Geoff Bysshe contributed to this article.

The reporting on last week’s Federal Open Market Committee (FOMC) press conference was all about the very topic that Chair Powell had predicted (and forewarned) in the prior meeting.

The topic wasn’t the interest rate cut, and yet again, Jerome didn’t get any credit for his kind and prescient forewarning.

Fortunately for us, he has a long history of not letting the opinions of his critics get in the way of doing his job in the way he believes best serves the Federal Reserve’s mandates.

Time will reward his legacy for this quality and demonstrate its importance in balancing the lack of it all around him in the current administration.

Fortunately for the attentive investor, he made another proclamation that, if prescient, will be the market’s narrative in 2026.

Again, it’s been largely ignored and certainly overshadowed by the media’s focus on the “dissention at the Fed!”, which (by the way) is exactly what he said was coming with his messaging in the last meeting.

In October, the market’s interpretation of his statement that a “December rate cut was “NOT a foregone conclusion” was interpreted as being a warning that the rate cut may not happen.

It seems clear now that the most important message in that statement was the changing and increasingly challenging role of the Fed chair to deliver a Fed rate decision that provides the certainty and confidence of the unanimous decisions the Fed board has delivered for years.

The Fed chair doesn’t have the same tactical latitude that politicians have to gaslight the public to justify their decisions. Markets may be temporarily distracted by a false narrative, but they are quick to correct course, and then they are not very patient or forgiving.

Fortunately, another quality of Chair Powell’s legacy that will become more appreciated in time is his ability to let the subtext of his press conferences guide the market’s narrative like a parent with the superpower to quiet a crying 5-year old without the use of an electronic device and without the child realizing how that just happened.

Like a parent with disciplinary superpowers, he knows markets don’t like surprises, and telling them to “stop crying, everything is ok,” doesn’t work either.

So, last October, Chair Powell let us know we might see a little mutiny at the next meeting.

Chair Powell’s messaging worked.

Despite the largest level of Fed governor disagreement in years, the market’s initial volatility gave way to a broadening of the bull market in response to the FOMC meeting.

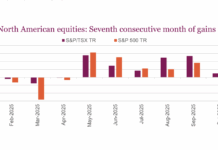

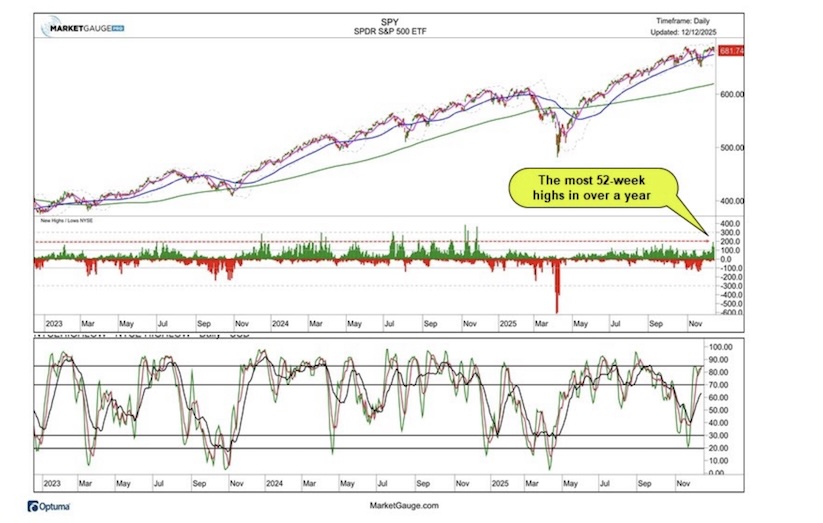

Small caps, shown by the chart below of the Russell 2000 ETF (NYSEARCA: IWM), hit new all-time highs, while the S&P 500 equal weight ETF (RSP) also hit new all-time highs.

Additionally, as Keith covers in this week’s video, and shown in the chart of the S&P 500 (NYSEARCA: SPY) below, the number of NYSE stocks at 52-week highs also hit a level not seen in a long time despite the bull market (see the middle pane).

The Most Important Proclamation in the FOMC Press Conference

With the market now acclimated to the new environment of a Fed that is not likely to deliver unanimous decisions, Chair Powell told us what his biggest concern is going into 2026.

However, like his messaging of “not a forgone conclusion,” in October, he delivered his intentions in a way that was less direct, more convincing, and largely overlooked.

