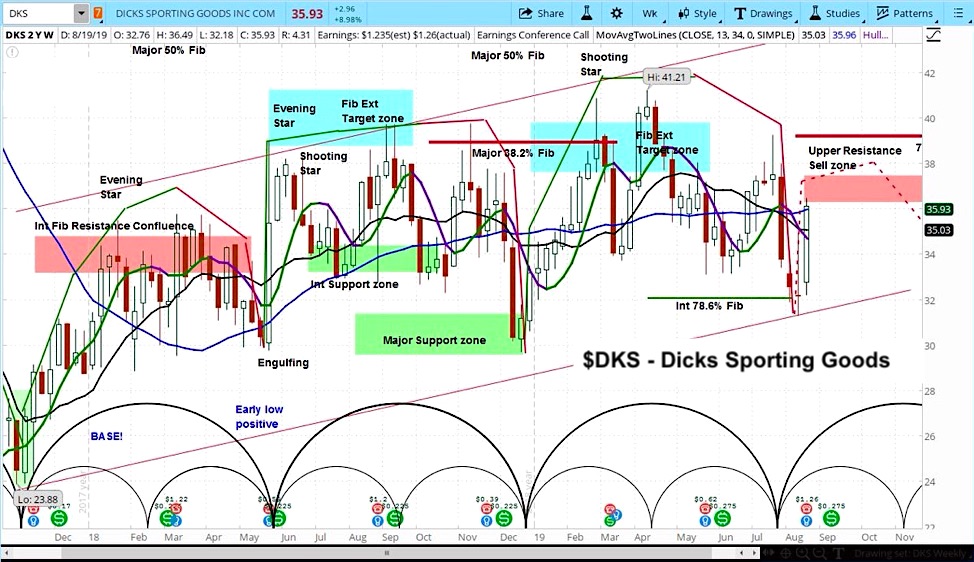

Dicks Sporting Goods Stock NYSE: DKS “weekly” Chart

Dick’s (DKS) rose 3% on Thursday after the company posted earnings that beat Wall Street expectations.

While it is still early in the stock’s market cycle, we believe there is only minor upside potential.

Our approach to stock analysis uses market cycles to project price action.

DKS is now in the rising phase of its current market cycle, but is close to resistance. With a price target of maybe $37.50, we do not believe that this one is worth chasing.

Dicks Sporting Goods Earnings Report Insights

The company reported earnings per share of $1.26 and total revenue of $2.26 billion, compared to analyst estimates of $1.21 and $2.21 billion. Management provided guidance for the fiscal year that was in line with the average analyst expectation.

CEO Edward Stack explained that, “We saw growth across each of our three primary categories of hardlines, apparel, and footwear. Our brick-and-mortar stores comped positively and our eCommerce channel remained strong, increasing 21%.”

For more from Slim, or to learn about cycle analysis, check out the askSlim Market Week show every Friday on our YouTube channel.

Twitter: @askslim

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.