The GameStop (GME) saga continues as a Reddit page known as Wall Street Bets and its members of small-time traders have pushed GME through another round of all time highs. Their influence and constant stream of messages throughout social media have reached even Elon Musk, who posted a tweet late Tuesday saying “Gamestonk!!”

While the hype has increased the prices of specific stocks like BlackBerry (BB) Nokia (NOK), Koss Corp (KOSS), and more, the general market had a rough day with all the major stock market indices closing negative.

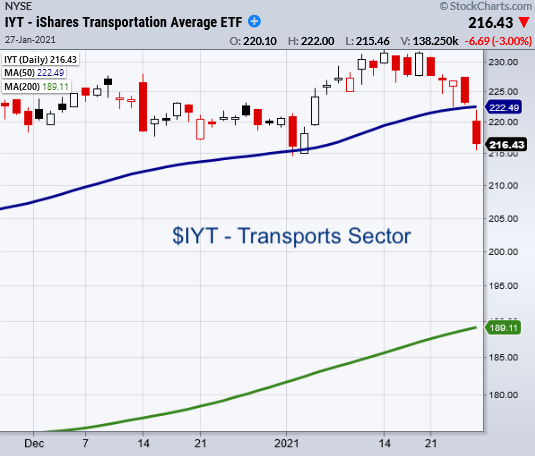

Even more alarming is how the market gave a warning signal in the form of the Transportation Sector ETF (IYT) breaking its 50-day moving average.

This merits extra caution as IYT is key a supporter of the markets demand side.

Watching for other key sectors to follow along would confirm that its break of the major moving average holds more value. That is why along with IYT, we watch the Russell 2000 (IWM), Retail (XRT), Regional Banking (KRE), Biotech (IBB) and Semiconductors (SMH)

Together they are called the Economic Modern Family, and they guide us into the best performing areas, while also alerting us to potential problems.

Currently, only the Transportation Sector ETF (IYT) has broken its 50-Day Moving Average (DMA) at 222.64.

Its next support area falls on 214.50 or the low of the first trading day this year.

Furthermore, while the other members of the family are sitting above their 50-DMAs, SMH has its 50-DMA nearby at 218.95.

Luckily, monitoring the situation through these major moving averages and key sectors gives us an easy way to see if overall support is holding up or breaking down.

S&P 500 (SPY) 370 the 50-DMA

Russell 2000 (IWM) Doji day.

Dow (DIA) Needs to hold the 50-DMA at 303.12

Nasdaq (QQQ) Like to see this hold 319 support from 01/08 high.

KRE (Regional Banks) If cant hold 54 then watch for 52.51 the 50-DMA next.

SMH (Semiconductors) 218.95 50-DMA

IYT (Transportation) Support 214.50

IBB (Biotechnology) 157 support area.

XRT (Retail) In a vulnerable spot sitting so high with IYT breaking down.

Twitter: @marketminute

The author may have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.