The market will come to accept his statement as the new main narrative in 2026, and investors will say, “I saw it coming”, but that’s not true, and more importantly…

The strength in a market-moving narrative is in its ability to build momentum, and for investors, their confidence to ride through the bumpy detours like last Friday.

With the Fed chair solidly behind this effort, 2026 could be another double-digit year, but before we focus on Mr. Powell’s focus for 2026, let’s look at what the market has decided to focus on instead.

Despite big earnings, big tech is getting punished.

The Market Is Distracted By Debt

Last week’s Market Outlook began with the following sentence,

“Next week could set the tone for the much anticipated Santa Claus rally, but be patient.”

The reason for “patience” was two-fold.

- Oracle (NASDAQ: ORCL) Earnings

The December rally statistically starts at the end of this week.

Last week, the market managed to weather Oracle’s earnings with the help of the Fed’s FOMC meeting, but then Broadcom’s earnings reminded investors that they are still worried about debt levels and valuations of the large tech stocks behind the big, beautiful AI spending boom.

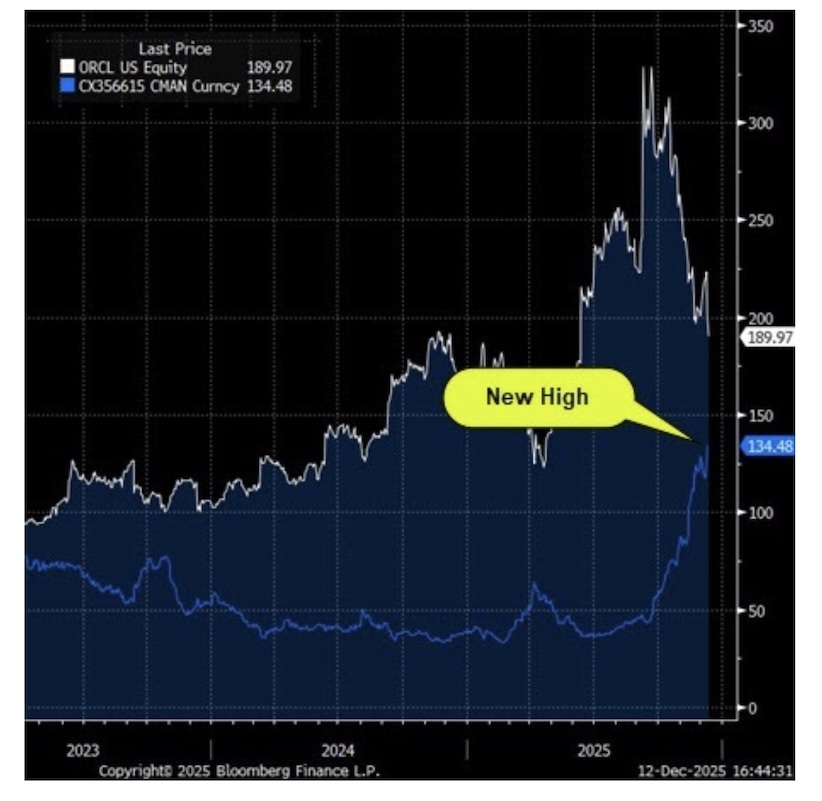

This fear existed and got worse when ORCL reported, as illustrated by the chart below, but it got harder to ignore when AVGO didn’t surprise the whisper numbers to the upside. It’s not easy to be a tech stock these days – expectations are high.

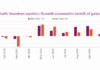

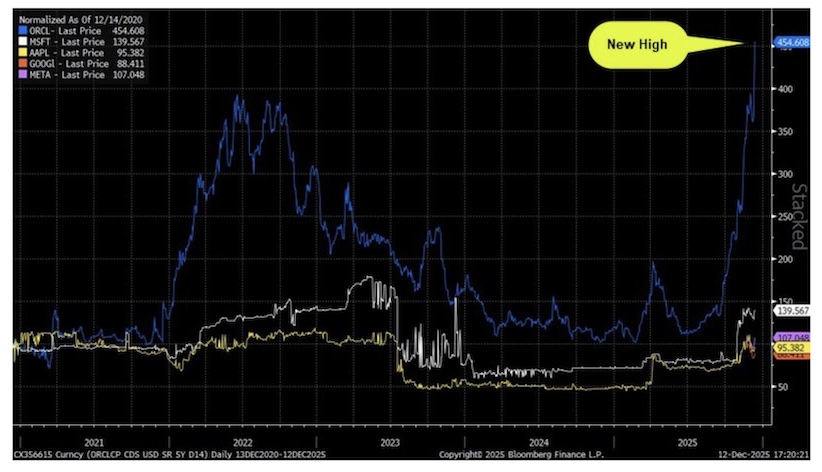

The ORCL credit default swap (CDS) hit a new high on top of an already extreme level, suggesting that bond investors are very concerned about the debt levels.

