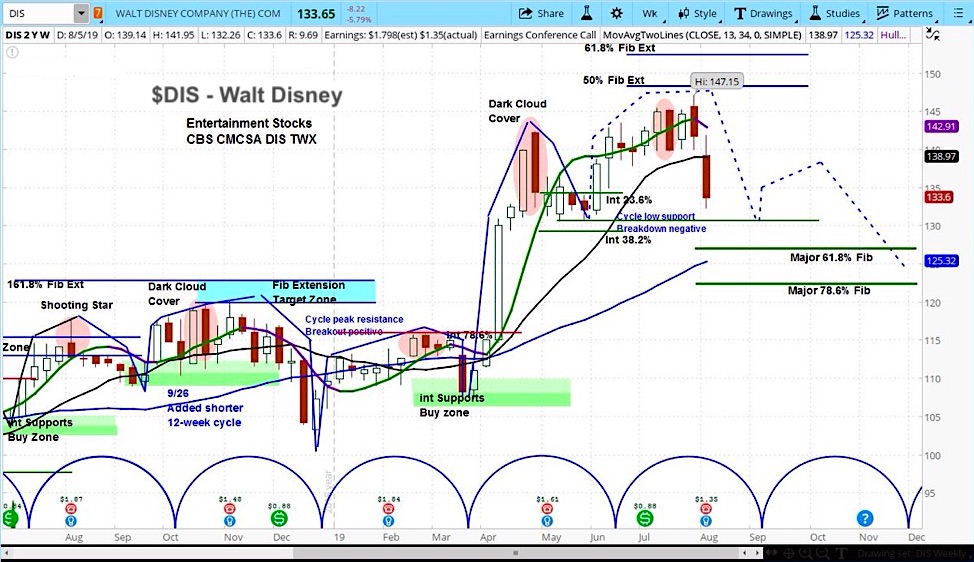

Walt Disney Stock (NYSE: DIS) – Weekly Chart

Shares of Walt Disney (DIS) are sliding this week the company’s latest earnings report didn’t help, missing Wall Street expectations.

Based on its market cycles, we believe the stock may be forming a major top.

Our approach to stock analysis uses market cycles to project price action.

Disney (DIS) now appears to be in the declining phase of its current cycle. Our analysis is that the stock may be forming a major top – a break below $130.75 would confirm this possibility.

Disney Earnings Report Insights

The company reported earnings per share of $1.35 and total revenue of $20.3 billion, compared to analyst estimates of $1.72 and $21.5 billion. Looking forward, management expects another $0.45 per share of dilution as a result of the recent acquisition of 21st Century Fox.

In the first full quarter since closing the deal, CEO Bob Iger explained, “We remain confident in our ability to successfully execute our strategy to drive maximum value from the combined company.”

For more from Slim, or to learn about cycle analysis, check out the askSlim Market Week show every Friday on our YouTube channel.

Twitter: @askslim

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.