This was a big week for the financial markets even before the Greek elections stole the headlines on Sunday. With several economic data releases on tap this week, the markets will have plenty to digest. And investors hope they’ll get a better idea of where the equities markets are headed.

Oh, and I almost forgot, it’s also FED week.

Perhaps my lack of enthusiasm means that the Fed meeting and accompanying FOMC statement on Wednesday will actually mean something. As a trader, I focus on price and tend to ignore (or stay away) from the noise on Fed day. That said, most investors are simply looking for the Fed to remain patient. Perhaps the FOMC statement will be an excuse for a US Dollar pullback. Considering the poor retail sales release for December, I can’t see any reason why the Fed would get overly hawkish.

As I mentioned earlier, there are several important economic data releases this week. And perhaps that is what will shape the markets response. Here’s a quick calendar rundown:

TUESDAY:

- 8:30 am ET: Core Durable Goods, forecast +0.6%

- 10:00 am ET: Conference Board Consumer Confidence, forecast 95.1

- 10:00 am ET: New Home Sales, forecast +2.7% MoM, 450K annualized rate

WEDNESDAY:

- 2:00 pm ET: FOMC Fed Statement, forecast 0.25% target rate

THURSDAY:

- 8:30 am ET: Initial Jobless Claims, forecast 300K

- 10:00 am ET: Pending Home Sales, forecast +0.5% MoM

FRIDAY:

- 8:30 am ET: Q4 GDP, forecast +3.0%, GDP Price Index, forecast +0.9%

- 10:00 am ET: Michigan Consumer Sentiment, forecast 98.2

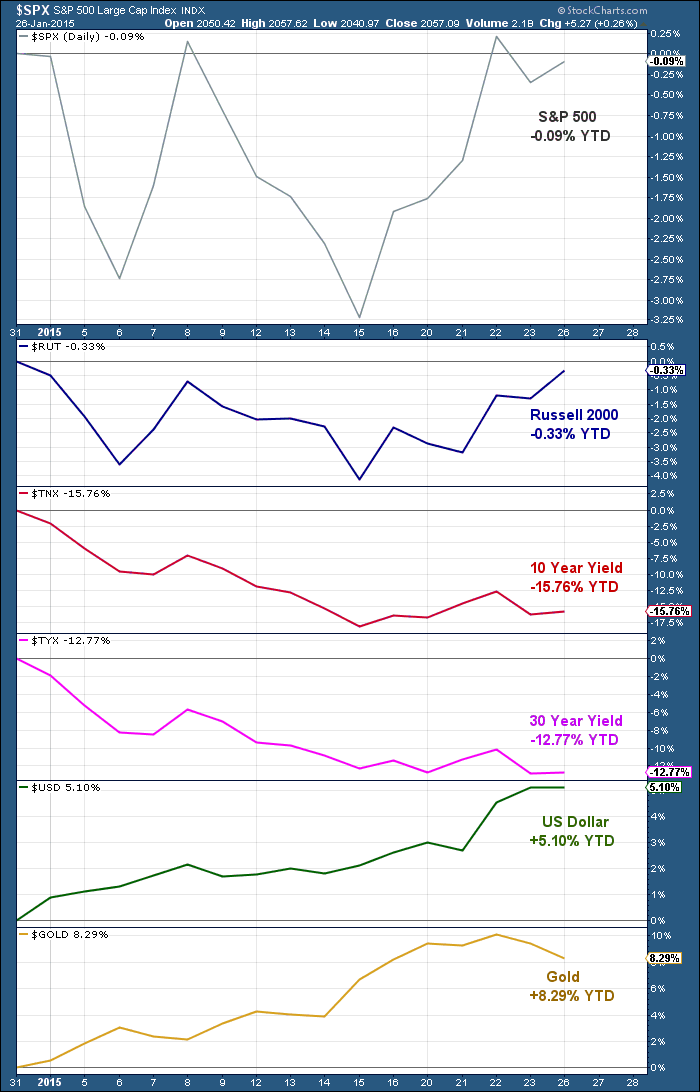

With all this data to digest amidst falling Crude Oil prices, a stronger US Dollar, and lower US Treasury yields, it’s no wonder the markets have been choppy. Here’s a quick look how the US markets are shaping up into the FOMC statement.

US Markets Performance YTD: S&P 500, Russell 2000, 10 Year UST, 30 Year UST, the Dollar and Gold

Although it’s been choppy, US equities have battled back and are almost at par for the year. In fact, the S&P 500 closed higher today after a lower open on the Greek election news. This resilience also comes in the face of a US Dollar that is up 5.1% for the year. This gives the bulls a psychological edge heading into the week, but until the S&P 500 closes at new all-time highs, the markets are still a chop-fest. Note that Apple (AAPL) also reports earnings on Tuesday after the bell – it’s sure to be a pre-Fed market mover. Buckle up and have a great week.

Follow Andy on Twitter: @andrewnyquist

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.