable as the holiday season typically has lower than average volumes.

Heading into seasonally strong January, GLD deserves consideration as a potential long with low correlation to other markets. Any US Dollar weakness will only further bolster GLD’s potential to move up past the October high near 124.

Thanks for reading!

The author may hold positions in mentioned securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.