Two of the major Crypto Currencies including Bitcoin ($BTC) and Ethereum ($ETH) are looking to clear and hold over resistance.

Bitcoin at 40 – 42k and Ethereum at $2900.

The next test is to hold at or over these price levels through the weekend.

If they do, we could see not only continued price runs in many altcoins, but traded companies that closely follow the space could also be poised to run higher.

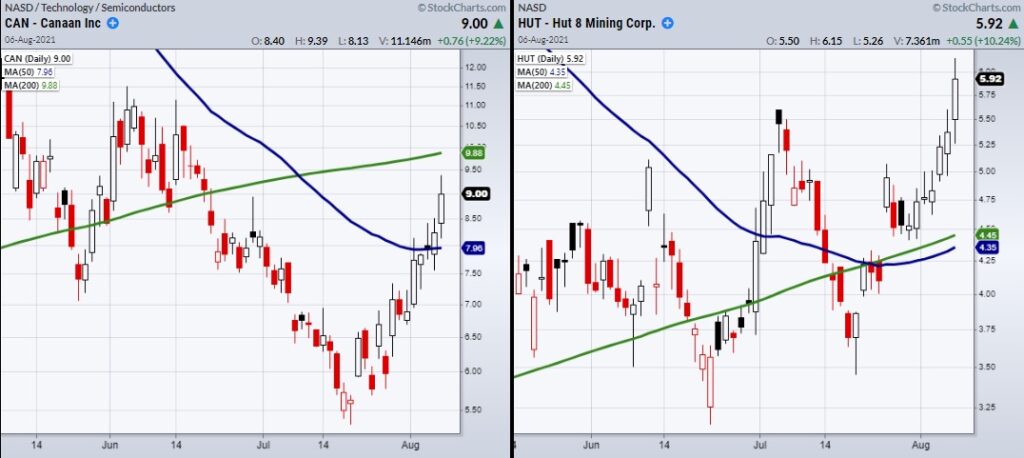

Let’s start with two Crypto mining companies. Both Canaan (CAN) and Hut 8 Mining (HUT) have recently cleared over resistance levels.

CAN is now over its 50-Day moving average at $7.96 and barly over resistance from June 29that $8.94. Additionally, the next level it needs to climb over is the 200-DMA at $9.88.

On the other hand, HUT is over both its major moving averages and now needs to hold over its July 7th high at $5.59.

The increase in prices across the board has made crypto-mining companies more profitable and has also opened the doors to the crypto banking trend.

One company we have been following is Silvergate Capital (SI).

On Friday, SI cleared resistance at $114. However, it still has remaining resistance at $118 it needs to clear.

If it does, SI has the potential to run into the $140 price range.

With that said, the main caveat is if prices in the major currencies can hold over the weekend. If so, we should have a keen eye on these companies since they can be very quick to move.

Stock Market ETFs Trading Analysis and Summary:

S&P 500 ETF (SPY) New highs with small range day.

Russell 2000 ETF (IWM) Still needs to clear 225 resistance.

Dow Jones Industrials ETF (DIA) Needs to hold 351 as new support.

Nasdaq 100 ETF (QQQ) Held its 10-DMA at 366.63

KRE (Regional Banks ETF) Watching for a bullish phase change over the 50-DMA at 65.71.

SMH (Semiconductors ETF) 263.86 support area.

IYT (Transportation ETF) Cleared the 10-DMA at 251.51.

IBB (Biotechnology ETF) Closest support the 10-DMA at 167.86.

XRT (Retail ETF) Very choppy.

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.