November was an eventful month for the financial markets, as emerging market currencies, especially the Russian ruble, came under heavy downward pressure along with oil prices. Wall Street continues to read the FOMC tea leaves for any clues about future monetary direction. Inflation remains muted and many domestic stocks and bonds continued to post healthy gains in November.

November was an eventful month for the financial markets, as emerging market currencies, especially the Russian ruble, came under heavy downward pressure along with oil prices. Wall Street continues to read the FOMC tea leaves for any clues about future monetary direction. Inflation remains muted and many domestic stocks and bonds continued to post healthy gains in November.

Stocks & Bonds

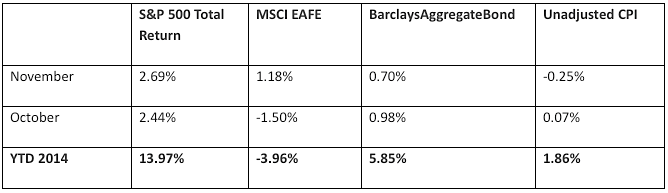

In November the U.S. stock market continued its rise year-to-date, while treasury yields continued to drop, good news for bond investors. Foreign capital markets continue to post mixed results as US Dollar strength is causing capital flows to reverse in many emerging economies. Here’s the financial markets, by the numbers:

Commodities & Currencies

NYMEX Crude Oil prices continued to sell off in November, dropping almost 18% for the month and over 28% for the year-to-date. Gold prices steadied somewhat, closing at $1,175 per ounce, down just 2.5% year-to-date. The dollar continued to strengthen, aided by the end of QE in October. Year to date the Dollar Index has increased 10.22%, contrary to many prognosticators estimates of never ending dollar declines.

Economy

The Department of Commerce released its latest estimate of 3rd quarter GDP, increasing their estimate to annualized growth of 3.9%, higher than the previous estimate of 3.5%. Inflation (as measured by CPI) in November declined the most in six years, by 0.3%, and has increased only 1.3% over the last 12 months. Falling energy prices caused most of this decline, although core CPI, which excludes volatile food and energy, is still just 1.7% over the last year.

The unemployment rate stayed at 5.8% in November. Estimates for job growth in both September and October were both revised upwards slightly. As the economy continues to add jobs, economists are somewhat puzzled that wage growth has not kept pace. A disproportionately large number of jobs created have been in lower-paid jobs such as restaurants and retail, perhaps contributing to anemic wage growth. The Institute for Supply Management showed continued expansion with a reading of 58.7, although that is down slightly from October’s reading of 59.

Summary

Falling oil prices have led to various interpretations of consequences. On the positive side, falling energy prices put more money back into American consumers’ pockets. Economists posit that most of this extra cash is immediately spent, spurring economic activity. On the other hand, as oil and gas companies experience reduced revenue, they must cut back on capital expenditures, financing activity and employment. And this too has an effect on the financial markets. Since GDP is simply a dollar measure of economic activity, falling prices tend to be a drag on GDP, even if consumers experience a net positive. As many smaller oil and gas companies have borrowed heavily to capitalize on shale discoveries, it is likely that there will be more loan defaults which could cause yields for many corporate borrowers to rise.

As global demand destruction for fossil fuels has continued over the past few years, the underlying global energy problem is too much supply and not enough demand. Unless Americans start to trade in small cars for gas guzzlers sometime soon, or China’s growth slowdown reverses, it does not appear likely that demand will see any large growth in the near-term. The supply-demand imbalance must therefore be solved by a reduction in supply, which means less efficient producers might simply have to go through the painful process of closing their doors. Concerns about the end of OPEC are overgrown as the ability to pump oil on the Arabian Peninsula remains much more profitable than the expensive quest for shale oil in the U.S. Low oil prices, in my opinion, will likely continue until enough suppliers have closed to rebalance the market. Thanks for reading this review of the financial markets.

This material was prepared by Greg Naylor, and does not necessarily represent the views of Woodbury Financial or its affiliates. This information should not be construed as investment, tax or legal advice and may not be relied upon for the purpose of avoiding any Federal tax liability. This is not a solicitation or recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. The S&P500, MSCI EAFE and Barclays Aggregate Bond Index are indexes. It is not possible to invest directly in an index. Investing involves risks and investors may incur a profit or a loss. Past performance is not an indication of future results. There is no guarantee that a diversified portfolio will outperform a non-diversified portfolio in any given market environment. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

Data Sources:

- www.standardandpoors.com – S&P 500 information

- www.msci.com – MSCI EAFE information

- www.barcap.com – Barclays Aggregate Bond information

- www.bloomberg.com – U.S. Dollar & commodities performance

- www.realtor.org – Housing market data

- www.bea.gov – GDP numbers

- www.bls.gov – CPI and unemployment numbers

- www.commerce.gov – Consumer spending data

- www.napm.org – PMI numbers

- www.bigcharts.com – NYMEX crude prices, gold and other commodities

- https://data.bls.gov/timeseries/LNS11300000 – Labor participation data

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.