DowDuPont Inc. (NYSE: DWDP) traded 8% higher on Thursday morning, after posting mixed earnings compared to Wall Street expectations.

The chemical company reported earnings per share of $0.74 and total revenue of 20.1 billion, compared to analyst estimates of $0.72 and $20.2 billion.

Also, as DowDuPont plans to split into three separate firms by June 2019, management announced the boards of directors for each company.

CEO Ed Breen explained that the three new firms would focus on materials science (Dow), agriculture (Corteva), and specialty products (DuPont). In the meantime, the company will implement a $3 billion stock buyback program focused on DWDP shares.

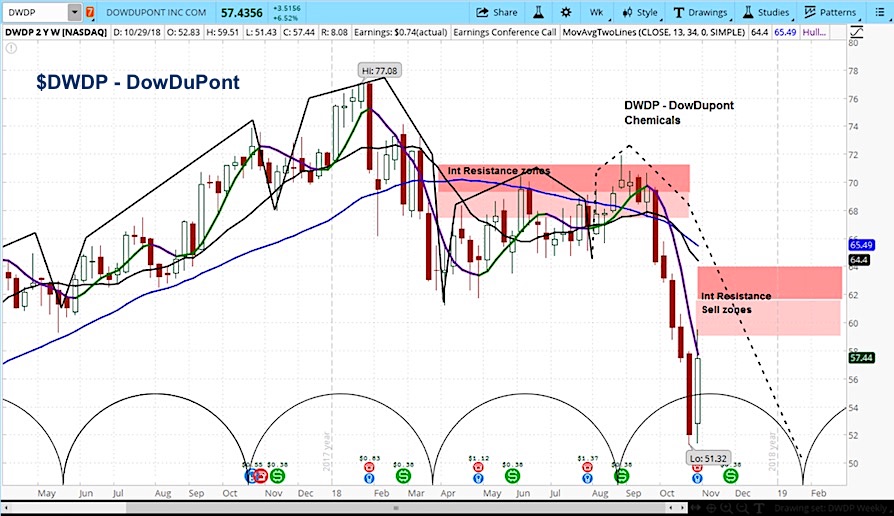

In analyzing the market cycles for DowDuPont (DWDP) on the chart below, we can see that the stock is in the declining phase of its current cycle. We can also see that there’s plenty of time left before the cycle concludes.

As it approaches a resistance zone, our analysis shows this rally is premature, and we are looking for a drop to near $50 in the coming months.

DowDuPont (DWDP) Stock Chart with Weekly Bars

For more from Slim, or to learn about cycle analysis, check out the askSlim Market Week show every Friday on our YouTube channel.

Twitter: @askslim

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.