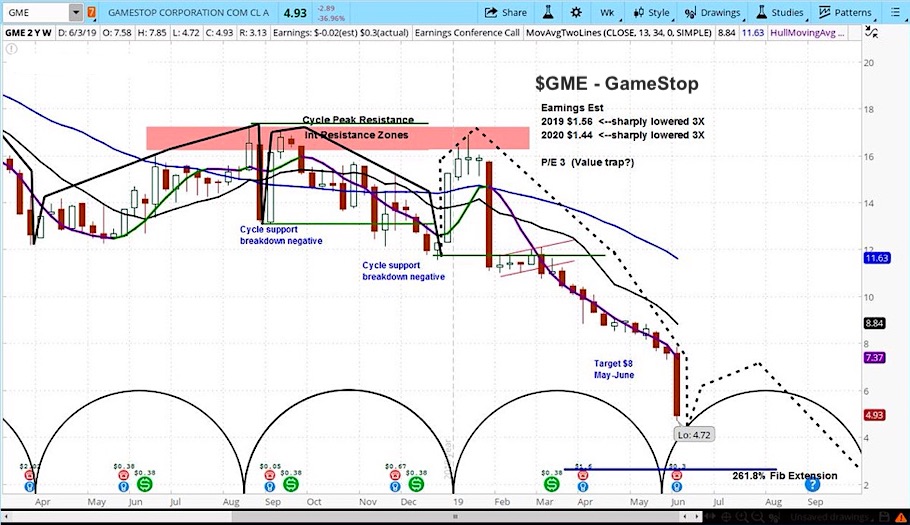

GameStop (NYSE: GME) Stock Weekly Chart

GameStop tanked 35% on Wednesday after the company missed Wall Street expectations for sales and sales guidance.

Poised for a bounce, we expect it to fall to even lower levels after that rebound.

The company reported earnings per share of $0.07 and total revenue of $1.55 billion, compared to analyst estimates of -$0.06 and $1.64 billion. Further, in addition to eliminating its dividend, management issued same store sales guidance indicating a decline of 5-10%.

The new CEO George Sherman appears to be reform-minded, “We have solidified our go-forward leadership team and established a transformation office and a framework for execution.”

Our approach to stock analysis focuses on market cycles. For GME, we believe it will soon complete the declining phase of its current cycle.

Once the next cycle begins, we expect a bounce. But after that, it could fall to near $3.

For more from Slim, or to learn about cycle analysis, check out the askSlim Market Week show every Friday on our YouTube channel.

Twitter: @askslim

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.