Bifurcated Rate Cut Sentiment

When Fed member John Williams suggested last Thursday that ‘r-star’ is .50%, markets took it as a sign that a 50 bps rate cut is in the cards.

Treasury bonds (NASDAQ: TLT) rallied, markets recovered their day’s losses and Gold (NYSEARCA: GLD) and Silver (NYSEARCA: SLV) skyrocketed.

Although talked back that evening, clearly it shows the market is uber-sensitive to the yield curve and rates and all things priced in the USD. But opinion on whether to cut is also clearly divided.

Those who don’t think Fed should cut:

- “US Economy is doing fine so why waste the bullet?” and “If Fed is so bullish the economy, why cut?”

- “Lower yields are not stimulative this late in the cycle” inspires “Rate cuts incentivize malinvestment and asset bubbles”

- “We are Turning Japanese!”

Those who do think Fed should cut:

- “US Economy is fragile, as witness between Oct and Dec 2018, so must cut rates to sustain current market

exuberancestability.” - Only a Half-Point Rate Cut From the Fed Will Do “Anything less would fail to fix the imbalances in the global bond market, continuing to weigh on economic sentiment.”

Global Central Banks have their own ideas:

We expect 12 central banks to cut rates in the next couple of months. JPMorgan

At least they are talking their book!

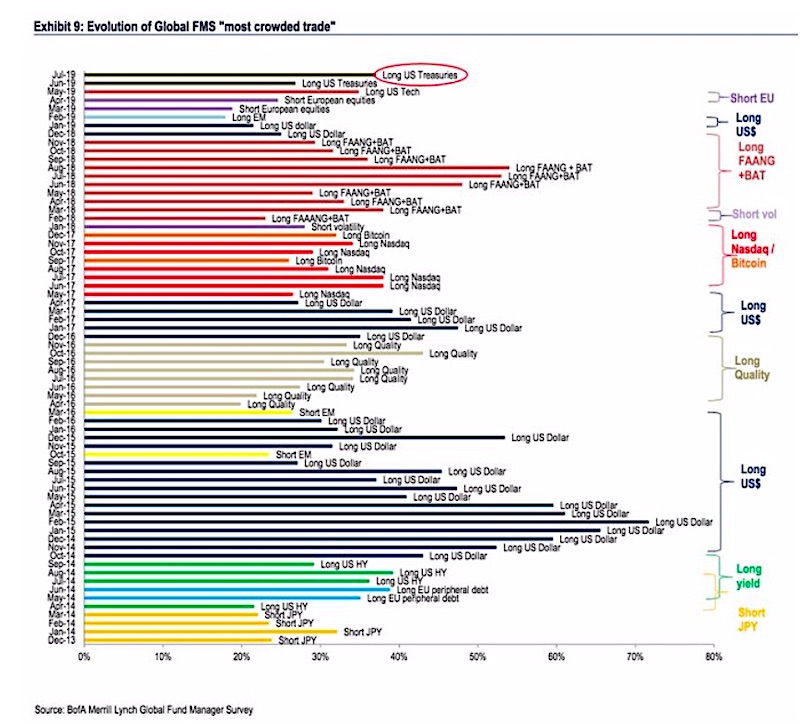

According to the July BofA fund manager survey:

Bond yield expectations are the lowest since 2008 and inflation expectations are at a 7-year low. Just 1% expect inflation to rise in the next 12 months vs 80% a year ago. @FerroTV

And might I add, they have had this book for awhile…

The Global Carry Trade Freight Train Rolls On

“On a cumulative basis, bond fund inflows total $1.7trn since the start of 2007, an interesting mirror image of the $1.7trn in domestic equity fund outflows since 2007”

My View:

- Powell’s position – there’s no going back to “normal”– only fuels more demand for the long end.

- Inflation expectations reverse sharply: Just as they did of late – “1% expect inflation to rise in the next 12 months vs 80% a year ago”.

- Fed lowers short-term rates – to better sync with 2-year Treasury Note Yield: ~1.85 now on it way to where they were in Dec 2015 ~1%.

- Bull Steepener in yield curve results in the next 6-12 months.

- With “Fed-induced” inflation coming as short term rates fall, dollar weakness results but not likely until after Fed is done cutting 50 bps (estimated December 2019).

And with that, a Steepener is not bullish equities.

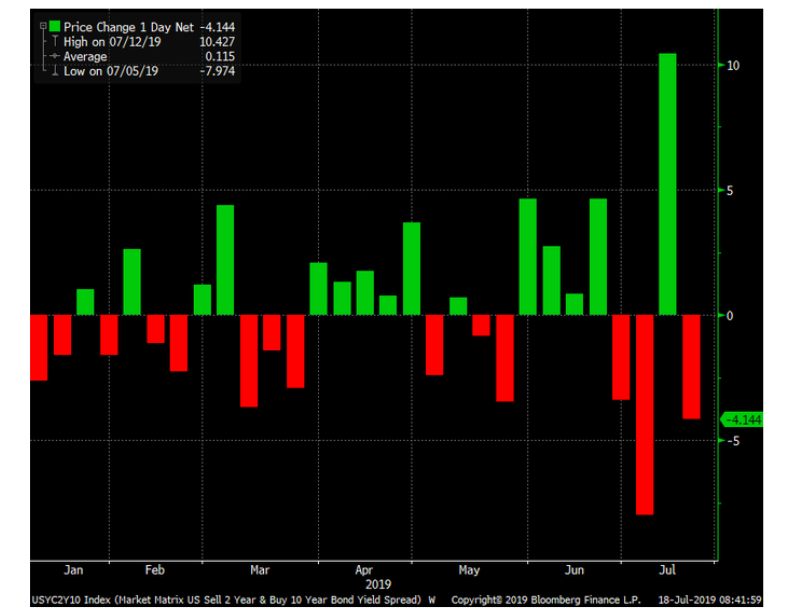

Are markets unstable? Look no further than the rates market.

Curve conniptions: 2s10s on track for biggest weekly flattening of 2019 followed by biggest weekly steepening followed by second-biggest weekly flattening. @LJKawa

I mean, this is Crazy Ivan kinda stuff.

Russian Captains sometimes turn suddenly to see if anyone’s behind them.

We call it, Crazy Ivan.

Anything you can do is go dead, shut everything down, and make like a hole in the water.

Big Volatility in Yield world gonna spill over to equities is my bet …

Twitter: @SamanthaLaDuc @LaDucTrading

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.