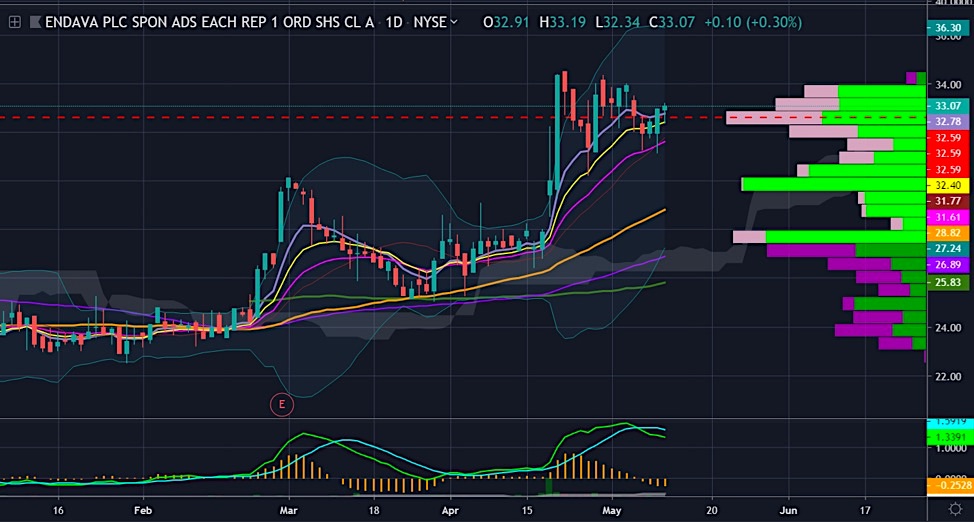

Shares of Endava (NYSE: DAVA) are technically flagging just under new highs.

This is a bullish formation that caught my eye over the weekend and caused me to do some research.

Endava – Fundamentals

Endava is a $1.79B UK-based provider of technology services for the digital evolution, cloud, IoT and other growth areas of spending across Tech.

Shares of Endava (DAVA) trade 30.2X Earnings and 4.5X EV/Sales with 13% FCF margins in 2018.

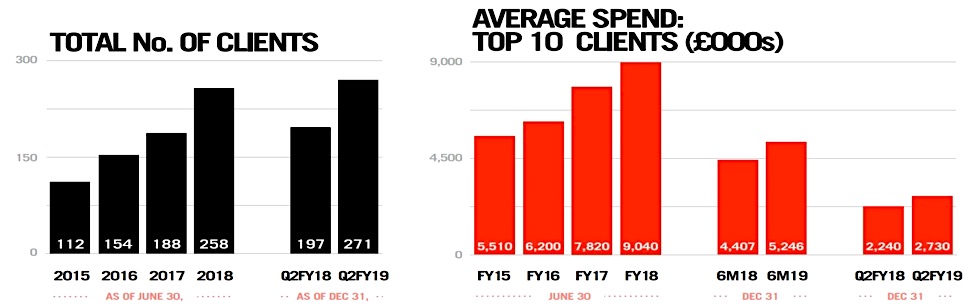

In 2018 it reported 33.2% gross margins and 15.7% EBIT margins. It last reported on 2-28-19 beating estimates and posting 43.6% Y/Y revenue growth and impressive client metrics. Note that the statistics and information are sourced to Sentieo and company filings / presentations.

Endava generated 45% revenue growth in 2018 and forecasts call for 26.8% in 2019 and 22% in 2020 while EPS seen growing 30% and 18% respectively those years. It calls itself a pure play next generation technology company targeting a massive $390B digital transformation spending market expected to grow at a 20% CAGR through 2021.

Endava generates the majority of its revenues in Europe while also seeing Latin America exposure, but very little North America revenues. Payments and Financial Services is 53% of its verticals for revenues while Tech, Media and Telecom 27% and Other is 20% which includes Consumer Products, Healthcare, Retail and Logistics.

In summary, Endava (DAVA) is a combination of rapid revenue growth, improving profitability, strong client metrics, and low capex with strengthening free cash flows. It recently priced a 5M share secondary at $27.25 that was well received.

Twitter: @OptionsHawk

The author does not have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.