April was an uneventful month, as oil and the U.S. stock market drifted a bit higher and investors began to speculate about the June Federal Reserve meeting. As well, official data from China indicated that the capital flight has abated somewhat, which lent a bit of support to global stock market indices and commodity markets.

But as the weeks move forward and the days inch toward the June Federal Reserve meeting, economic data will once again become important. And, at the same time, global growth will remain in the spotlight, along with China (and their growth #s).

Without further adieu, let’s break down the month that was.

Stocks & Bonds

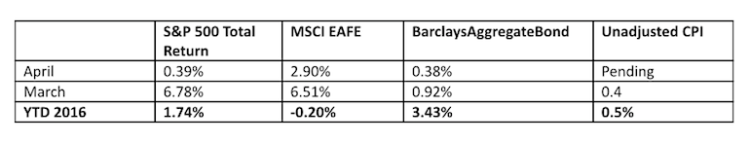

The S&P 500 was largely flat in April after a strong March showing for the major stock market indices. It is now up marginally for the year. Bonds are still outperforming as 2016 has largely been a year of worry.

By the numbers:

Commodities & Currencies

Although the stock market was anemic, the oil market found some hope that demand for petroleum products is picking up again in the United States. So, despite OPEC’s inability to coordinate production cuts, oil prices moved up about 6% in April, leaving them up about the same for the year. Surprising many, the U.S. dollar has reversed its weakening trend of 2015, and so far in 2016 is down against most major trading partners. Whether this trend will continue remains to be seen, and many currency prognosticators are looking to the Fed to decide the near-term fate of dollar direction. The Bank of Japan and the European Central Bank have largely been staying the course with their existing stimulus programs, being unable to ease further for the time being.

Economy

ISM Manufacturing PMI in April came in at 50.8, a second month of growth after 5 straight months of contraction. The non-manufacturing, or services, index showed a reading of 55.7 in April, 1.2 percentage points higher than the March reading of 54.5. The Commerce Department released its advance estimate of GDP for the 1st quarter of 2016, which showed the economy expanding at an annual rate of 0.5%. Existing-home sales in March 2016 were 5.5% higher than in March 2015, and the median sale price increased 5.7% from $210,700 to $222,700. Distressed sales (foreclosures and short-sales) were 8% of the market in March.

As the month of May develops, investors will begin to ratchet up the buzz around economic data and the June Federal Reserve meeting. Should add interest to the financial markets as we head into summer.

Thanks for reading.

This material was prepared by Greg Naylor, and all views within are expressly his. This information should not be construed as investment, tax or legal advice and may not be relied upon for the purpose of avoiding any Federal tax liability. This is not a solicitation or recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. The S&P500, MSCI EAFE and Barclays Aggregate Bond Index are indexes. It is not possible to invest directly in an index. The information is based on sources believed to be reliable, but its accuracy is not guaranteed.

Investing involves risks and investors may incur a profit or a loss. Past performance is not an indication of future results. There is no guarantee that a diversified portfolio will outperform a non-diversified portfolio in any given market environment. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Listed entities are not affiliated.

Data Sources:

- www.standardandpoors.com – S&P 500 information

- www.msci.com – MSCI EAFE information

- www.barcap.com – Barclays Aggregate Bond information

- www.bloomberg.com – U.S. Dollar & commodities performance

- www.realtor.org – Housing market data

- www.bea.gov – GDP numbers

- www.bls.gov – CPI and unemployment numbers

- www.commerce.gov – Consumer spending data

- www.napm.org – PMI numbers

- www.bigcharts.com – NYMEX crude prices, gold and other commodities

- www.federalreserve.org – historical data on 10-year Treasury note

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.