Equity markets continue to move higher on the hopes of fiscal stimulus in the U.S.

But the pressure is on… Analysts are increasingly divided into bearish and bullish camps, as the politicians must now deliver on their promises to avoid disappointing the stock market.

Stocks & Bonds

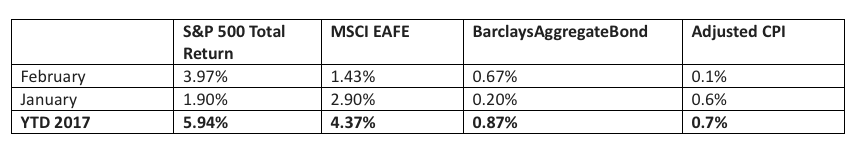

Looking at the month of February, the U.S. stock market continued to move higher on hopes of tax cuts and other fiscal stimulus – see S&P 500 (INDEXSP:.INX) returns below. Foreign markets also performed well as Chinese economic growth continues to surprise on the upside, and reflation appears to making progress in Europe.

And bonds are underperforming as expected – when faster economic growth dominates the headlines. Here are the numbers:

Commodities & Currencies

Oil prices are in a broad consolidation. Indications are that oil and gasoline inventories in the U.S. are still near record highs, so market bulls are hoping that the OPEC production cuts will eventually have an impact. Gold prices rose several percentage points in February and cling to gains for the year. These price gains show that, although political uncertainty is generally bad for investments, it continues to be good news for those who seek haven in gold.

The U.S. dollar is also in consolidation, after rising almost 2% in February and erasing most of its January losses.

Economy

The ISM Manufacturing PMI in February came in at 57.7%, showing accelerating growth from the previous month. The non-manufacturing, or services, index came in at 57.6%, which was also an improved reading from January. The Commerce Department released its second estimate of fourth quarter GDP growth, calculating an annual rate of 1.9%. The National Association of Realtors reports that existing-home sales in January 2017 were 3.8% higher than in January 2016. In addition, the median price increased 7.1% to $228,900. We are now approaching almost 5 years of rising median home prices. Distressed sales (foreclosures and short-sales) were 7% of total sales in January, higher than previous months but lower than the 9% number from a year ago.

Market Commentary

There is a raging debate, and probably always will be, about passive vs. active management. The question is, should you pay for professional money management, or is better to simply buy an index that tracks the market and skip the fees? Both sides have some ammunition to support their arguments, and both sides tend to be fairly fervent in their approach. In general, if the S&P 500 is rising 12% per year, it is difficult for an active fund manager to beat that rate of return.

But what happens when the market declines 12%? Active fund managers have historically done better during a declining market. If they have a thorough vetting process, they can avoid the most overpriced stocks, and outperform a declining passive index that has to buy everything by definition. Active managers can sometimes do a better job of earning their fees when the stock market is struggling.

When clients ask me what I think about ‘the market,’ I’ll admit I am currently more concerned about a down period than an up period. The doomsayers talk about a ‘debt bomb’ that could go off at any time, and the accompanying economic calamity. I prefer to avoid such drastic language, but at the same time our nation does have a historic level of debt, and we are entering an historic period of demographic change as the baby boomers retire. The engine of our economy for several decades, the baby boomers, were putting money into the stock market, driving capital growth and capital prices. They did this primarily in 401ks and IRAs that were tax deferred.

Now it is time for them to take the money out – the fable of Rumpelstiltskin, played by the IRS. Baby boomers have about $10 Trillion dollars of retirement funds that will be taxed as ordinary income over the next several decades. Of that $10, several trillion must go to the IRS, so there will be large selling pressures in the stock market for many years. This selling can be overcome by purchases by younger workers and foreign institutions, but the reality is that the tailwind of boomer 401k contributions has become a headwind of boomer 401k withdrawals.

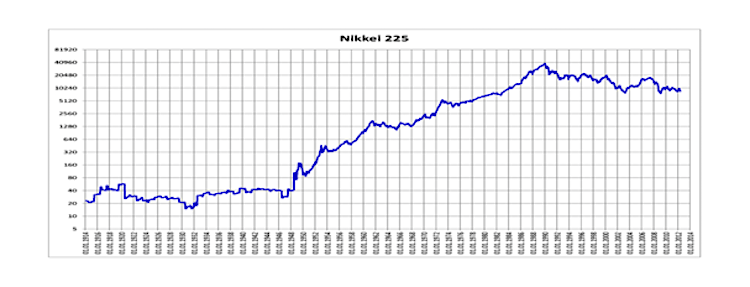

So I do not recommend that clients buy and hold the S&P 500, and ignore the quality of the companies in which they invest. This strategy sometimes works well, but not always. For example, Japan’s population aged relatively faster than the United States post-World War II, and their ‘baby boom’ transformation happened in the late 1990s. The equivalent of the S&P 500 in Japan, the Nikkei 225, did not fare well for many years. Between 1990 and 2014 it lost almost 75% of its value:

Keep in mind, Japan is one of the largest economies and most stable countries in the world, and they were not engaged in any wars or other extreme events in that period. They simply had too much credit expansion for many decades, their population aged, and then money started flowing out of stocks rather than in.

In summary, I think there is an element of wisdom in both passive and active investing styles. It is important to keep costs down and to be patient with your process – passive does a better job of this. However, it is also important not to interpret past results as indicative of future performance – and I think active management has the potential to do a better job here. If you pay for advice, no different than if you pay for some work to be done on your house, the key isn’t necessarily the lowest bid, but rather getting the most lasting quality for your dollar.

Thanks for reading.

This material was prepared by Greg Naylor, and all views within are expressly his. This information should not be construed as investment, tax or legal advice and may not be relied upon for the purpose of avoiding any Federal tax liability. This is not a solicitation or recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. The S&P500, MSCI EAFE and Barclays Aggregate Bond Index are indexes. It is not possible to invest directly in an index. The information is based on sources believed to be reliable, but its accuracy is not guaranteed.

Investing involves risks and investors may incur a profit or a loss. Past performance is not an indication of future results. There is no guarantee that a diversified portfolio will outperform a non-diversified portfolio in any given market environment. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Listed entities are not affiliated.

Data Sources:

- www.standardandpoors.com – S&P 500 information

- www.msci.com – MSCI EAFE information

- www.barcap.com – Barclays Aggregate Bond information

- www.bloomberg.com – U.S. Dollar & commodities performance

- www.realtor.org – Housing market data

- www.bea.gov – GDP numbers

- www.bls.gov – CPI and unemployment numbers

- www.commerce.gov – Consumer spending data

- www.napm.org – PMI numbers

- www.bigcharts.com – NYMEX crude prices, gold and other commodities

- https://time.com/money/4377233/retirement-boomers-taxes-required-withdrawals/ – Baby Boomers and RMDs

- https://www.britannica.com/place/Japan/Demographic-trends – Demographics in Japan

- https://en.wikipedia.org/wiki/Nikkei_225 – Nikkei 225 chart

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.