- Bond market stress, global geopolitical risk, and weather shocks at home have lifted Energy to the top sector spot YTD

- Baker Hughes’ Q4 report this weekend follows a slew of oil services company earnings

- Exxon Mobil and Chevron commentaries may be just as impactful as their Q4 numbers following the Maduro capture

It was a sea of red to kick off the holiday-shortened trading week yesterday. President Trump’s ambition to annex part or all of Greenland drew backlash from European leaders. A new set of tariffs also riled markets, precisely one year after the 47th POTUS took office.

In terms of market action, the Cboe Volatility Index (VIX) spiked above 20, while the U.S. Dollar Index (DXY) suffered its worst session since last August. But it wasn’t solely a U.S.-Europe macro story.

The Land of the Rising Sun….And Falling Fixed Income Market

An outright bond market implosion occurred in Japan. The island nation’s 40-year yield skyrocketed to a record above 4.20%, and its benchmark 30-year rate jumped 27 basis points to a fresh all-time high of 3.88%. Worries over tax cuts and their impact on Japan’s fiscal situation continued a macro trend ongoing for the past year-plus.

All eyes will be on the upcoming Bank of Japan monetary policy meeting, ahead of the U.S. Federal Reserve’s January 28 interest-rate decision.

Energy Atop the Early-Year Sector Leaderboard, High Macro Volatility

For investors, 10 of the 11 S&P 500 sectors traded in the red yesterday morning. The lone bright spot? Energy.

The oil & gas space often offers diversification benefits to global portfolio managers when macro jitters take center stage. Shares of Exxon Mobil (XOM), the world’s most valuable publicly traded energy company, tagged a record high above $131 for the first time. It has been remarkable how resilient large energy firms have been, given depressed oil prices.

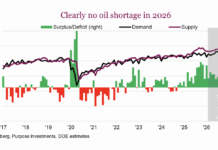

Indeed, both WTI and Brent crude have felt the brunt of a global oil glut. President Trump’s “drill, baby, drill” mindset and OPEC’s unsuccessful attempts to stabilize the supply-demand balance have kept oil bears in charge. Though prices spiked earlier this month when the U.S. captured Venezuelan President Nicolás Maduro (it feels like ages ago at this point), prices quickly fell back down. American households probably aren’t complaining, as AAA reports that the average cost of a gallon of regular unleaded is near five-year lows at $2.82.

Don’t Forget about Natural Gas: Old Man Winter Tightens His Grip

Stable oil prices contrast what’s happening in the natural gas markets. The February 2026 contract of U.S. Henry Hub gas jumped nearly 30% on Tuesday. Forecasts for bone-chilling cold over the final week of January spooked markets, and this weekend’s wintry blast could rival what transpired in Texas four years ago, just as power grids grapple with rising prices and pressure from policymakers. Impacts are likely from the Lone Star State to the Mid-Atlantic.

Earnings Events Add Drama and Investor Interest, BKR Stands Out

So, there’s no shortage of drama at home and abroad, as well as across oil and natural gas markets, for energy executives to weigh. Near-term risks and long-term opportunities are aplenty at the moment. That will make the upcoming round of energy-sector Q4 reports all the more interesting. Additionally, our team uncovered an outlier company that will report off schedule this coming Sunday night.

What is that firm? Baker Hughes (BKR). Shares of the $41 billion market-cap oil and gas equipment and services company hover near record highs ahead of its unusual weekend earnings event. There hasn’t been significant news lately—we have to go back to last summer, when BKR acquired Chart Industries in a $13.6 billion M&A move.

Market pricing also suggests that the January 25 Q4 report might not include many fireworks. According to data from Option Research & Technology Services, the stock is expected to move just 4.8% (near its long-term average earnings-related straddle of 4.9%). Shares dipped 3.3% following the October Q3 report.1

We also dug into the corporate event calendar. BKR’s quarterly conference call takes place Monday morning next week, but a quiet stretch then ensues—no major volatility catalysts until its April Q1 report. Nevertheless, be on guard for potential one-time items to be included in Sunday’s release.

Listen Up!

Beyond Baker Hughes, and after Halliburton (HAL) reported this morning, SLB Corp (SLB), formerly known as Schlumberger, serves up numbers Friday before the bell. The heavy hitters—XOM and Chevron (CVX)—report next Friday, January 30. Investors will listen intently to what CEOs Darren Woods and Mike Wirth have to say about the volatile state of the global energy market, particularly regarding Venezuela.

Opportunities in South America?

Much has been made of the country’s oil reserves, which are likely materially lower than what the Maduro and former Chávez regimes have claimed. Moreover, while resource-rich, Venezuelan oil is notoriously sour and dense, more like tar than domestic light sweet crude.

In short, establishing a further U.S. presence there will take years, so don’t expect any concrete developments to be unveiled next Friday morning. Still, Chevron’s existing Venezuela assets could be optimized to extract more “black gold” in the quarters ahead.

Bulls Gaining Steam

As for price action, XOM and CVX are up almost 9% so far in 2026, outperforming the S&P 500 by more than eight percentage points. Momentum is solid, and income investors may be drawn to those stocks’ dividend yields (3.2% for XOM and 4.1% for CVX).

Elsewhere, the energy conference tour heats up in March. Three notable events take place toward the end of Q1:

- March 2: Jefferies Flagship Power, Utilities, Clean Energy & Energy Conference

- March 16: Piper Sandler 26th Annual Energy Conference

- March 23: CERA Week

The Bottom Line

The Energy Select Sector SPDR ETF (XLE) leads among the 11 S&P 500 sector funds. Up more than 6% on the year, shares of oil & gas companies have offered decent diversification amid a very busy January on the macro front. The coming days will bring company-specific story updates, including an unusual Sunday-night earnings event. Next week’s XOM and CVX Q4 reports will be particularly revealing, given early-year geopolitical developments.

Sources:

1 BKR, ORATS, January 21, 2026, https://dashboard.orats.com/analyzer/earnings?ticker=BKR

Twitter: @ChristineLShort

The author may hold positions in mentioned securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.