Occasionally, I like to feature a stock or ETF as a trade idea.

Generally, I will go more for a commodity, index or sector related ETF.

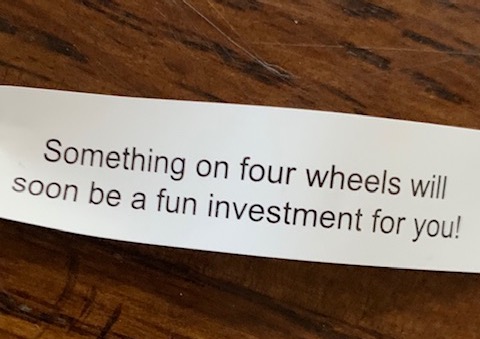

However, the fortune cookie pictured below got me thinking about cars and car stocks.

At first, I thought it was about my Range Rover, which is a 2012 Autobiography supercharged version. It’s currently useless and sitting at the shop as the timing chain busted.

We later learned that there are a couple of class action suits against Land Rover as this model was never recalled and this is a known problem with the 2012s.

(Wish we had known about it before we bought the car!)

Anyway, as a trader and one who likes to use consumer instinct, I began thinking outside of the box and looking at car companies and stocks.

And, although Tesla (TSLA) is all the rage, I found another car company whose chart is worth mulling over.

Once you get your hands on a Toyota, will you never let go? Here’s the chart of Toyota’s stock NYSE: TM – Ticker: TM

First off, Toyota did just recall 3.4 million vehicles worldwide due to air bag problems. Toyota will inspect and fix the defect, if there is one, free of charge.

Kudos to them unlike bad Land Rover.

Secondly, a few Toyota models have gotten rave reviews for 2020.

Particularly their hybrid cars are selling well.

Perhaps the most bizarre news is that the company has made a $394 million bet on flying taxis.

Take that, Elon Musk!

Toyota reports earnings on February 6, 2020. That should be interesting.

In the meantime, the top of the seasonal range is at 142.43. That has cleared.

The blue line or the 50-DMA has also cleared putting this in an unconfirmed bullish phase.

That means it must close above the 50-DMA again tomorrow.

If it does, there is resistance on the way up, but with upward momentum and in a good market, the price can easily pierce through that resistance.

Disclaimer-I have no position in this stock and with a weekend of concern over the virus, trade at your own risk.

Please have a listen to my interview last week with TraderTV.com: https://youtu.be/Tx9__q-DlEk

S&P 500 (SPY) Held the 10-DMA support now at 329.33

Russell 2000 (IWM) 167.17-after all is said and done, the 10-DMA held

Dow (DIA) 290.78 support as after all is said and done, the 10-DMA held

Nasdaq (QQQ) 221.60 support to hold

KRE (Regional Banks) Held the weekly EMA support and now back over 57.11 will look better.

SMH (Semiconductors) 145.40 pivotal support.

IYT (Transportation) 195 major support with 200 pivotal.

IBB (Biotechnology) 120.85 is pivotal price resistance with 118.50 support.

XRT (Retail) 45.40-46.00 is pivotal.

Twitter: @marketminute

The author may have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.