September was a relatively quiet month across global financial markets, as investors returned from summer vacation to mixed economic news. The economy is likely recovering enough to eventually warrant an interest rate hike. The worry is what happens to credit and equity markets as they adjust to higher interest rates, since they have been enjoying near-0 rates since the end of 2008.

So far, it seems the interpretation is slightly positive, as market fund flows are slowly, and unevenly, moving out of bonds and into stocks.

Stocks & Bonds

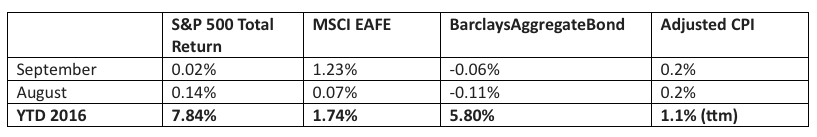

Bonds continued to soften as the Federal Reserve continues to use language approaching an interest rate hike. Stocks have proven resilient through a historically tough time of year, and overseas equities in particular are starting to reverse their underperformance of the first half of the year.

By the numbers:

Commodities & Currencies

Crude Oil prices rose almost 8% in September, fueled by talk of an OPEC production cut. Year-to-date, prices are up over 12% to almost $50 per barrel. Gold was essentially unchanged in September. Having gained over 23% year-to-date, gold prices seem to be treading water as the market debates the prospect of a hike in interest rates in December.

The U.S. dollar lost a smidge in September, and is down just over 3% year-to-date. up over 23% year-to-date.

Economy

The ISM Manufacturing PMI in September came in at 51.5%, a slightly positive reading which reverses the surprisingly negative number from August. The non-manufacturing, or services, index delivered even better news, coming in at 57.1%, marking strong growth. The Commerce Department released its third estimate of second quarter GDP growth, a lackluster 1.4%, although this was still an improvement over the first and second estimates of 1.2% and 1.1%. The National Association of Realtors reports that existing-home sales in August 2016 were 0.8% higher than in August 2015. In addition, the median price increased 5.1% to $240,200. This marks over 4 years of rising median home prices. Distressed sales (foreclosures and short-sales) were 5% of the market in August, matching the 8-year low of the previous month.

Commentary

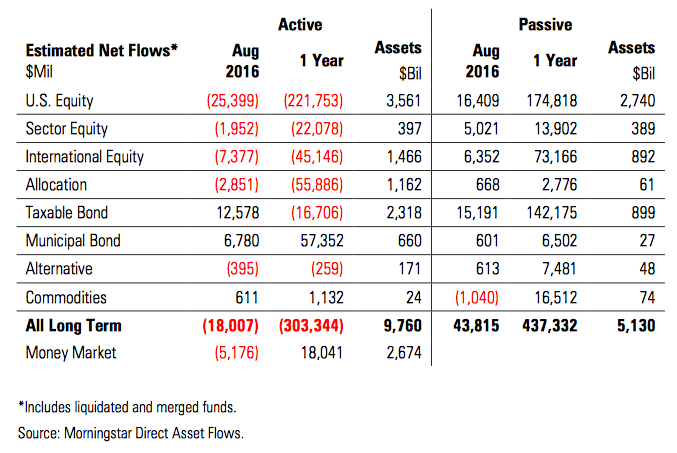

The S&P 500 (NYSEARCA:SPY) is up 6% or so year-to-date, which sounds like a pretty stable number. No double-digit decline, no double-digit gains. But behind the scenes, a lot is happening. There is a massive change from ‘active’ fund management to ‘passive’ fund management, often in the form of mutual fund outflows and ETF inflows. Here is the most recent fund flow data from Morningstar:

There is a lot happening in this data (which reflects retail activity only, excluding institutional activity), but first let’s look at the big numbers in the U.S. equity row. Huge selling in the ‘active’ column has been largely offset by large purchases in the ‘passive’ column. Still, over the last 12 months, many equity funds outside the S&P 500 have seen outflows, perhaps as much as $70 billion in aggregate. International equities look as if they have performed better, but data in Europe shows that the Europeans themselves are selling their stocks at an historic pace. The Wall Street Journal reports that through August 24th, European funds saw 29 consecutive weeks of outflows. This stretch is even longer than the previous record of 27 weeks of outflows ending in February 2008.

So the S&P 500 is up a little bit year to date, a boring news headline, but behind the scenes there is a lot of selling in many other areas. On top of that, we have seen huge inflows into bonds, almost all of it into ‘passive’ funds.

The change from ‘active’ to ‘passive’ is probably good for Americans in general. The great credit expansion that occurred in the U.S. from the ‘70s until recently protected many underperforming managers. Consumers are paying more attention to their investments, yields are lower, profit margins are compressed, so it makes a lot of sense that ‘passive’ is winning business.

From a contrarian standpoint, however, sometimes it is helpful to put your money in the opposite direction of fund flows. When money leaves an active mutual fund, the manager is forced to sell his or her holdings, regardless of their individual merit. It is certainly possible, then, that some non-S&P 500 equities are oversold and relatively more attractive than S&P 500 equities, which could be overbought simply by virtue of their membership on the list of 500.

Looking at the bond fund-flows, I have to be at least a little concerned that I have ‘missed the boat’ on the largest gains. Some of the bond investments are due to an aging population seeking ‘safer’ assets, and I am also not worried about large interest rate hikes by the Fed. The headwinds might not be too bad, but from a fund-flows perspective bonds might also be lacking strong tailwinds for a while.

Thanks for reading.

This material was prepared by Greg Naylor, and all views within are expressly his. This information should not be construed as investment, tax or legal advice and may not be relied upon for the purpose of avoiding any Federal tax liability. This is not a solicitation or recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. The S&P500, MSCI EAFE and Barclays Aggregate Bond Index are indexes. It is not possible to invest directly in an index. The information is based on sources believed to be reliable, but its accuracy is not guaranteed.

Investing involves risks and investors may incur a profit or a loss. Past performance is not an indication of future results. There is no guarantee that a diversified portfolio will outperform a non-diversified portfolio in any given market environment. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Listed entities are not affiliated.

Data Sources:

- www.standardandpoors.com – S&P 500 information

- www.msci.com – MSCI EAFE information

- www.barcap.com – Barclays Aggregate Bond information

- www.bloomberg.com – U.S. Dollar & commodities performance

- www.realtor.org – Housing market data

- www.bea.gov – GDP numbers

- www.bls.gov – CPI and unemployment numbers

- www.commerce.gov – Consumer spending data

- www.napm.org – PMI numbers

- www.bigcharts.com – NYMEX crude prices, gold and other commodities

- www.federalreserve.org – historical data on 10-year Treasury note

- www.bigcharts.com – chart illustrating index returns

- Morningstar fund-flows information

- Wall Street Journal article regarding European fund flows

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.