I never thought I would be interested in buying SNAP Inc. (SNAP), the maker of Snapchat. But here we are.

As an active investor, I have no choice but to listen to what the market is telling me.. and it’s telling me to own SNAP stock.

Let’s take a closer look today…

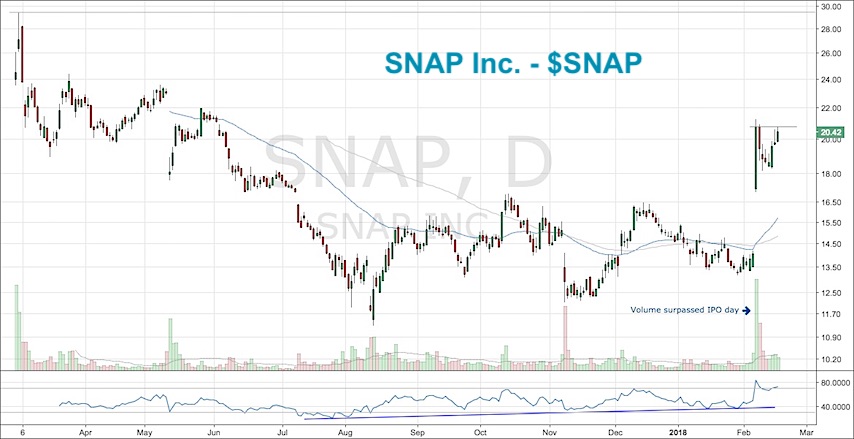

After falling 50% from its IPO price, SNAP’s stock price looks ripe for a move higher following its latest earnings report. Now I do not know what the earnings report stated but all I care about is the reaction… and that reaction was a monstrous 50% gain on a 1,100% above average volume spike in a single day.

What has my attention the most is how this one day move ‘shocked’ the market. SNAP caught investors off guard, specifically the institutional type who are the only ones capable of leaving behind such an accumulation blueprint. What do I mean? Shares of SNAP traded 217 million shares on its IPO day. It surpassed that by trading 232 million shares by the close of February 7th. This is rare as the IPO day volume in most stocks is not usually surpassed for a many, many years.

Taking a look at the chart, SNAP was building a bullish momentum divergence prior to this move and the 50/100 day moving averages have now turned up. SNAP has even held the 5 day moving average so far, which is something I only briefly monitor following large price gaps. That’s a sign of strength.

SNAP Inc. Stock Chart

While I normally avoid IPOs due to the lack of historical data, I cannot ignore what may be going on in SNAP. So what next? Well if it can get back to IPO highs around $30 that’s about a 50% move. From there? Time will tell.

Regardless, SNAP looks poised for higher prices and from here forward I want to see it get above and hold the 20.75 level.

Thanks for reading!

Twitter: @AlphaEyeCharts

The author has a long position in SNAP at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.