Traders returned on Wednesday to see fractional gains in across the various global equites markets.

Domestically, trends remain very much neutral for the S&P 500 (INDEXSP:.INX). Deteriorating sectors like Technology have not had much effect on the S&P 500 thus far… this likely due in part to Financials breaking out last weeek.

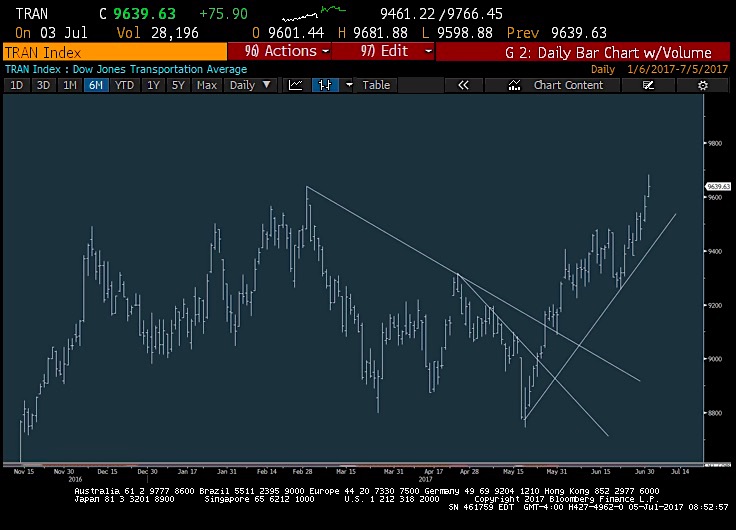

But Financials aren’t the only sector supporting the market here. The Transports have risen to record highs, which is a real positive… especially for Dow theorists.

On the downside, commodities have begun to rollover a bit as the US Dollar (CURRENCY:USD) shows signs of stabilization. The Dollar is likely getting help from rising 10 year treasury bond yields (INDEXCBOE:TNX). Gold prices broke down under the important 1230 area and remains susceptible to pullbacks towards 1200. Crude oil may have reached a very short-term trading peak.

Below are 5 charts of key stock indices, sectors, and assets that I am watching right now.

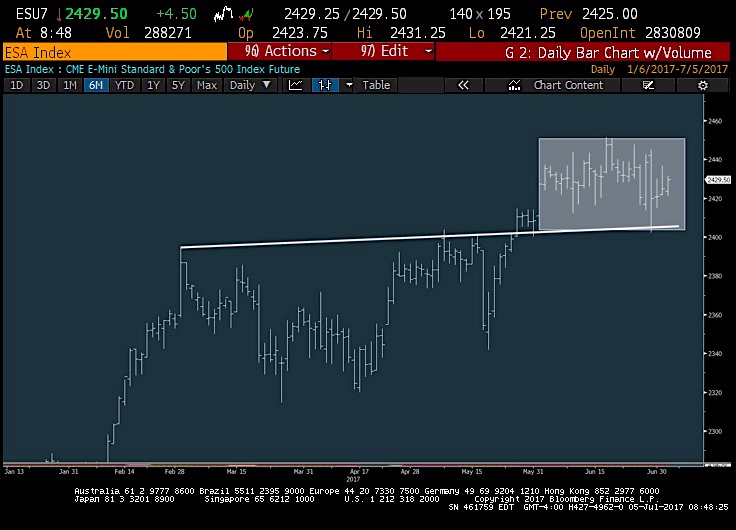

1. S&P 500 Futures

Currently in an ongoing range, despite sector rotation at work under the scene. Overall. 2402 is important support for S&P Futures. 2444 remains as resistance.

ALSO READ: Trading Update Into 3rd Quarter

2. NASDAQ Composite

Tech is holding near trendline support, despite the deterioration in Semiconductors (SOX) and the Nasdaq 100 (NDX). For now, a close UNDER 6087 would be a negative.

3. Gold

The yellow metal has broken down given the recent 10 year treasury yield (TNX) rally US Dollar stabilization. 1200 looks likely near-term.

4. Financial Sector (XLF)

The ongoing rally in Financials has helped to support the S&P 500 during a time of Technology weakness. The XLF is nearing prior highs from March which are important at 25.29.

5. Dow Jones Transports

The move back to new all-time highs on the Dow Jones Transports is promising and helps the Industrials. Both the Rails and Airlines are favored.

Thanks for reading.

Twitter: @MarkNewtonCMT

Author has positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.