After a decent correction from the all-time highs in gold (NYSEARCA:GLD) and silver (NYSEARCA:SLV) last week was the reentry point.

We tracked the gold to silver ratio for clues.

At the end of October, the ratio ran back up to 85.

Looking at September, that was a support and then a resistance area when the ratio dropped from under 85 to around 78.

That alerted us to think that with the rally in the ratio and the selloff in the metals, should the ratio roll over from there, it was time to consider buying silver.

The SLV ETF, (closely tracking the silver futures) never broke the 50 daily moving average at the same time the ratio rolled over.

Note, the lower the ratio, the more it favors silver over gold.

Also note the Leadership indicator. Silver is beginning to outperform the SPY.

Momentum through Real Motion cleared the 50-DMA.

However, we need to see a lot more momentum before getting excited about new all-time highs on the horizon.

Plus, on the fundamentals, nothing has changed.

A persistent supply deficit,

Surging industrial demand (especially from green technologies),

Its status as an undervalued safe-haven asset relative to gold,

And a supportive macroeconomic environment.

We have one reason to think the metals rally can stop dead in its tracks despite this move and the reasons to be bullish.

Gold.

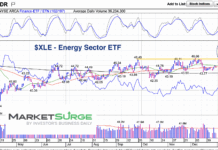

The first 2 ellipses from mid-October illustrate how strong outperformance, great momentum and new highs must line up.

As soon as the gap lower from the all-time highs happened the next day, see how the momentum (red dots) broke the dotted line of the Bollinger Band.

That is when we exited our long positions.

Fast forward to the next ellipses.

First off, SPY is on par with gold on performance. That is neutral for gold unless that changes.

Secondly, while the price is climbing, the momentum is quite far from the highs made in October.

Should GLD begin to decline, performance favor SPY and/or the momentum drop below the 50-DMA (red dots under blue), that could impact the rally.

Silver could still do better of course.

However, going back to the ratio.

A break under 78 gold to silver ratio, as we saw almost happen in October, would get us very bullish silver and we would see gold rise as well.

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.