As investors cheer on the Magnificent 7, some football fans are forging new allegiances in hopes of rooting for the coming Super Bowl champion. The task isn’t easy. Recent favorites like the Bills and Bengals are fighting to make the playoffs. Indeed, a few fans of those teams will jump on the recently popular Dolphins or Lions bandwagon. Others may stick with the dependable Eagles, Chiefs, and Forty Niners.

Stock market investors and football fans are not that different. As 2023 ends, professional and amateur investors start thinking about what stock or investment theme bandwagon to jump on for the coming year.

This year, the Magnificent 7 stocks are the odds-on favorites to win the stock market Super Bowl. While hats off to those profiting from the Magnificent 7, we must look ahead. To do so, we must appreciate the bandwagon bias harbored in our mindsets and not let it cloud our vision of the future.

Bandwagon Bias Of 2023

Bandwagon bias is a psychological phenomenon that happens when people do something because others are doing it already. Often called following the herd in market parlance, the bandwagon bias forces many investors into decisions they ultimately regret.

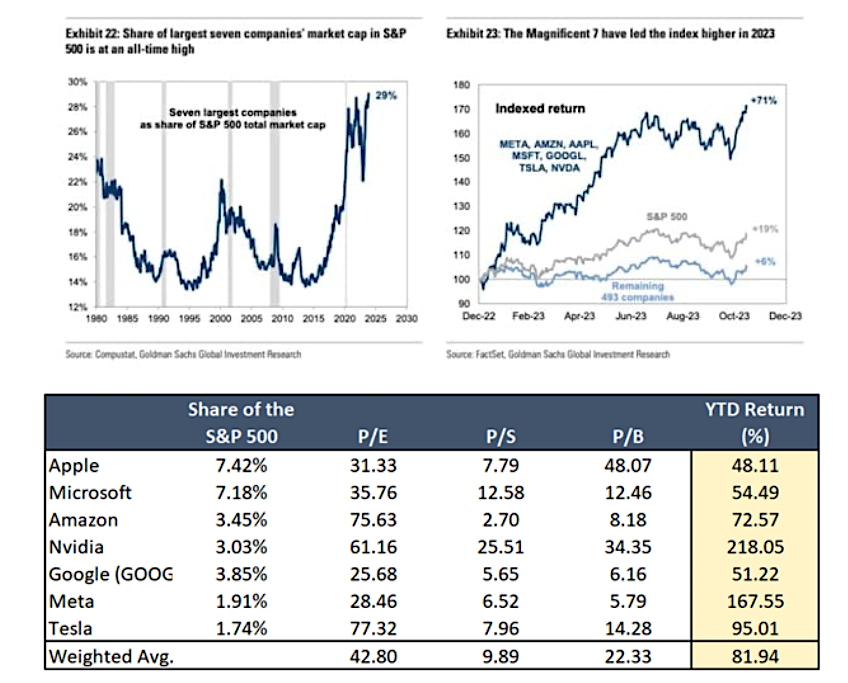

This year’s most popular investment bandwagon is the Magnificent 7, comprised of Apple, Microsoft, Google, Tesla, Nvidia, Amazon, and Meta. The graphs below, courtesy of Goldman Sachs, and our table show these 7 stocks gained 71% this year to date, while the remaining 493 stocks added a mere 6%. The outperformance pushed up their contribution to the S&P 500 to nearly 30%. Lastly, the sharp increase in stock prices led to even more extreme valuations for the group.

The Magnificent 7 are fundamentally stronger companies than the aggregate of the S&P 500. Per Goldman Sachs, revenues for the Magnificent 7 are expected to grow by 8% more than the S&P 500. At the same time, net margins are forecasted to be around 21% for the next two years. Such is double the S&P 500.

Is their share price outperformance justified? Yes. However, if the prices outperformed their fundamentals, as may likely be the case, it will now be much harder for a repeat performance in 2024.

Nvidia Vs. Albemarle

To help appreciate what may lie ahead, we compare Nvidia to Albemarle. Nvidia is up 230% year to date. As a result of the stock surge, Nvidia’s investors are paying a 250% premium for Nvidia’s earnings versus those of the S&P 500. Nvidia’s earnings will undoubtedly grow faster than the market for a while, but by how much and for how long? Can they avoid competition and margin pressures while keeping sales elevated long enough to justify the premium?

The world’s largest lithium producer is in quite the opposite shoes. Despite strong demand for lithium from electric vehicles (EV) and a projected shortfall of lithium to meet growing EV needs, Albemarle investors only demand a price to earnings of five, about one-fifth of the S&P 500. Its shares are down about 30% year to date.

Despite the significant value in Albemarle compared to Nvidia, investors continue to chase Nvidia and sell Albemarle. Comparing them does not endorse owning Albemarle or selling Nvidia, but they show how markets can be very inefficient.

Narratives Drive Markets

As we highlight with Nvidia and Albemarle, in the short run, narratives and bandwagons of investors drive individual stocks and markets, regardless of whether the narrative makes sense.

Only a few months ago, the popular narrative in the bond market warned that massive U.S. Treasury issuance was responsible for pushing yields higher. Well, such issuance has continued unabated, but yields have fallen precipitously. Despite the reality of the situation, as outlined in Context and Facts Expose Bearish Narratives, the narrative reinforced a growing bandwagon, resulting in higher yields. Today, the narrative and bandwagon are limping along.