When you look at history, below, you can see that major moves in CDS pricing is highly correlated (inversely) with the stock price.

ORCL is the market’s biggest concern in this area, but other big tech companies are not immune to the concerns, as you can see from the relative performance of the CDS prices for MSFT, META, GOOGL, and APPL.

The market’s focus on the big tech debt is a problem for the performance of the major indexes, but this is a healthy concern for the long-term durability of a bull market, and if Chair Powell is correct, there is good news on the way.

The Good News

While the last week could easily have felt like a bearish week, there was good news in the message of the market.

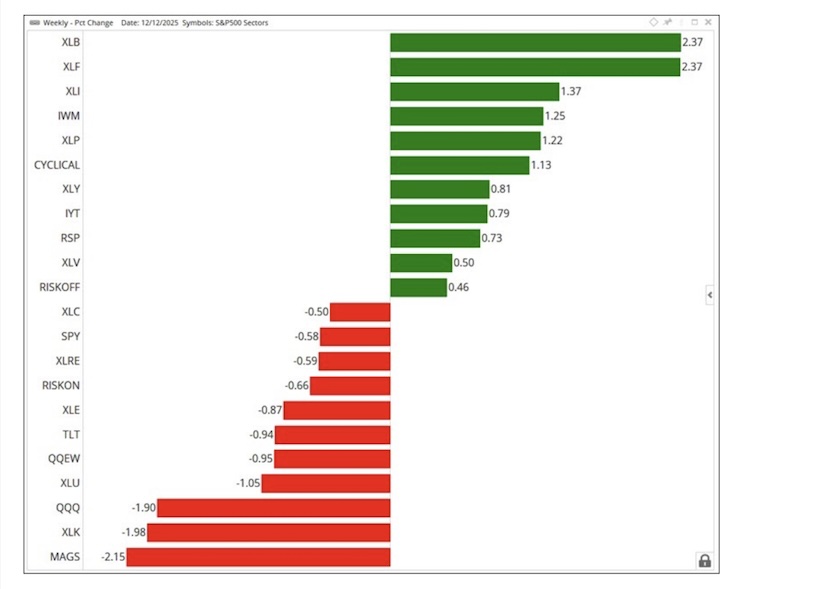

Keith covers this extensively in this week’s market video, and I hinted at it above. Last week, the market experienced a significant rotation into financials and cyclical areas of the market as tech sold off.

While this may be a nuance, the good news is that the market demonstrated rotation, and the areas it rotated into were not beaten down. The market didn’t just buy the cheap stuff, hoping for a bounce.

The market rotated into areas that have been strong and can continue to lead as tech takes a well deserved break.

Even in a market where the SPY and QQQ looked like it was a bearish week, the chart below shows good strength in good sectors and themes (financials, cyclicals, small caps, equal weighted S&P 500).

What’s Chair Powell Saying?

This rotational theme fits right in line with Chair Powell’s most important proclamation from the FOMC press conference.

Again, what’s important is not just what he says but how and why he says it.

I can’t summarize it better than the actual dialog, so I’ll leave you with what you’d read in the transcript….

Reporter: MATT EGAN. Thanks, Chair Powell. Matt Egan with CNN. After today, you only have three more meetings at the helm of the Fed. Since becoming Fed Chair, you’ve seen multiple trade wars, the pandemic, COVID reopening, period of high inflation. I know your term’s not up as Chair until May, but I’m wondering if you’ve given any thought to what you want your legacy to be.

CHAIR POWELL. My legacy. I — my thought is that I really want to turn this job over to whoever replaces me in — with the economy in really good shape. That’s what I want to do. I want inflation to be under control, coming back down to 2 percent, and I want the labor market to be strong. That’s what I want. And all of my efforts are to get to that place. They have been all along. But, ultimately, that’s what I want. And it’s — you know, I don’t have time to think about the bigger things. I have many years ahead to worry about that. But there’s enough to do.”

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.