Often times, investors get caught up in valuing an asset in the world’s reserve currency: The US Dollar. This makes sense as it’s the deepest currency market in the world. However, it often doesn’t tell the whole story. If’ we truly want to see how an asset is performing on a global scale (and in terms of capital flows), then we need to value it in terms of the various currencies.

Often times, investors get caught up in valuing an asset in the world’s reserve currency: The US Dollar. This makes sense as it’s the deepest currency market in the world. However, it often doesn’t tell the whole story. If’ we truly want to see how an asset is performing on a global scale (and in terms of capital flows), then we need to value it in terms of the various currencies.

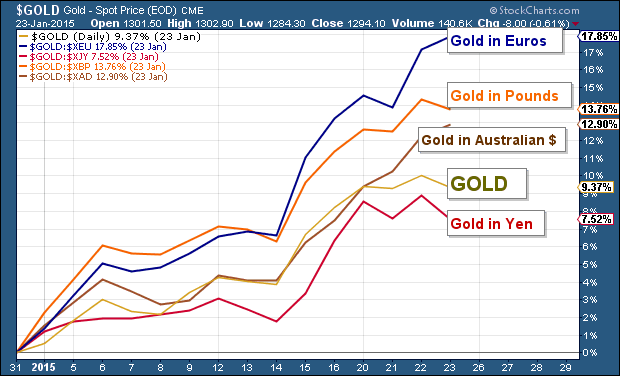

Take Gold performance year-to-date for example. 2015 has seen the yellow metal appreciate 9.4% (through Friday’s close). And these gains are occurring as deflation concerns ratchet higher around the globe and Crude Oil continues to plummet. There has to be more to the story than that, right?

To uncover more details, we need to see how Gold is performing in other world currencies. Below is a snapshot of Gold performance in terms of several major currencies (through Friday’s close). Note that I had to create the 2nd chart of the Russian Ruble:

Gold Performance In Select World Currencies Year-To-Date

Gold Performance In Rubles YTD

The currencies in which Gold performed the best were the Euro and the Ruble. Any thoughts on why? Hint: European political dissent, Greek elections, falling Euro. Russian economic crisis.

With this in mind, there are a few important takeaways:

- Gold may be reacting to currency or government-related concerns in Europe and Russia.

- Keep an eye on developments in these regions/currencies. If the Ruble and Euro strengthen, can Gold hold its own/continue to go higher?

- Lastly, valuing an asset in other currencies allows us to see if a trend is global (I would advise much longer time frames to evaluate global trends). It also offers skilled investors a chance to use a currency hedge against their investment.

Thanks for reading.

Follow Andy on Twitter: @andrewnyquist

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.