US dollar is up sharply as 7 Federal Reserve officials expect rates to increase in 2022, 13 Fed officials see rate increase in 2023.

I see some intraday impulsive reactions but keep in mind that if you zoom out your price chart you will still see a sideways move since January.

Also other Central Banks waited on the Federal Reserve first, and now they will look for similar policy, which may cause some stabilization on currencies like eur, aud, gbp, nzd, but not just yet, maybe after the summer and towards the end of the year. Therefore, I will continue to track higher degree corrections but with room for more dollar strength in the short-term.

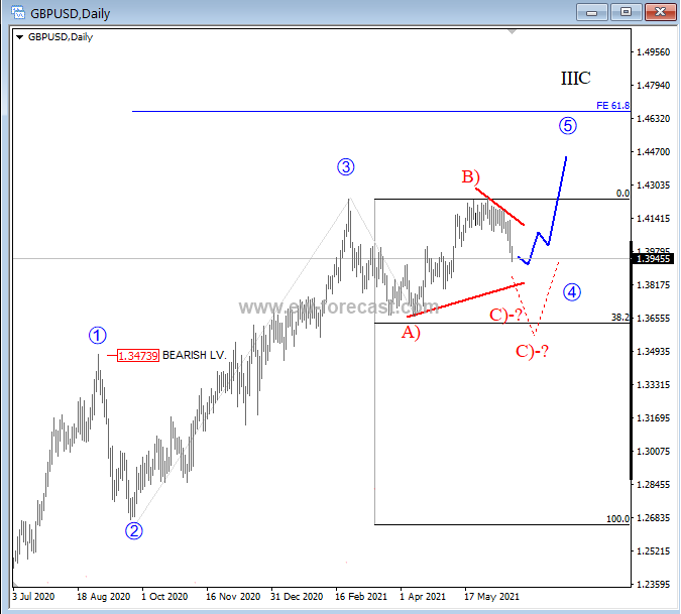

On the chart below we are looking at which is coming lower as ease regarding covid resitrcions have been removed, but BoE may be forced to act next due to inflation data. From an Elliott Wave perspective we are still tracking a fourth wave here which can be more complex and longer in time that we firstly thought. We are observing an irregular formation in a fourth wave which can form a flat or even a triangle if price will find a support at 1.38-1.39 area.

GBPUSD Daily Elliott Wave Analysis Chart

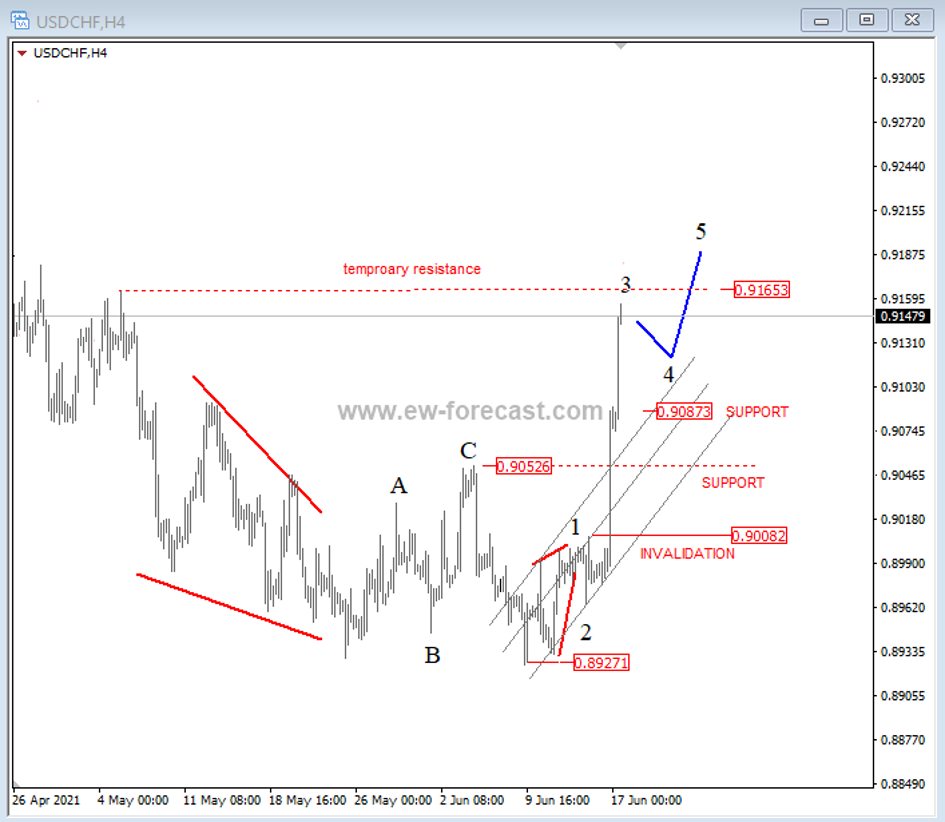

Rgearding the short-term moves, with current dollar strenght and weakness on metals we think it’s worth to keep an eye on USDCHF for more upside, espeically if risk-off will continue away from yesterday levels. Pair looks bullish, with nice impulsive personality that can resume after wave 4. Currently wave 3 can be moving into a temporary resistance here around 0.9165.

USDCHF 4h Elliott Wave Analysis Chart

Finally, another ELLIOTT WAVE OPEN DOOR Event is here. See all of our charts FREE for 10 days. Join us at Elliot Wave Forecast!

Twitter: @GregaHorvatFX

The authors may have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.