Such is the nature of bandwagons. This year, the Magnificent 7 was the bandwagon to be on. It’s easy to assume that what worked in 2023 will work in 2024. That may be the case. Or it may be the case for the first four months. While the narrative is strong, it can fade quickly, like the bond narrative.

Understanding our bias toward owning the Magnificent 7 allows us to make rational decisions when the narrative changes. Lingering on yesterday’s bandwagon can be dangerous. Just ask those short bonds on the Treasury issuance narrative.

Equally important, renting, not owning, a bandwagon allows us to shift to the winning theme more quickly.

For example, since early November, small-cap stocks have handily beat the S&P 500 and Magnificent 7. These stocks are interest rate sensitive. Ergo, the more dovish Fed stance should help these relatively beaten-down stocks more than the less interest rate-sensitive large-cap stocks. Small-cap stocks may or may not be the winning bandwagon for 2024.

Summary

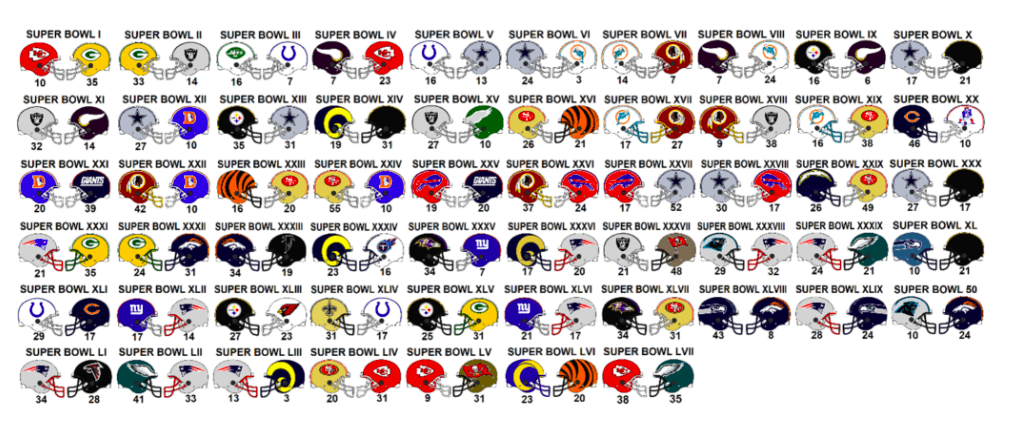

The graphic below shows that the Super Bowl tends to have different teams vying for the trophy each year. Some helmets appear more often than others, but there are few consecutive champions.

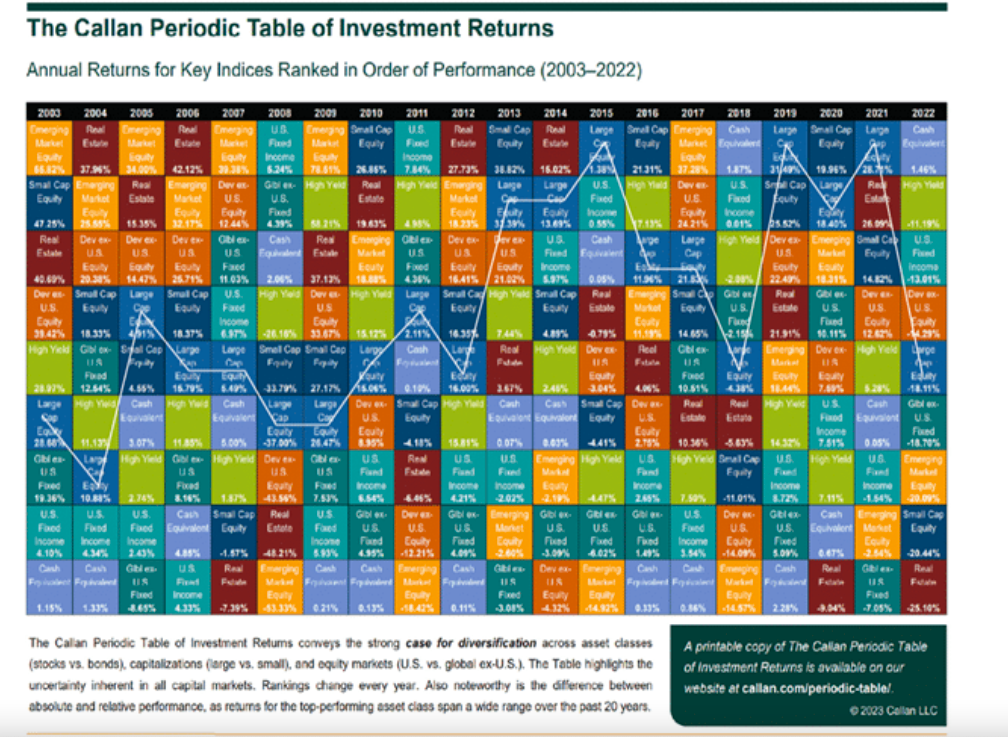

Such is like investing. The Callan Periodic Table of Investment Returns below ranks investment performance by year for key indices. As you will notice, there is no predominant winner year in and year out.

Bandwagon bias can be good as riding the hot theme or group of stocks helps investors grow their wealth. Unfortunately, jumping on a market bandwagon too late can come with steep costs.

As we enter 2024, be open to the possibility that last year’s winners will not take the crown this year.

We don’t know what will replace the Magnificent 7 or when, but we will be sure to keep our bias in check and stay open to new ideas.

Twitter: @michaellebowitz

The author or his firm may have positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.