By Joshua Schroeder

By Joshua Schroeder

In both 2010 and 2011 the US economy began growing at quick pace only to peter out later on in the year. Once again in 2012 we are out of the gates quickly with projections of the S&P reaching 1,500 all of a sudden being thrown about. So are we starting the second half, as Clint Eastwood put it, with a first down or is this simply another economic false start?

For the answer, I looked into the sector that represents a little over 70% of US GDP, consumer spending, and I found reasons for optimism. While consumer sentiment remains relatively depressed, shoppers continue to flock to malls, eat out and splurge on the latest Apple device. Why is this? Below are the top 3 reasons why I believe the US consumer may now be strong enough to keep the US expansion intact throughout 2012:

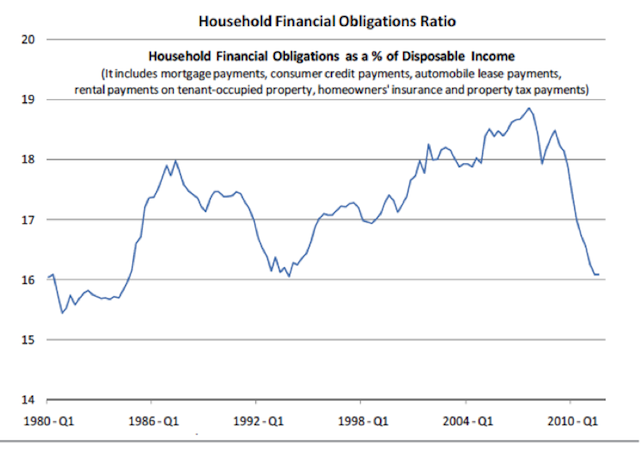

1. Consumers are not feeling quite the pinch from financial obligations. The feds accommodative policy and the resulting low interest rate environment have dramatically lowered the Household Financial Obligations Ratio and allowed for more disposable income to be allocated from household deleveraging and saving to consumption (see chart below). This is also reflected in the behavior of savings rate that increased from 1% in April of 2005 to an average of 5.2% in 2009. The increase in the savings rate over this period generated a significant headwind to consumer spending. Since its stabilization from 2009 through 2011 additional dollars have been freed up to be spent on our favorite gadgets, vacations or dining out in. Note it is the change in savings rate not the rate itself which affects spending.

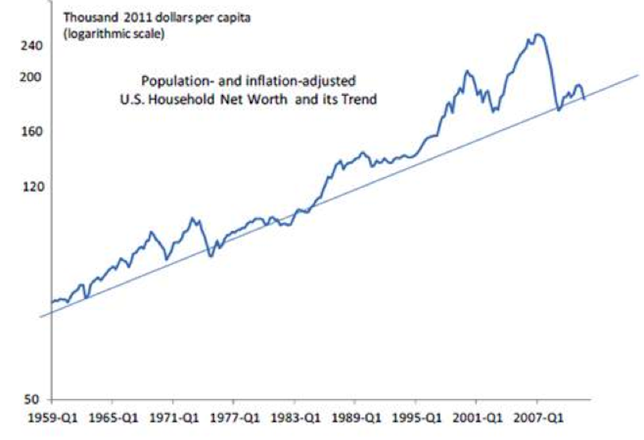

2. The high end US consumer will continue to drive consumption as strong corporate profits result in elevated equity prices, stronger personal balance sheets and increased disposable income (see net worth chart below). The top quintile of the income distribution accounts for almost half of consumer spending (70% of US GDP) and for this group profits growth has an outsized impact on incomes because they derive a greater share of their income from dividends, equity ownership and self-employment. According to government statistics the top 20% of income earners account for 50% of new car sales, 41% of total spending on entertainment and 40% on personal care spending, not to mention nearly all luxury items.

3. Lastly, the plague of high unemployment that has affected less educated and lower income households disproportionately is beginning to recede. In 2011 the average unemployment rate in the college educated workforce was approximately 4% compared to nearly 11% for those without a college degree. The most recent jobs report on February 3rd showed that non-farm employment jumped by 243,000 jobs led by manufacturers that increased payrolls by 50,000 jobs. As the US continues to rebuild its blue collar workforce the unemployment rate will continue to drop and bring even more Americans into the checkout lines at Apple stores. Source: The Economist, A Game of Two Halves, February 11th 2012

Lastly, I would like to note that while US consumers represent a source of strength for the economy and are responsible for this economic “first down”, Europe, geopolitical unrest and policy blunders still leave the second half very much in question. And further, this may affect equity prices over the months ahead.

———————————————————-

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of his employer or any other person or entity.

No positions in any of the securities mentioned at time of publication.

Follow us on Twitter @seeitmarket and be sure to “Like” See It Market on Facebook to keep up with current news and updates on the site.