The world was shocked last night as Donald Trump was elected as the 45th president of the United States of America. The biggest shock however came from the currency markets and a record Mexican Peso decline.

The Mexican Peso (CURRENCY:MXN) was down by -13% at one point versus the US Dollar!

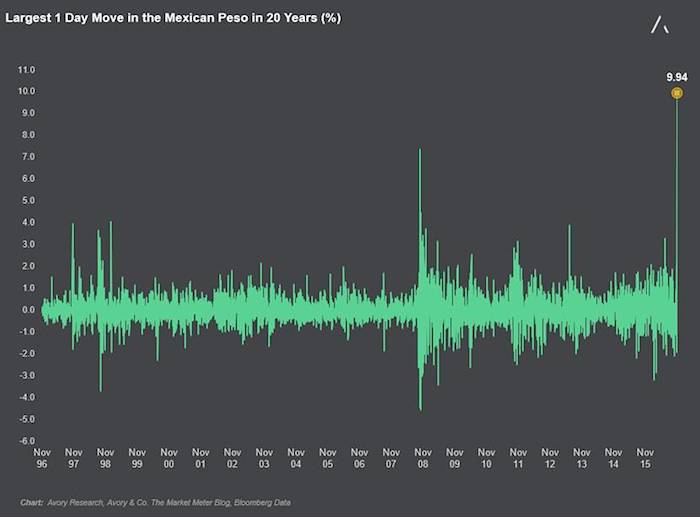

By 9:00 AM this morning, the pair settled in at -9.94%. To put it in perspective, this was the largest move in over 20 years.

For investors the move in the Peso impacts several things. Here are a few:

- Imports from Mexico are now 10% cheaper. Which should boost Mexican exports.

- Revenues derived from Mexico are now a headwind this quarter.

- Banks with Mexican loans will likely increase provisions.

So what does Mexico export? (2015 figures as per Trading Economics)

- Vehicles: US$90.4 billion (23.7% of total exports)

- Electronic equipment: $81.2 billion (21.3%)

- Machines, engines, pumps: $58.9 billion (15.5%)

- Oil: $22.8 billion (6.0%)

- Medical, technical equipment: $15.2 billion (4.0%)

- Furniture, lighting, signs: $9.9 billion (2.6%)

- Plastics: $8.3 billion (2.2%)

- Gems, precious metals, coins: $7.1 billion (1.9%)

- Iron or steel products: $5.7 billion (1.5%)

- Vegetables: $5.6 billion (1.5%)

So if you are looking to benefit from the devaluation, the list above is where you want to start. Thanks for reading.

Twitter: @_SeanDavid

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.