For the U.S. equity markets, we wanted to focus on the weekly sell signals that were generated a few weeks ago, and therefor avoided trying to catch the short-term turns.

Both the S&P 500 and Dow Transports have rallied back to their ellipse resistance zones, so we need to see how they trade into this area.

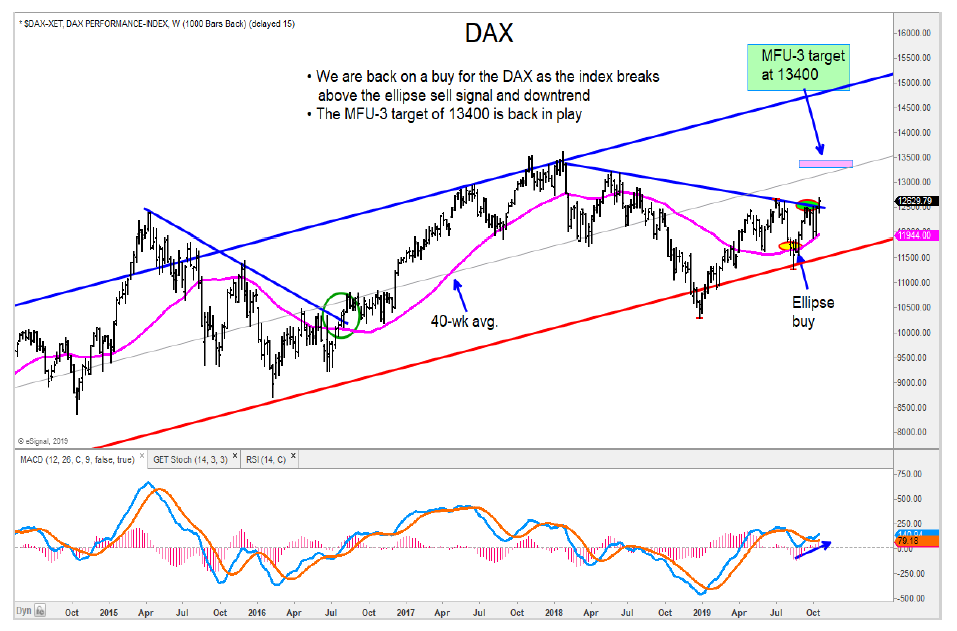

Both the DAX and Italy’s FTSE MIB have both cleared their ellipse sell zones with good momentum.

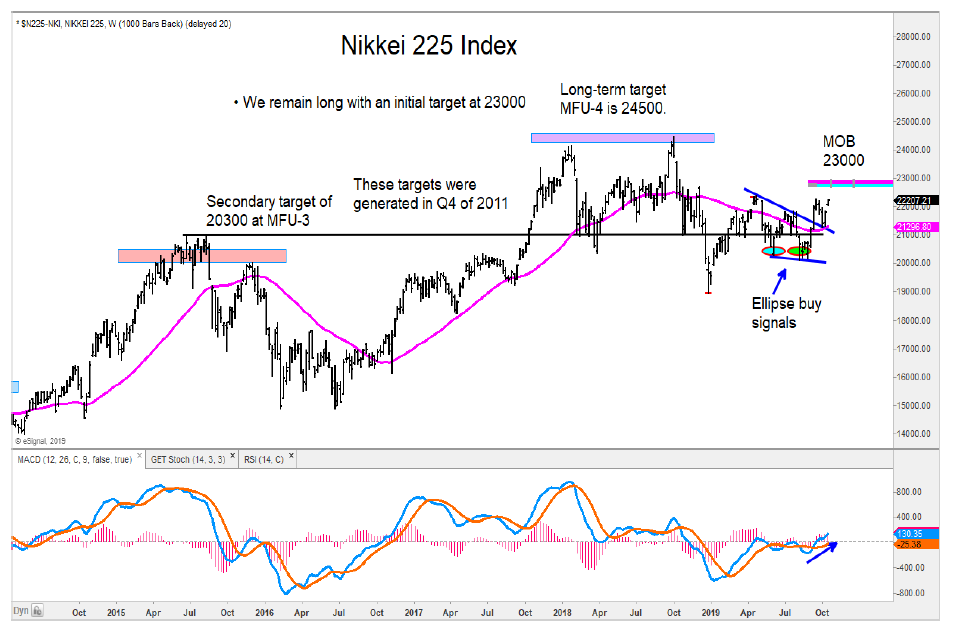

We are back on the bullish call for these markets. The Nikkei remains resilient and on target for the 23000 zone.

Let’s review the global markets and see where we are at.

We will review by region.

U.S. Equity Markets

The weekly sell signals that were generated by the ellipse indicator remain in place.

Both the S&P 500 and Dow Transports are back into the weekly ellipse sell zone, and we need to see if we can get a weekly close above those areas to change to a bullish call.

The Russell 2000 and Mid-Cap (MDY) have a bit more upside before they challenge their respective resistance areas.

The Dow Utilities remain in a firm uptrend.

European Equity Markets

Both the German DAX and Italy’s FTSE MIB have both cleared their ellipse sell zones with good momentum. We are back on the bullish call for both markets.

Spain’s IBEX is back up into resistance. We need to see if it can breakout or if we get another reversal.

Asian Equity Markets

We remain long the Nikkei with the initial target at 23000.

The Hang Seng is back up into the upper end of its channel, and we maintain a bearish view.

Emerging Markets

We are on the sidelines with China’s Shanghai Composite.

The author may hold positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.