Small cap returns crushed it since last fall. The move from large cap growth to small cap value has been discussed ad nauseam to this point, but I see another interesting trend emerging in the market cap space.

Phil Bak, CEO of Exponential ETFs, oversees the operations of two ETFs – the American Customer Satisfaction ETF (ACSI) and the Reverse Cap Weighted U.S. Large Cap ETF (RVRS). Let’s take a look at the latter.

RVRS is simple. It’s the S&P 500 only reverse-weighted. So the smallest weighted stock in SPY is the largest holding in RVRS.

Critics of the fund suggest investors should just venture into the mid cap and small cap spaces for exposure away from mega caps. The last several weeks show a flaw in that thinking.

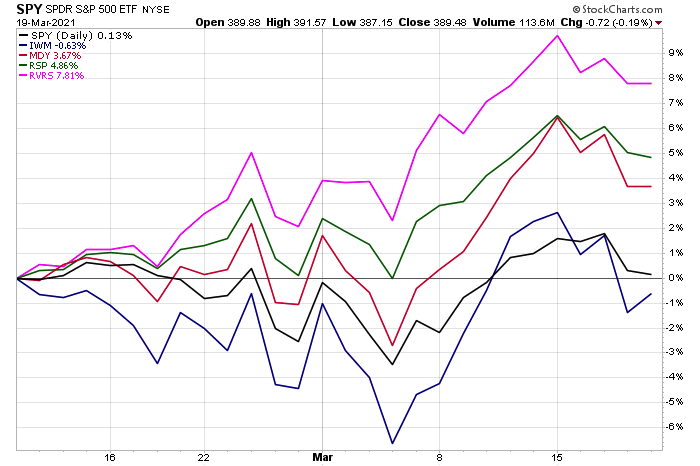

RVRS is up 8% from mid-February while mid caps are up only 4%. IWM is fractionally negative while the traditional cap-weighted S&P 500 is unchanged.

Let’s dig into the market cap data on several popular ETFs to see how RVRS compares.

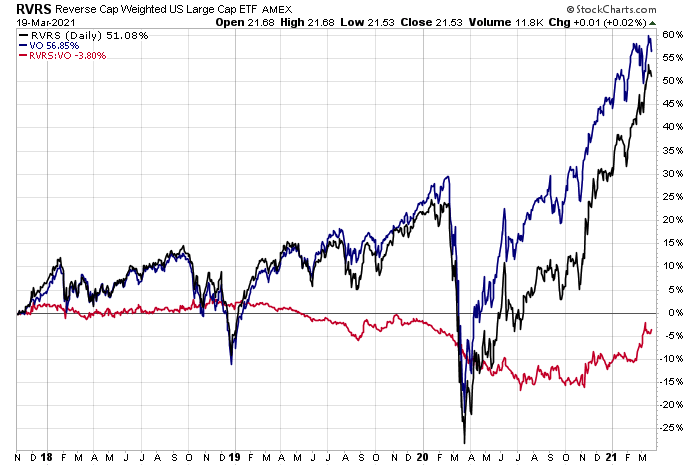

RVRS has a weighted-average market cap of $21B – that is most similar to the US mid cap index at $25B (using the Vanguard mid-cap ETF VO). SPY has a weighted-average market cap of just under $500 billion. Since the inception of RVRS, returns between it and VO are similar, but they can certainly experience periods of significant differences. RVRS has outperformed VO by 15% since mid-November 2020.

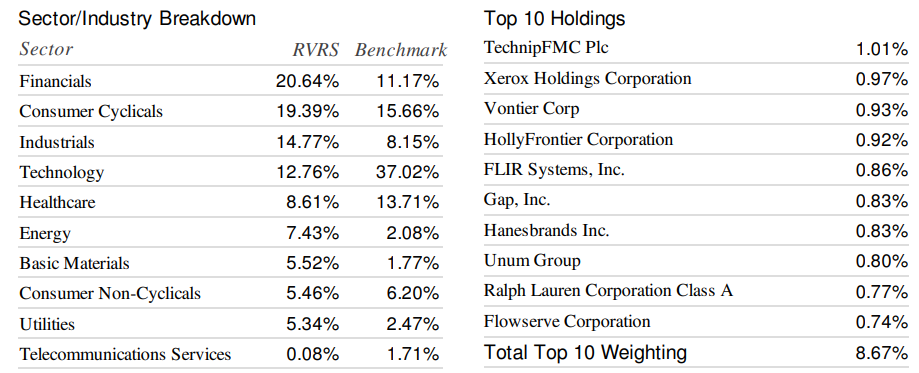

The portfolio is worlds apart from the cap-weighted S&P 500. As a trader might expect, RVRS has much less exposure to the growth sectors of IT and Communications Services and more to the value sectors like Financials, Industrials, and Energy.

I’m not doing a sales-pitch for RVRS, but it’s a compelling product for those looking for a liquid ETF that provides value exposure while still being focused on US large caps. It also has a very reasonable expense ratio of 0.29%. It complements a portfolio already holding SPY and the US extended market.

Note that RVRS will soon be rebranded to the Reverse Cap 500 ETF (YPS). Read more about it here: https://reverse500.com/

I am a Chartered Financial Analyst (CFA) and Chartered Market Technician (CMT). I have passed the coursework for the Certified Financial Planner (CFP) program. I look to leverage my skills in a consultant role for financial advisors – that could be portfolio analysis, planning, writing etc. Please reach out to me at mikeczaccardi@gmail.com for more information. Connect on Linkedin.

Twitter: @MikeZaccardi

The author may hold positions in mentioned securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.