Estimating the value of gold through history is an inherently challenging pursuit. Nevertheless, Chartered Financial Analyst, Stephen D. Simpson has attempted to glean some insight into how ancient societies valued gold.

Estimating the value of gold through history is an inherently challenging pursuit. Nevertheless, Chartered Financial Analyst, Stephen D. Simpson has attempted to glean some insight into how ancient societies valued gold.

An 829 troy ounce Greek talent valued near $1.0 million today was valued at $13.5 million in ancient Greece when used to purchase labor presumed to be valued at $20 per hour.

A worker in the 5th century earned about 1 drachma or 0.004 troy ounces of gold for a day’s work. This is worth about $5 today. This would also purchase about 3 kilos of olive oil.

Gold prices held and changed value throughout ancient times. All the gold that has ever been mined through history only totals 171,000 metric tons. Economies through society have bought, sold and reused a fairly static supply of the metal. Over time, the view of the public and investors towards gold has changed significantly.

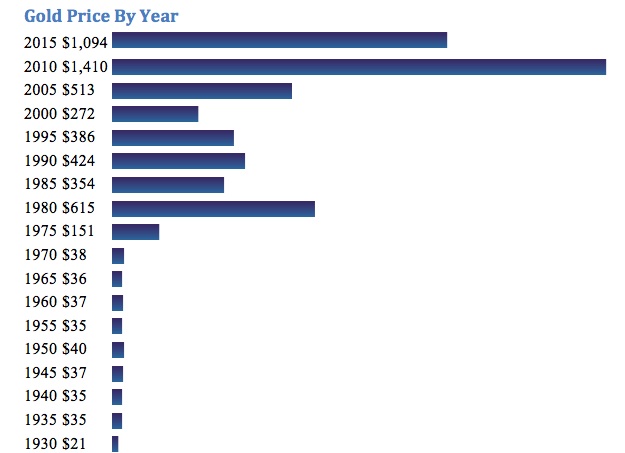

The following chart by wiseGEEK shows gold prices in five-year increments back to 1800. Measuring Worth provides more detailed yearly data going all the way back to 1257 in London. Gold is currently trading near $1,094.

Wikipedia provides an excellent list of market panics and crashes dating back to 1623.

The Tulip Bulb Panic from 1633 to 1637 had no effect on the price of gold. Gold prices were steady at £3.73 in London through this period.

During the years previous to and following the South Seas Bubble in 1720 gold prices were steady at £4.25; what had been proclaimed the gold standard in 1704 and remained-so essentially unchanged for the next three centuries.

The years preceding and following the Panic of 1792 saw steady gold prices at £4.25-standard levels.

The 1800s saw no less than a dozen named panics: gold in the United States rose briefly in 1865 preceding the Panic of 1866, but otherwise remained locked in a range between $19 and $23 for 130 years.

As a result of the Gold Reserve Act of 1934, the price of gold became essentially fixed at $35 per ounce, with minor deviations from this, until President Richard Nixon abolished the gold standard in 1971. The price of gold has appreciated at a rate consistent with U.S. stock market since that time; it has also experienced periods of extreme volatility and exhibited a markedly different character.

While gold has undoubtedly carried real value throughout the history of civilization, available data demonstrates that its value remained quite steady, under different gold standards, until 1971 when its value began to change significantly. Prior to 1971 gold was somewhat of a safe haven, but it certainly did not increase in value during times of financial turmoil or geo-political unrest.

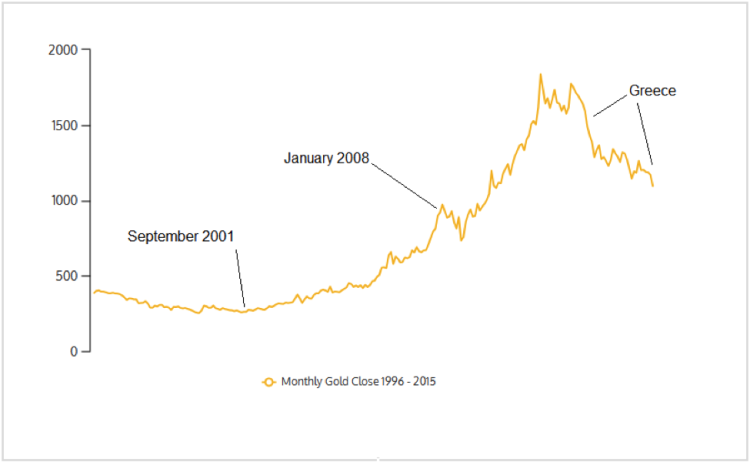

Recently, uncertainty related to Greece has had almost no impact on the price of gold. Gold has lost just over 8% of its value in 2015.

Gold in 2015

Chart created using MultiCharts. ©MultiCharts LLC, 1999-2015. All rights reserved.

The price of gold reacted only modestly after the September 11, 2001 terrorist attacks and actually lost value through 2008, with many viewing the height of the sub-prime crisis as having occurred in September of that year: the month Lehman Brothers filed for bankruptcy, gold again only showed a modest reaction.

The price of all commodities and, indeed, any traded instrument is determined by supply and demand alone. The gold run from 2001 to 2011 was produced by buyers stepping in and moving the price higher. While some may contend that the gold run that began, slowly, after September 11 surely demonstrates cause and effect. Detractors continue to ask, “What about 2008? Why did gold sell-off through the sub-prime crisis? What about more recent Greece worries?”

Sometimes gold may act as a safe haven, and rally in times of uncertainly, though there are many times that it doesn’t. In fact, sometimes gold seems to join others assets in selling-off during times when uncertainty is pervasive. The value of the gold-as-a-safe-haven premise as a money-making proposition would seem to suffer in comparison with other, more empirically-sound methods that focus on supply, demand and other, more-quantifiable, factors.

Thanks for reading.

Trading futures and options involves substantial risk of loss and is not suitable for all investors. Past performance is not necessarily indicative of future results. The risk of loss in trading commodity interests can be substantial. You should therefore carefully consider whether such trading suitable for you in light of your financial situation. External links are provided as a matter of convenience only and have not been verified as far as their accuracy. Please conduct your own due diligence. Full Risk Disclaimer: https://optimusfutures.com/RiskDisclosure.php

Follow Matthew on Twitter: @optimusfutures

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.