Is The Age Of Zero Interest Rates Over?

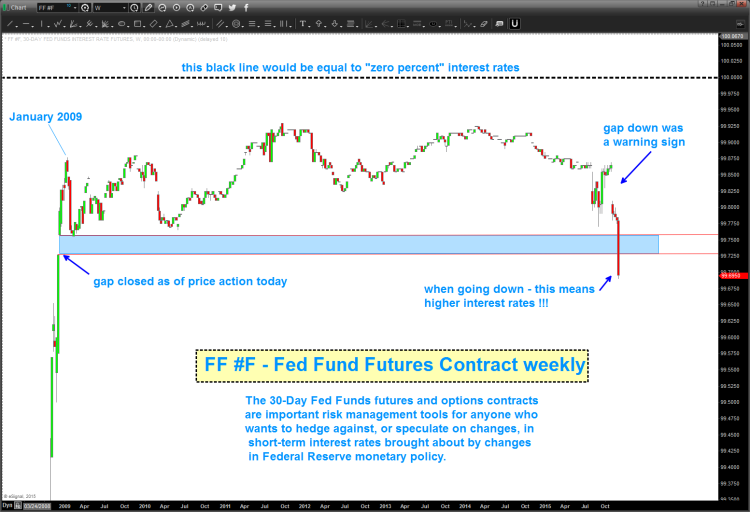

On November 9 I wrote a post detailing why interest rates may be on the rise. Or rather, why the age of zero rates may be over. In that post, we highlighted an incredibly important area of support on the Fed funds futures chart.

A MAJOR gap higher in 2009.

In sum, Fed funds futures had respected (and held) that gap up support for over 6 years. And that gap was filled today… and then some.

Folks, we smashed through that support today, giving cause for a very big move in the bond markets today. Here’s a couple of excerpts from my prior post on fed funds futures:

Folks, the market is telling us we are entering a higher rate environment… UNLESS… [the] big and open window (gap) holds as support.

Wow, just look at the chart below. The move today was powerful. In all, treasuries got crushed, the Dollar slipped, and the Euro flew.

Is this a sign that the age of zero interest rates is over? It appears that way.

Fed Funds Futures Contract – Weekly Chart

As investors await the Federal Reserve, it appears that the market has already spoken. Thanks for reading.

Twitter: @BartsCharts

Author does not have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.